TMTB EOD Wrap

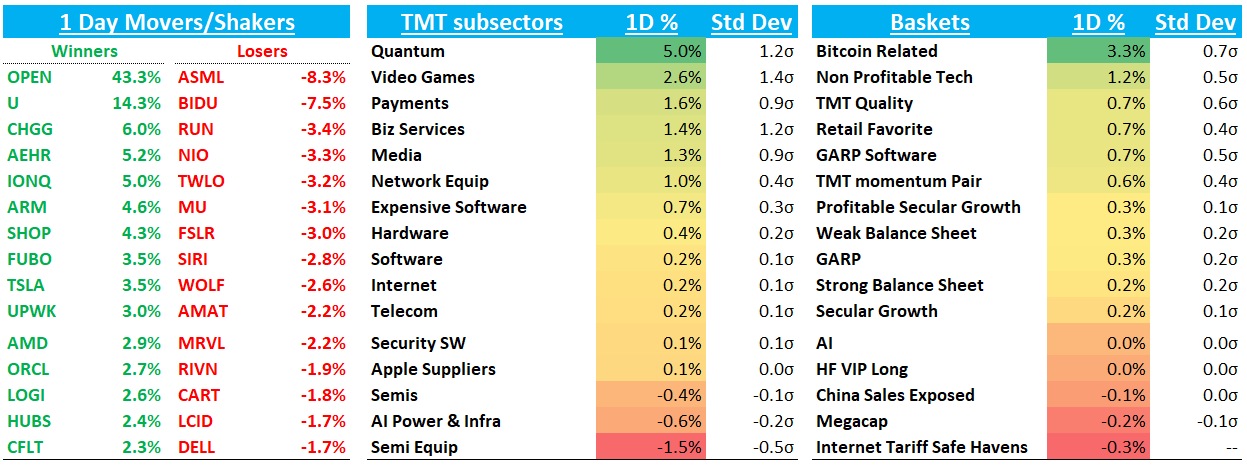

QQQs +10bps as yields finished flat to down. More noise around Powell, but Trump denied he would fire him. BTC +3%. ARKK +3.6% continues to rip to new highs.

Let’s get straight to the recap…

INTERNET

RBLX +6% ripping to new highs as stock is re-rating higher as investors continue appreciate the multi-legged bull case + sustainability of bookings growth, along with some nice optionality on the name. Still one of our favorites.

AMZN -1.4% as Bofa removed it from its US 1 List, Clev said Prime day was slower than channel expectations, Bezos sold some more stock, and Jefferies said AWS still capacity constrained int h eir preview this morning and that AWS margins likely pull back from Q1 record levels

META -1% continues to lag as investors worry about increasing opex and capex. FundamentalBottom with a good break down of capex:

DUOL -4.5% as 3p and app data continues to be weak along with secular AI fears (LLMs, glasses) pressuring the multiple

SHOP +4% Chart looking like it wants higher, helped today by news OpenAI getting deeper into online sales- FinancialTimes:

OpenAI plans to take a cut from online product sales made directly through ChatGPT, as the Sam Altman-led group looks to further develop ecommerce features in the hunt for new revenues. The feature is still in development, so the details may change. However, OpenAI and partners such as Shopify have been presenting early versions to brands and discussing financial terms, these people added.

GOOGL +50bps as investor sentiment turning a bit more positive - couple positive notes from Needham and Cantor this morning

CVNA +1% as 3p pointing to a solid start to Q3 QTD with units tracking 10ppts ahead of street

UBER -1.5% has lagged over the last several days as TSLA has expanded Robotaxi rollout

SOFTWARE

U +14% as Edgewater was out with positive checks saying they’ve seen significant improvement since late June and calling out UA KPIs up as much as 25-30% on the high end. We mentioned yesterday we warmed up to the name as there was already lots of smoke on improving vector checks (Wells kicked it off a couple weeks ago and investors had passed along several positive ones to me as well). Now there is fire as Edgewater lit the flame, also helped by some positive checks at Jefferies this morning. A very clear break above $30 resistance and we wouldn’t be surprised if the $43-$45 level gets tested in short order, assuming market holds up.

Edgewater left room to upgrade if Vector checks continue improving (we don’t see why they wouldn’t as U continues to iterate the product) and still 13 holds on the sell-side. The bull case here is simple:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.