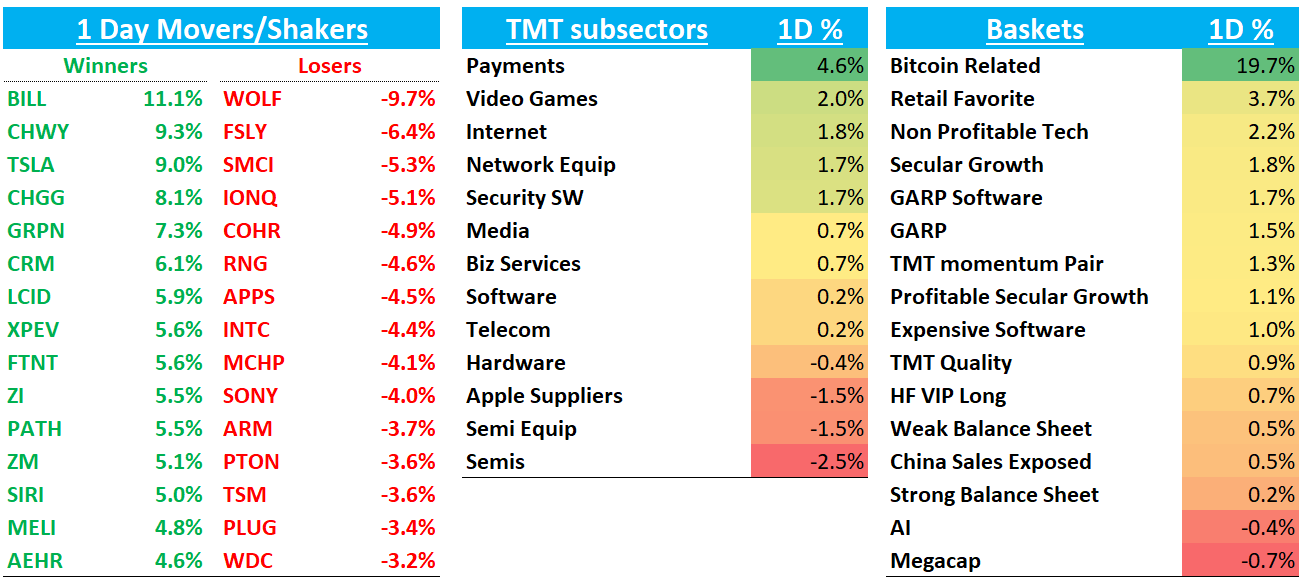

QQQs finished flattish on a day where under the surface price action tells a more complete story than the indexes. ARKK +7% and BTC +9% continue to rip while small caps +1.5% outperformed again. As mentioned on Friday, we’re still seeing big moves in names with scarcity value (TSLA, CRM, PLTR, etc.) along with names perceived to be winners in a Trump admin.

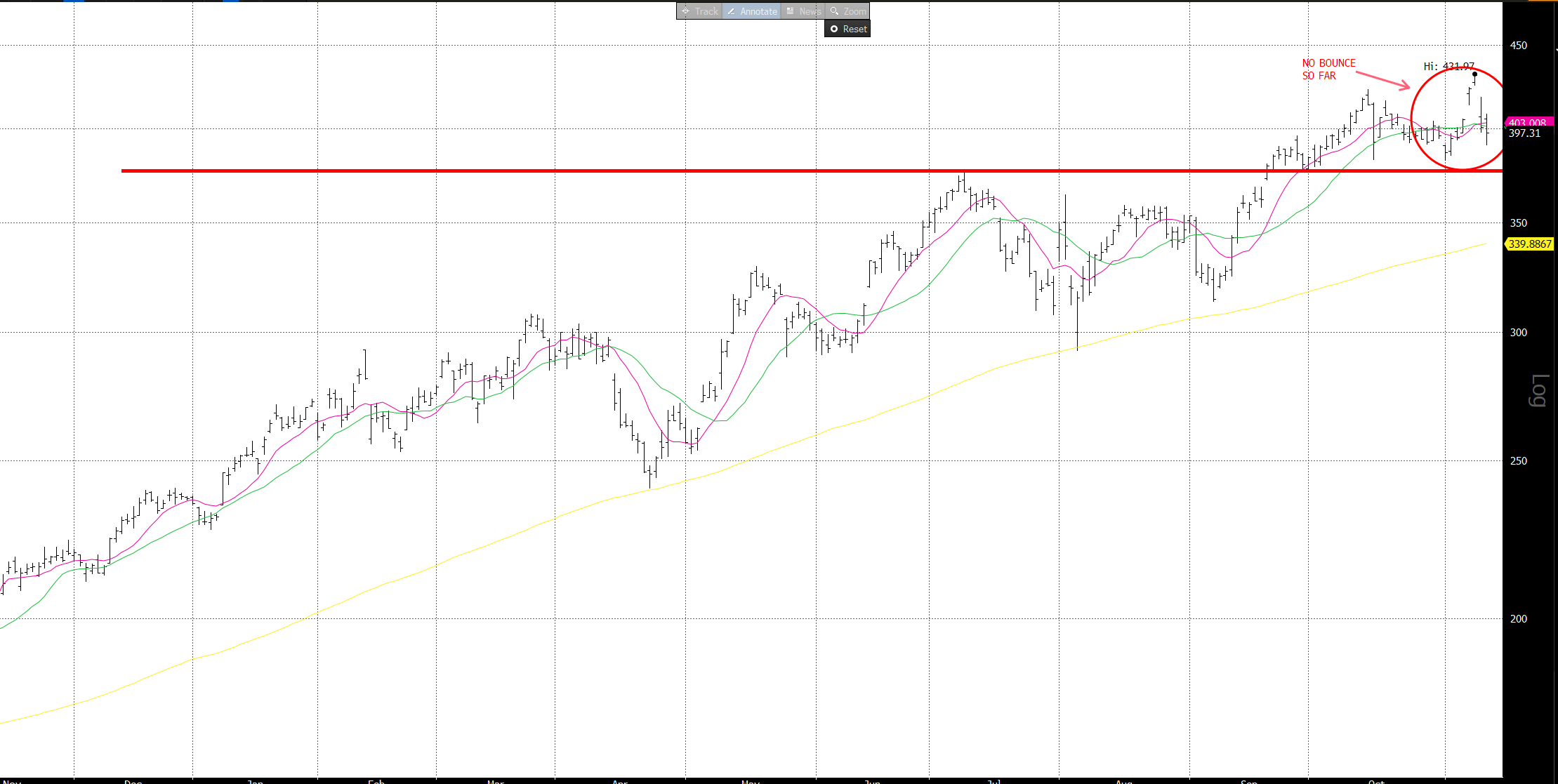

Semis -2.5% - hurt by rotation and maybe some sentiment headwinds from the TheInformation article talking about LLMs reaching a limit on performance improvements (along with -ve TSM news/tariff fears). Amazing the SOX is flat since March. Amidst all the different pockets of strength in Tech and indexes hitting new highs, Semis have struggled to regain strength and remain well below early July highs. Check out the SOX:

Still, AI leaders like NVDA, MRVL, AVGO, and TSM charts still looking good but the divergence in high quality AI stocks vs. low quality AI stocks/AI losers continues to grow. NVDA’s print on 11/20 main catalyst on the horizon for the group (Jensen talking to Masa on Wednesday in must watch TV)

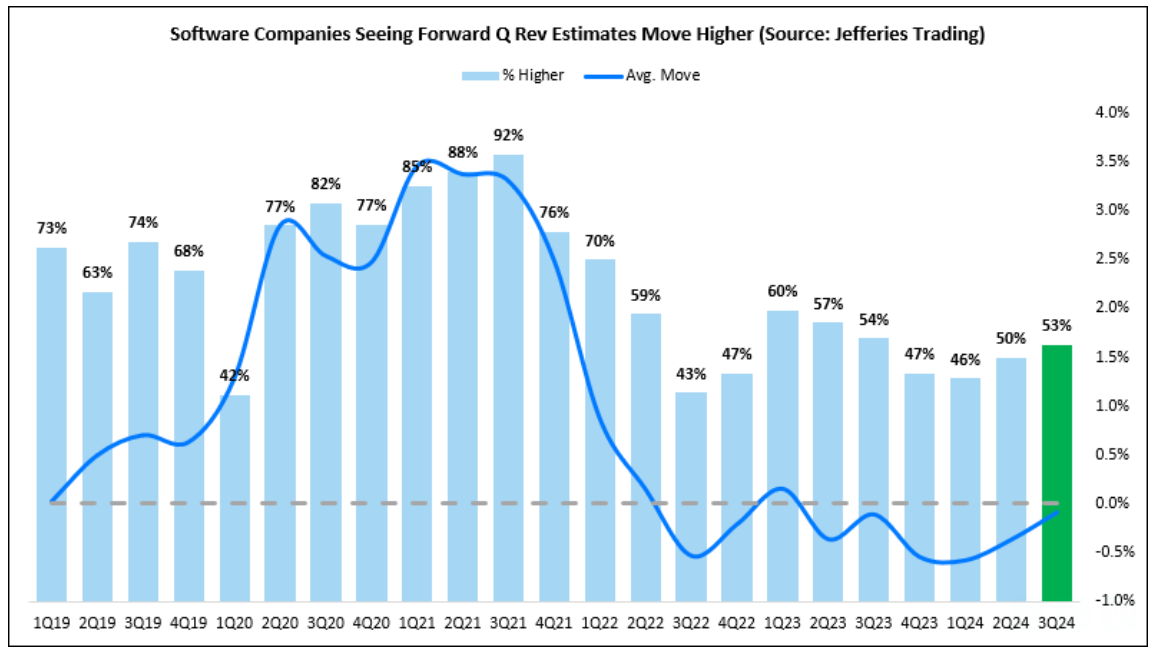

Meanwhile, Software +2.2% tells a different story. Jefferies noted this afternoon that sw has now outperformed Semis for 9 straight days, the longest streak by their count in ~5 years or 1,250 trading days. Earnings largely better for the group and for the first time since Q3’23, rev estimates are moving higher for the group. IGV chart looks totally different than the SOX as investors re-gross up:

Even more impressive when you realize MSFT - which has a 7% weighting in the index - looks more like a semi chart as it’s become a go to funding short (no one likes hockey stick guidance).

Was down 1% today and hurt by investors flocking to CRM, which is quickly becoming a new darling in sw — so far Benioff seems to be winning the Co-pilot/Agent faceoff between him and Nadella. CRM +6% still only trades at 20x FY 26 FCF with top line estimates likely going higher on Agentforce strength (who doesn’t love a numbers revision higher + good secular narrative long in tech?). We thought the checks from Jefferies this morning were surprisingly bullish talking up increasing deal sizes bc of Agentforce. ROI for a sales power user (CRM customer) pulling in $M+ in deals a lot easier to demonstrate than a finance user using $35/month Excel co-pilot. CRM breaking out to ATHs and chart looks like it wants $400+ (Read our weekly from yesterday for more around the bull case here…):

We think the Agent theme has legs as more companies ride this wave (NOW, HUBS, TEAM, GTLB, FRSH). SW co’s are in a sweet spot where seats are unlikely to be affected NT while Agent roll out begins to contribute to both numbers + multiple re-rating going into early 2025. We liked this chart from Jefferies showing software rev estimates finally moving up after 2 years of decline..

Along with earnings-follow through from winners like PLTR, RDDT, BILL, TEAM, etc. I’m seeing a lot of stocks outside of semis bounce back after earnings decline. Just look at AFRM +24% after being 5% on Friday (chart looking juicy here too):

SQ +12% after being down following earnings. We don’t think q was that bad potentially setting up for GPV accel in ‘25 and its obviously a BTC play (the company’s name is Block after all):

ROKU - now back to where it was pre-earnings after being down 20%

I won’t post more, but EBAY MELI TTD PINS looking very similar. Don’t need to tell you, but when stocks rallying like this on misses, it screams strength.

Interestingly, ANET - 1% after falling 7% on Friday bucking the trend which just goes to show how weak semis are vs. rest of the market right now:

Or QCOM which is now down 10% after initial pop…

Ok enough charts for today. Overall, my base case is this is just churn/near-term rotation out of semis while laggards rip, but we’ll be watching closely for what happens to the group as market digests recent strength in coming weeks.

In terms of the macro, the market continues to price in 65-70% odds of a 25bp cut at the next meeting on 12/18. DXY jumped 50bps, extending post-Trump rally. Crude fell 3%. while Nat Gas jumped 10%.

Let’s get to the recap…

Internet

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.