TMTB EOD Wrap

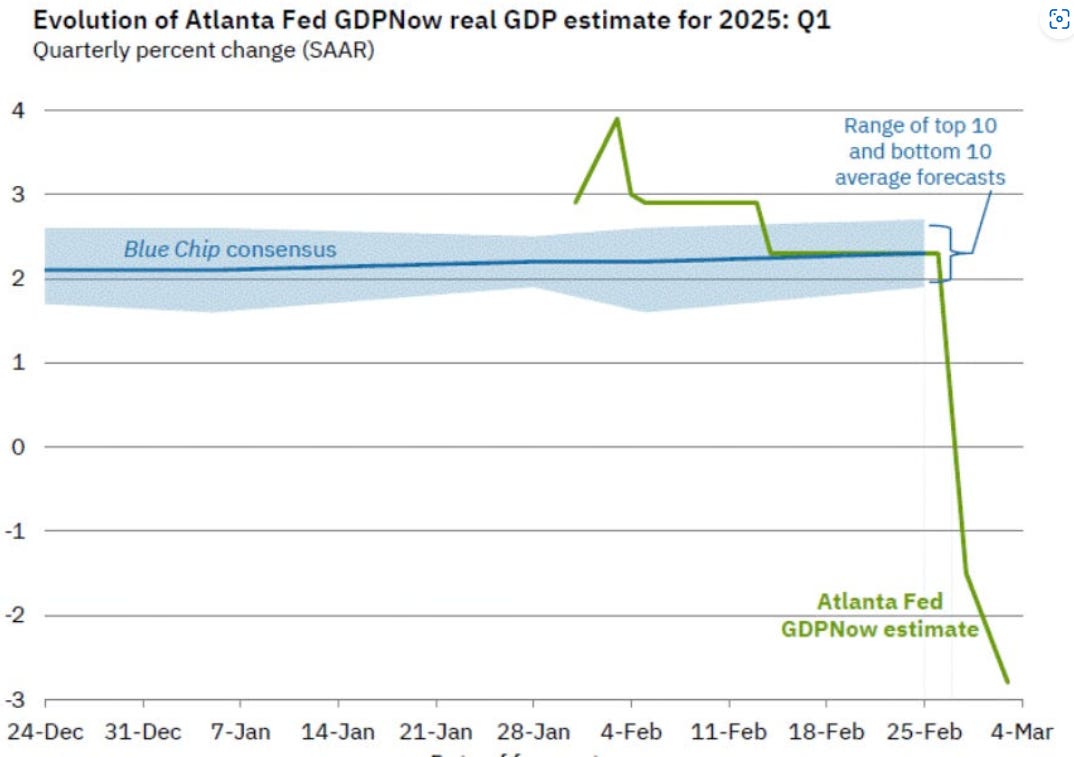

QQQs -2.2% as invesors getting more uncomfortable with growth scare and Trump’s policies (DOGE, tariffs, shutdown deadline 2 weeks away). Yields dropped 4-6bps across the curve. Fed expects continue to shift in a dovish direction with market now pricing in 75bps worth of cuts. DXY -75bps worth of cuts. ISM mfg was a - what’s the opposite of golidlocks - print with lower new orders but a spike in prices paid as respondents called out cautious commentary around impact of Trump’s tariffs. Atlanta’s Fed GDP tracker is doing it’s best NVDA impression, dropping to -2.8%:

This afternoon, Trump said there was no time for Mexico/Canada to strike a deal to avoid Mar 4 tariffs. VitalKnowledge put it well this afternoon: “we still struggle to be any more bullish than neutral given intense policy uncertainty in Washington that’s clearly eroding confidence and sentiment, growth that’s (at least) slowing, and valuations that are still rich (assuming $270 in 2025 SPX EPS, which isn’t guaranteed given recent economic data, the PE is still 22x).” How far does the growth/tariff scare have to go before Trump or Fed blinks / narrative changes to bad is good? For now, PnL protection remains the name of the game.

Trump and macro releases will continue to play an outsize role in market direction and on that front we have SOTU tomorrow, ISM Services on Wednesday, and NFP on Friday.

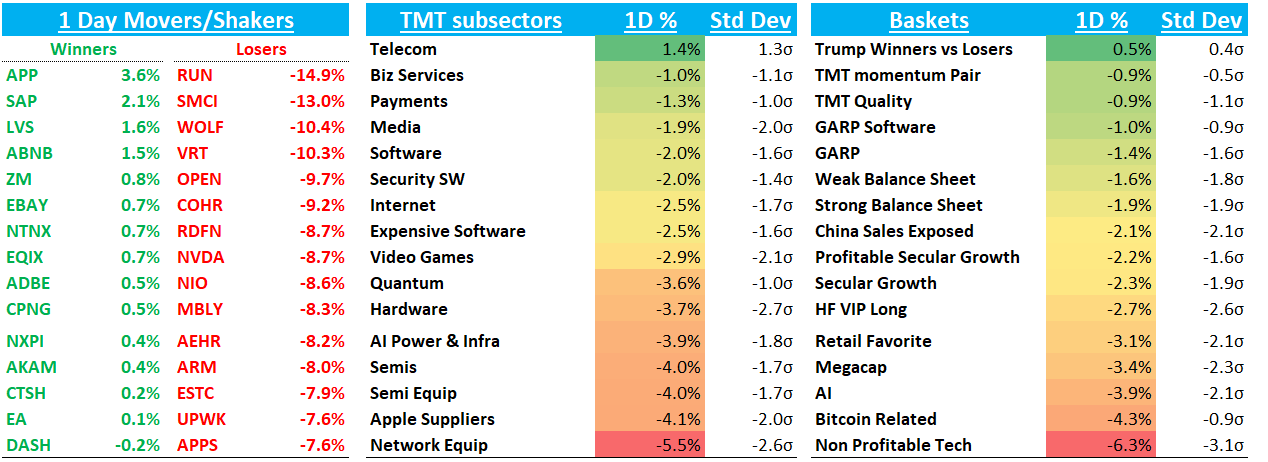

Price action in Tech was horrible with AI semis -4% taking the brunt of the pain. BTC -8% giving back almost all of its gains from over the weekend (as one friend put, if BTC can’t rally on one of the most bullish news possible - US gov’t buying - then what will take it higher?). ESTC -8% no follow through from Friday.

Post-close, GTLB +3% looked ok with Q4 inline with bogeys although Q1 was guided a bit light of the street. FY26 guide about in line with the street. Subs inline / billings beat.

4Q revenue of $211m vs. Street of $206m, with the beat in the range of the buyside

1Q revenue of $212.5m vs. Street at $214m

FY26 revenue to $939m vs. Street at $942m, with growth of ~24% near high of what buyside expecting

Internet

RDDT 50bps: didn’t see much today for the outperformance. Here’s what we wrote yesterday as COO presents tomorrow at MS:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.