What a week! Apologies for getting this one out late - was visiting some family in Northern Cali earlier today and just got back in front of my screens.

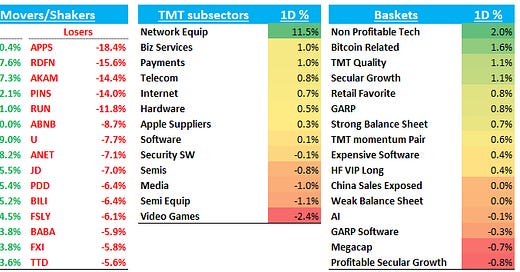

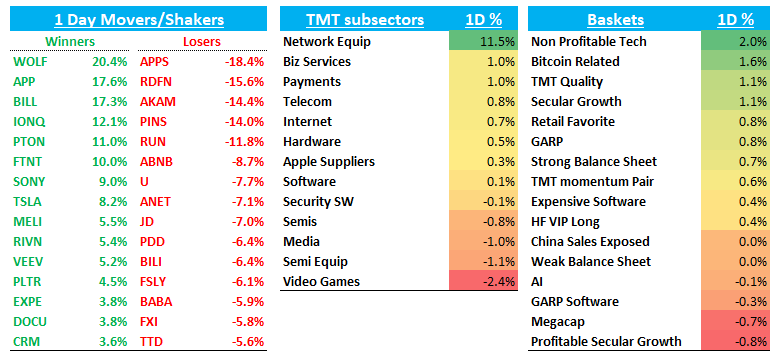

QQQs +12bps and lots of red on my screen (megacaps and semis), but some big moves and more follow through for the winners (RDDT +2.5%; TSLA +8%; APP +17%; PLTR +5%; IONQ +12%, UPST +46%!). Some big moves making it feel like 2021 again.

A lot of these moves scream scarcity value to me. TSLA: One of only ways to play AV and Robotics (+ a good narrative with low cost model and robotaxi catalysts in 2025 along with Musk Trump Bromance). APP/PLTR: A couple of the only mid-cap sw stocks to get exposure to application layer AI exposure. CRM: One of only ways to get exposure to AI Agents. IONQ: Only way to play Quantum. These themes (AV, robotics, AI agents, App Layer AI…I need to dig into quantum more but sounds sexy) some of my early favorites for 2025 and there isn’t a lot of market cap to go around in them so the winners here getting bought up. We’ll talk more about this in our weekly this weekend.

In terms of macro moves today, treasuries saw mixed action with 2 year yields rising 6bps while the 10/30 year fell 2.5/6.5 bps respectively. Fed expects shifted in a hawkish direction with market now placing only 65% odds on a 12/18 rate cut. DXY rose 43bps while Crude fell 2% and Copper fell 260bps on the back of China weakness.

Let’s get to the TMT recap…

Internet

ABNB -8.5% after guiding down margins as investors didn’t like the level of spend. The valuation gap is become starker with EXPE (+4%) only trading at 10x FY26 P/E growing room nights close to 10% while ABNB trades closer to 30x with similar room night growth but declining margins.

UBER -1.5% continues to be in the dog house (or the Master bedroom of funding shorts) as investors worry about secular issues and share losses vs LYFT

NFLX -20bps as M-sci called out strength in gross adds so far in Q4 and investors looking forward to Jake Paul v Tyson fight next weekend. I remember I used to trade NFLX on the long side into big show releases like Arrested Development, etc. and traders had a high hit rate but now with market cap a lot bigger we’ll see if it continues - stock at ATHs and after Paul vs Tyson, next catalysts are NFL Live on Christmas and Squid games two right after with WWE Raw launch in Jan. Then we can begin to worry about valuation and paid sharing winding down

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.