TMTB EOD Wrap

QQQs -44bps as SOX -1.6% went back to doing what it does best: underperforming, although the price action in NVDA was quite encouraging. We’ve been writing about how r/r begins to get pretty juicy at around $125 and it hit $127. $125 is also the 150d, which is where stock has liked to bounce at the 150d:

Obviously stock narrative a bit muddied right around with concerns around ASICs and scaling limits as well as some sell-siders in Asia (Jefferies + MS) saying not much upside in Jan and Apr. We’ll see what happens. MRVL -10% was the big loser as JPM Asia said AI chip will win some Tranium 3 biz, although we’ve been hearing that for a while now and a reader added some color in TMTB chat:

A bit of de-risking ahead of FOMC tomorrow with some weakness in momentum names. TSLA px continues surprisingly strong - doesn’t matter what kind of factor day it is and continues to finish near the highs of the day every day (Mizuho ug today)

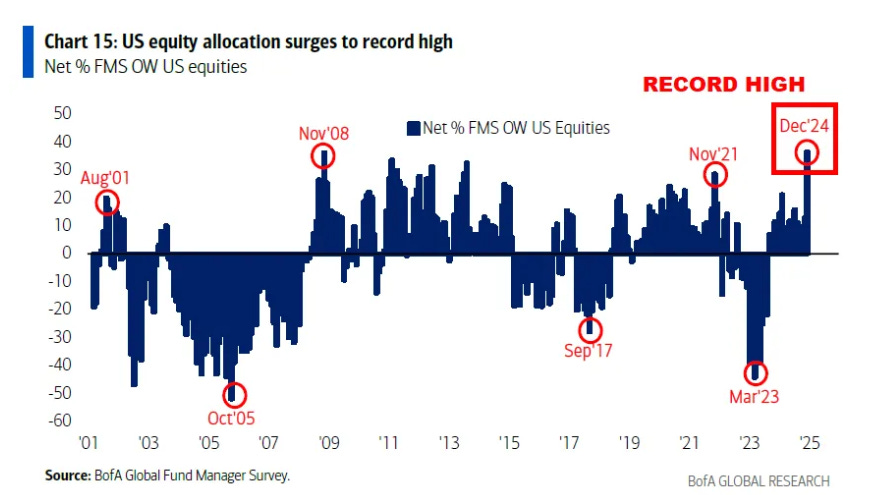

FOMC and MU on deck tomorrow. Treasuries didn’t do much today finishing flat while market is pricing in 100% chance of 25bp cut tomorrow and just 50bps of cuts in 2025. This chart from Harnett at BAML was getting passed around a lot today, showing US equity allocation near highs:

Market was down but today was a happy day! As my wife said yesterday: “There are thousands of reasons to be unhappy. I don’t even need one reason to be happy!”

Slow day - had to throw some dharma in there…

Let’s get to it!

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.