TMTB EOD Wrap

QQQs -50bps / SPY 15bps / IWM -75bps as lots of red filled the screen to start what is the last non-holiday week of the year. From conversations with investors, many are already running lower gross into year end, effectively calling it a year, while others don’t want to put on any large bets on before the holidays.

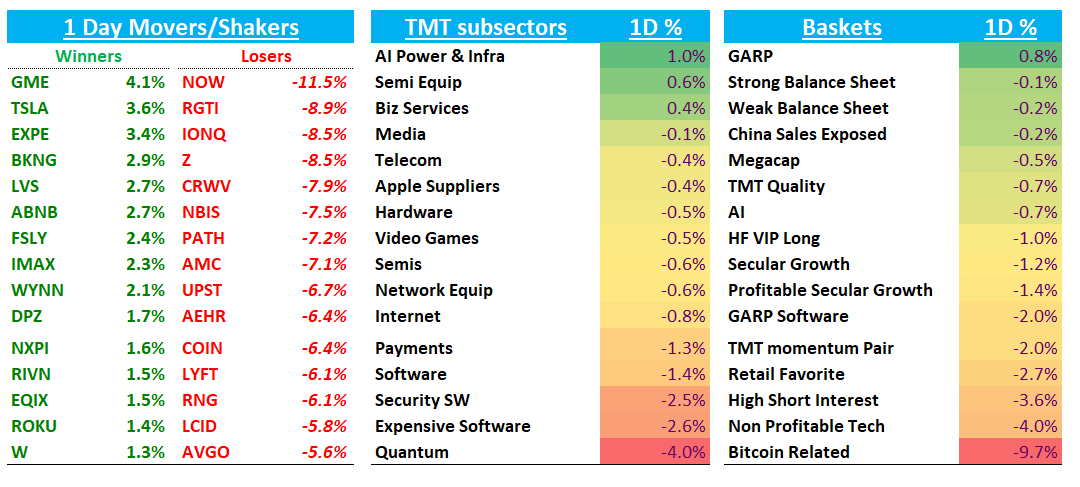

Tech felt risk-off and fragmented: high beat/spec led the way lower: Quantum -4%, Non-profitable Tech -4%, and High interest short baskets -3.5%. Mega Cap /GARP factors outperformed. In Sw, Security SW (-2.5%) / Expensive SW (-2.6%) led the way lower with NOW -11.5% the main drag after their Armis acquisition. Semis were only mildly weak with the SOX -0.6% helped by NVDA +75bps and analog names while some of the spec names fell MSD (BE -6%; NBIS/CRWV -8%, ARM -5%) as price action overall still didn’t feel great. It’s been a bit tougher than normal finding a clear bigger picture pattern of what and why things are working on any given day over the last few weeks and a low liquidity environment the week before Christmas won’t help things.

Let’s get to it…

AI / SEMIS

AVGO -5.5% was the main focus for many with lots if investors questioning why the large -17% move after earnings and whether it’s over done or not. The multiple was definitely priced near perfect and you had a not-so great earnings call from CEO Hock Tan although mgmt (including him) have been making the rounds with sell-side on call backs and sounding good (You can see UBS’ recap here). Investors are still hoping for clearer detail on AI backlog and a tighter/rinsed rackscale margin narrative. Some ascribed the extra weakness today to the news overnight out of Asia claiming MediaTek starts trial production of TPU v7e in C1Q26 and is positioned to win TPU v8e, with implied MediaTek CoWoS wafer demand of ~20k in ’26 and ~150k in ’27. Others blamed the NDX reconstitution on Friday. Stock was at its highs going into the print, so maybe just as simple as some sell the news to “catch down” to NVDA which has basically been flat since Sept despite a great print as well. I don’t get the sense in my conversations that any long-term bulls are leaving the stock with many just questioning when exactly to step in. Stock bottomed around 20x 2 yr fwd P/E back during the Tariff scare in April. 20x $15+ FY27 EPS # gets you to $300+ downside, which is ~10% dn from here. Doesn’t sound too bad.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.