TMTB EOD WRAP

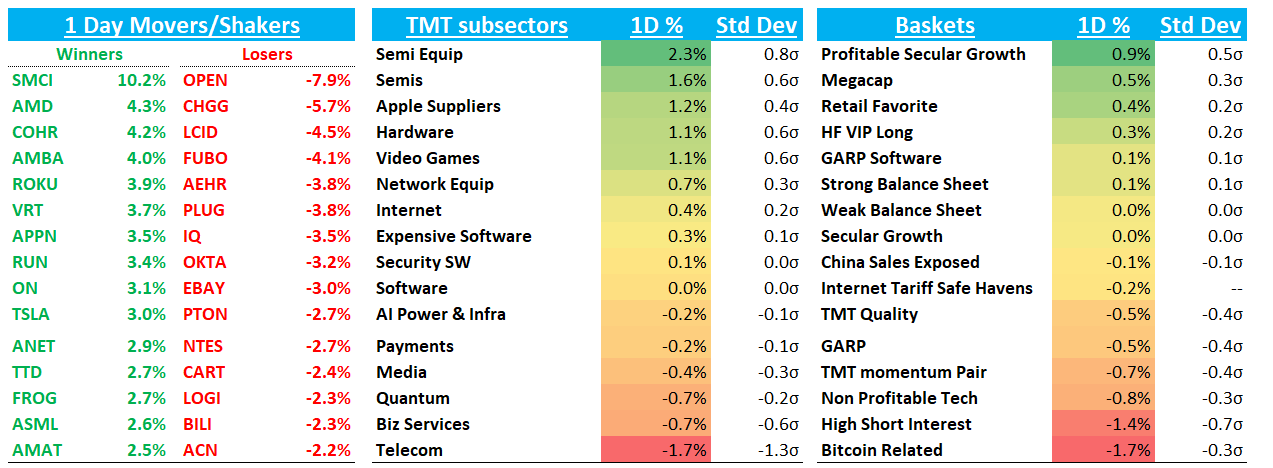

QQQs +30bps as the AI trade continues to lead us higher. Investors are moving further out the risk curve in AI - diversifying outside of favorites NVDA + AVGO. Just take a look at SMCI +10%. For those of you that don’t remember, SMCI was the highest beta AI stock back in ‘23/’24 at the start of the AI boom - +10% was a normal day for it. That doesn’t mean the bid is leaving AVGO +1.4% or NVDA +2%; on the contrary, the Hot AI Summer is just expanding as positive datapoints pile up with potential for more bullish commentary - and possible capex raises — from the likes of META, AMZN, and MSFT later this week. We’ll see if the upcoming Aug/Sept stretch - which is the weakest 2 month seasonal period semis - will slow things down. My sense if we do get some sort of pullback, it will get quickly bought as investors are getting increasingly comfortable that GPU demand will continue past ‘26 — humanoids, FSD, videos & agents all require heavy GPU usage and are all in their very early infancy. Simple enough.

In other factors, the bid to shorted names was lacking today as Megacap and HF favorites led the way higher relieving some L/S HF pain from the last couple of weeks.

It was the quiet before the start of the big earnings storm today. We’re working on an earnings matrix with bogeys for everything this week and will send around shortly.

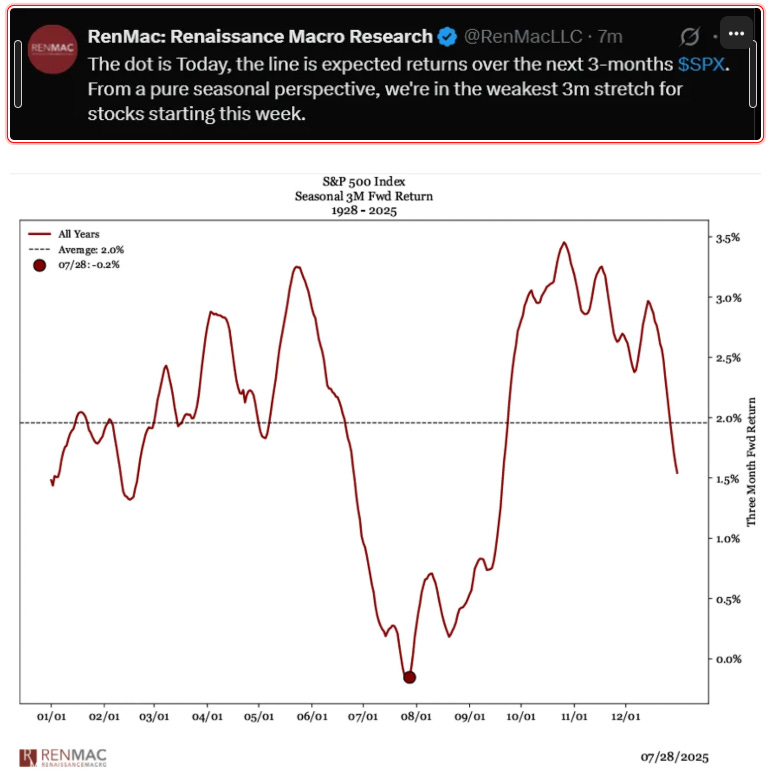

In macro land, the dollar surged 100bps after the US/EU Trump deal and yields ended flat to up across the curve. The market continues to price in about 1.8 cuts this year. In addition to semis, the market is entering its most seasonally weak period over the next 3 months:

We’ll see if that matters vs. a market that has a very strong underlying bid.

Post-close a strong set of results from AMKR +6%, CLS +11% and CDNS +7%

AMKR beat and raised and guided Q3 to $1.925B vs $1.76B

CDNS posted a huge beat on stronger than expected growth and margins and raised FY25 revs to +13% vs +12%

CLS with another strong beat across the board and mgmt took up FY guide on strengthening demand outlook from CCS customers. Call tomorrow at 8am, but should bode well for the AI semi trade.

Let’s get to it…

INTERNET

RBLX +2% as Q2 metrics continue to trend upwards and BTIG raised PT to $131 calling out July showing mid to high teens growth in DAUs vs. June. No signs of strength in data stopping. BofA was also positive raising their PT to $133.

ROKU +4% as both Clev and Yipit were positive calling out better than expected finishes to Q2. Investors expecting upside on platform Q2 and Q3 guide.

RDDT +1.3% as Jefferies was positive saying July DAUs +1% m/m so far. Decent set up as plenty still short here and revs likely to beat and raise - as long as they can thread the needle on the call and help turn narrative their way, think stock can work. We likely go in with small—sized calls into the print.

META +70bps / AMZN +60bps ahead of earnings on Thursday

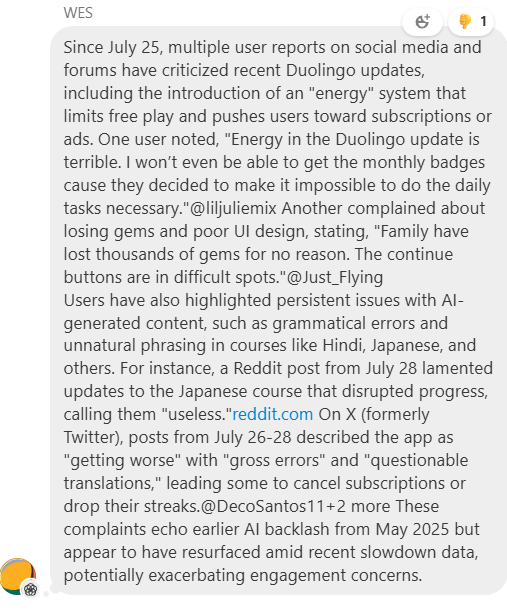

DUOL -6.5% as 3p continues to show a deceleration in paid bookings through the end of Q2. JMP was also out calling out decelerating DAU growth.

W +4% as China/US tariff delay + Piper raising PT. Had the right thought about nascent bull case - share gains from AtHome bankruptcy, better 3p data, best way to play tariff deals - on this one back in the 20s, just totally whiffed on execution and missed getting involved. Stock up close to 300% from the bottom. 3p data continues to point to a beat and plenty of EBITDA torque on this one if revs can accelerate into the MSD/HSD range.

SEMIS

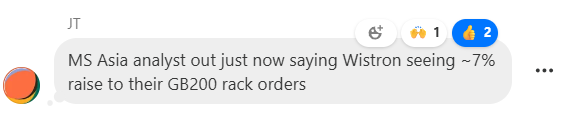

AMD +4% as Asia Press was circulating the $10k price increase on AMD355 to $25K, which has already been out on the sell-side. Still, just shows how strong the stock is now as investors continue to get bulled up on the 2H/’26 story and GPU rev estimates are finally trending in the right direction. Another sign where AI demand + vibes are at — at the place where we were in ‘23/early ‘24. Acuri at UBS was also out raising PT to $210, citing upside bias to Q2 results and increasing conviction in DC ramp. They are at $3-5B in Mi300x rev in 2H25, also calling out better ASPs ($25k) and that Mi355x could represent 2/3 of DC GPU revs by year end, implying a $10B run rate exiting 2024, supporting a $13B C2026 GPU estimate, which is close to where buyside is at right now (street is still around$10B). We’ve been long here for a while, but unfortunately not in size — we’re looking for places to add as we see the narrative/checks just getting stronger through 2H25

NVDA +1.9%

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.