TMTB EOD Wrap

Good afternoon. QQQs +1.45% in a nice green day helped by MU print and a cooler CPI number. Odds of a 25bp Fed cut is ~30% on 1/28 and ~70% on 3/18. Yields fell 3-4bps across the cure while BTC fell 1.5% and now hovers around $85k.

Tech had a strong risk-on session, led by AI infrastructure and memory as MU blew out results yesterday and reports that OAI was raising near $750B (WSJ out after the close saying new raise could target $830B). Whatever the number ends up being able to raise $100M at $500B+ valuation is a good thing.

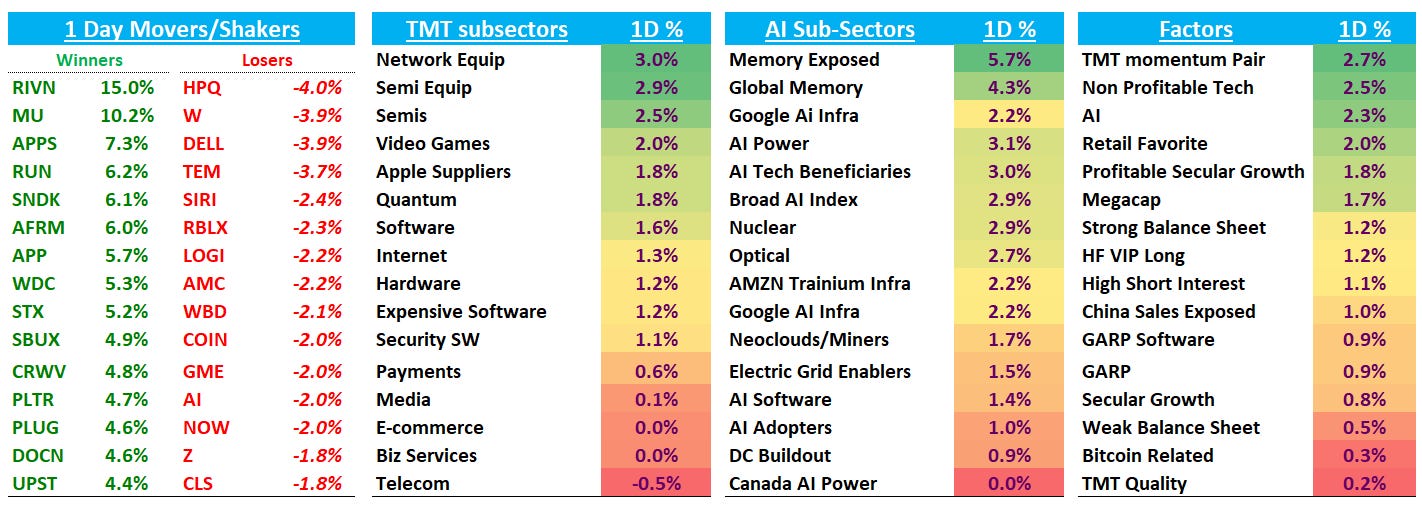

Semis (+2.5%), semi equipment (+2.9%), and network equipment (+3.0%) all outperforming. Memory-exposed and optical names were the clear standout (MU +10%, SNDK/WDC/STX +5–6%, LITE +5%), reinforcing where investor preference/sentiment currently sits in AI land: DRAM > Optical > HDDs > NAND > Power > ASICs > GPUs > Networking. Basically, the sectors with tight supply/demand dynamics and increasing prices where investors continue to want to be exposed. On the factor side, momentum, non-profitable tech, and AI worked, while defensiveness lagged. The main pockets of weakness were legacy hardware and PCs as MU results renewed margin pressure fears.

We mentioned in our EOD wrap yesterday that we thought the combo of washed out sentiment + stellar MU results + better seasonality merited getting tactically long. That turned out well and now one can just set a closing stop below yesterday’s low near entry and relax into the holidays with a risk free trade. Personally, we took all short/medium term exposure off today (BOJ overnight/Quadwich is tomorrow) as a clean book makes for a cleaner psyche and deeper relaxation/enjoyment over the holidays, but to each their own. On that note - tomorrow will be our last day of posts for the year.

Let’s get to the recap:

INTERNET

DASH +4% as they announced their teaming up with OpenAI to offer Grocery shopping in ChatGPT. Under the partnership, users can ask ChatGPT for meal or recipe suggestions, then ask the chatbot to shop for it using the DoorDash app. Users would be able to build their carts and place orders through DoorDash’s app within the chat.

AMZN +2.5% with a nice day of outperformance following some positive 3p checks which called out spot instance interruption rates declining (= improving capacity). Clev also said that holiday performance sounding good (retail and advertising) and AWS channel sentiment improving. We took opportunity to size up stock in our long-term accounts. It’s been a frustrating couple months, but we think the narrative is improving around AWS/Trainium as we turn the page into 2026 (we won’t rehash the full bull case here). Also a decent spot on the chart: adding at the 150d has worked well the last 4 times it’s touched or dropped below it:

Other large cap strong: GOOGL +2% and META +2.3% although NFLX -1% continues to lag on WBD acquisition overhang.

RDDT +2% didn’t see much here other than the Piper note yesterday calling out better user #s. 3p has been pointing to a slight beat to US DAUs QTD while early ad checks strong.

SHOP +4% following through on the better 3p data along with Wells Fargo’s Agentic Commerce note yesterday. Oppenheimer was out today too with a positive note.

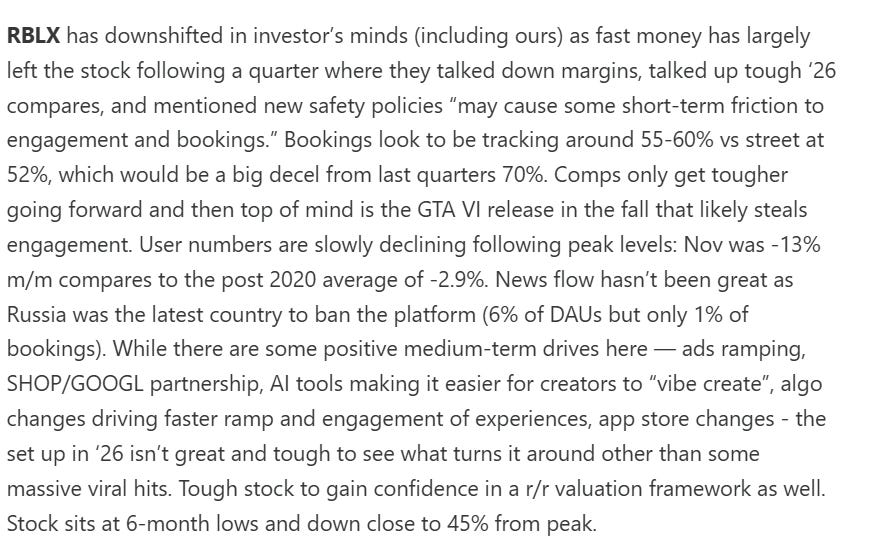

RBLX -2%: All I saw was 3p calling out slight decel in Nov bookings although still tracking a few ppts above for UCAN. Other data has already shown that. Here’s the sentiment/narrative rundown on the stock from our weekly in case you missed it;

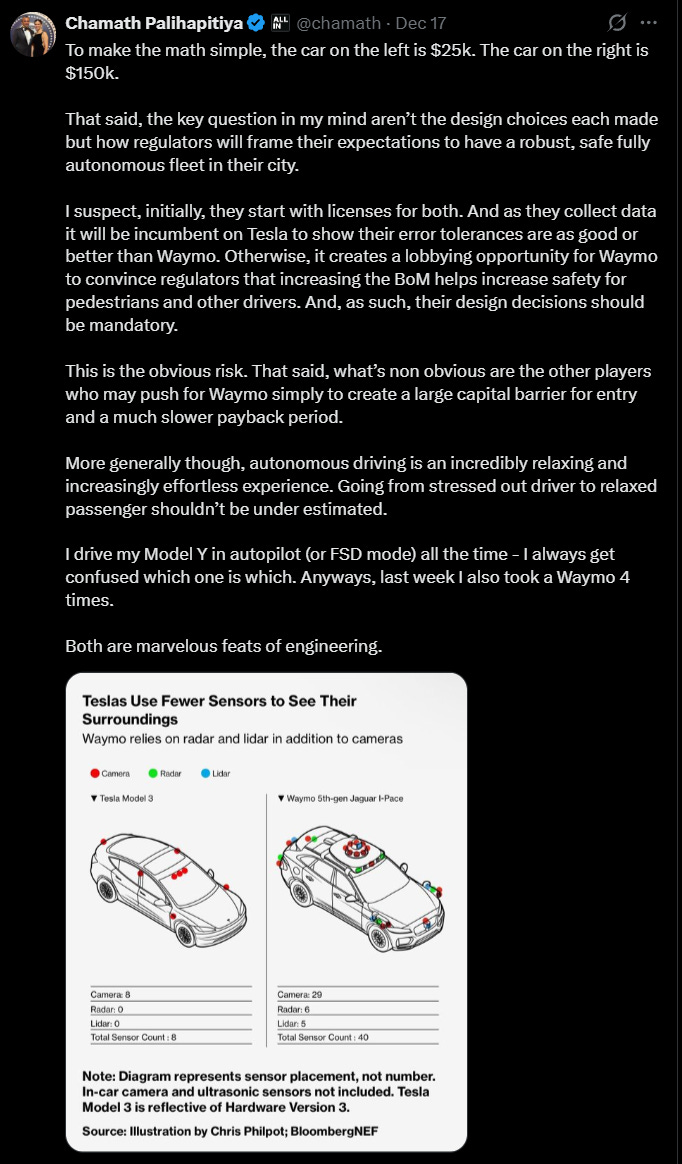

UBER +70bps. CEO Dara was on Swisher pod: On AI: ‘value creation in very practical stuff on recommendations … these larger models are enormously more effective than the last generation of models and translating into hundreds of millions of benefit to us’. On autonomous vehicles, he expects Waymo and other AV operators to establish their own direct customer brands while still integrating into Uber’s platform. Uber would initially purchase and deploy AVs, then transition to an asset-light model as proven economics attract partners to finance and operate vehicle fleets.

AI / SEMIS

WSJ after the close:

OpenAI is aiming to raise as much as $100 billion as it seeks to pay for ambitious growth plans in a market that has cooled recently on the artificial-intelligence boom.

The fundraising round, which is in the early stages, could value the company at as much as $830 billion, if it raises the full amount it is targeting, people familiar with the matter said. The startup aims to complete the round by the end of the first quarter at the earliest. Terms of the deal could still change, and it is unclear whether there will be sufficient investor demand to reach the goal.

MU +10% after their stellar beat and raise got memory bulls even more excited and managed to improve AI vibes at least for one day

TSM +2.8% as MS was out reitteratingTop Pick and expects 2026 revenue growth guide to mid 20s initially before ultimately delivering +30%y/y, with capex guide ~$48-50B driven by 3nm + CoWoS expansion.

GEV +4% as Jefferies upgraded to Buy saying long-term services contracts are cutting through near-term AI and data-center noise. . The firm said gas turbine pricing continues to surprise to the upside, while high-margin services provide deeper visibility into annuity-like cash flows through the 2030s, offsetting near-term equipment cyclicality

CRWV/NBIS +4-5%…LITE +5% / COHR +3% / CIEN +3%

AVGO +1% - FundaAI had a note saying that their latest checks indicate a structural shift as GOOGL is now actively prioritizing its engagement with MediaTek — as a second source — to diversify its supply chain and mitigate concentration risk.

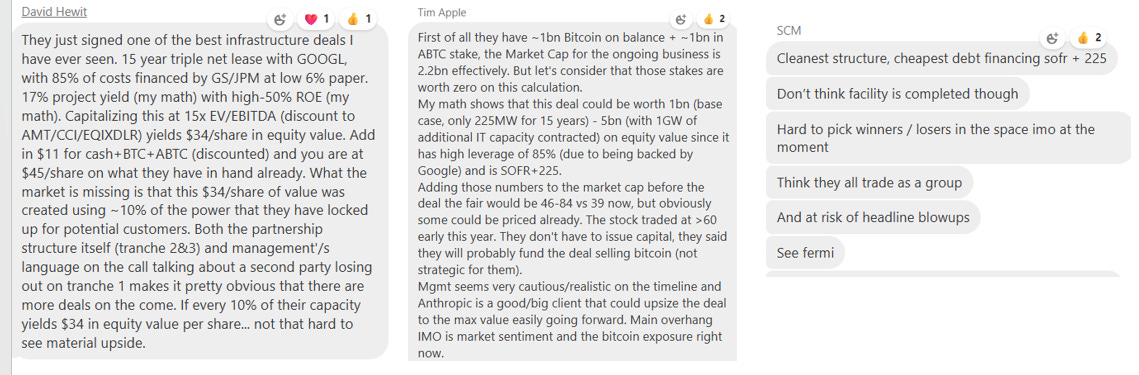

HUT -4% no follow through on their deal yesterday as was widely telegraphed to some across street so some sell the news. Still terms were very good and sell-side was out raising targets today. Good TMTB Thread here

SOFTWARE

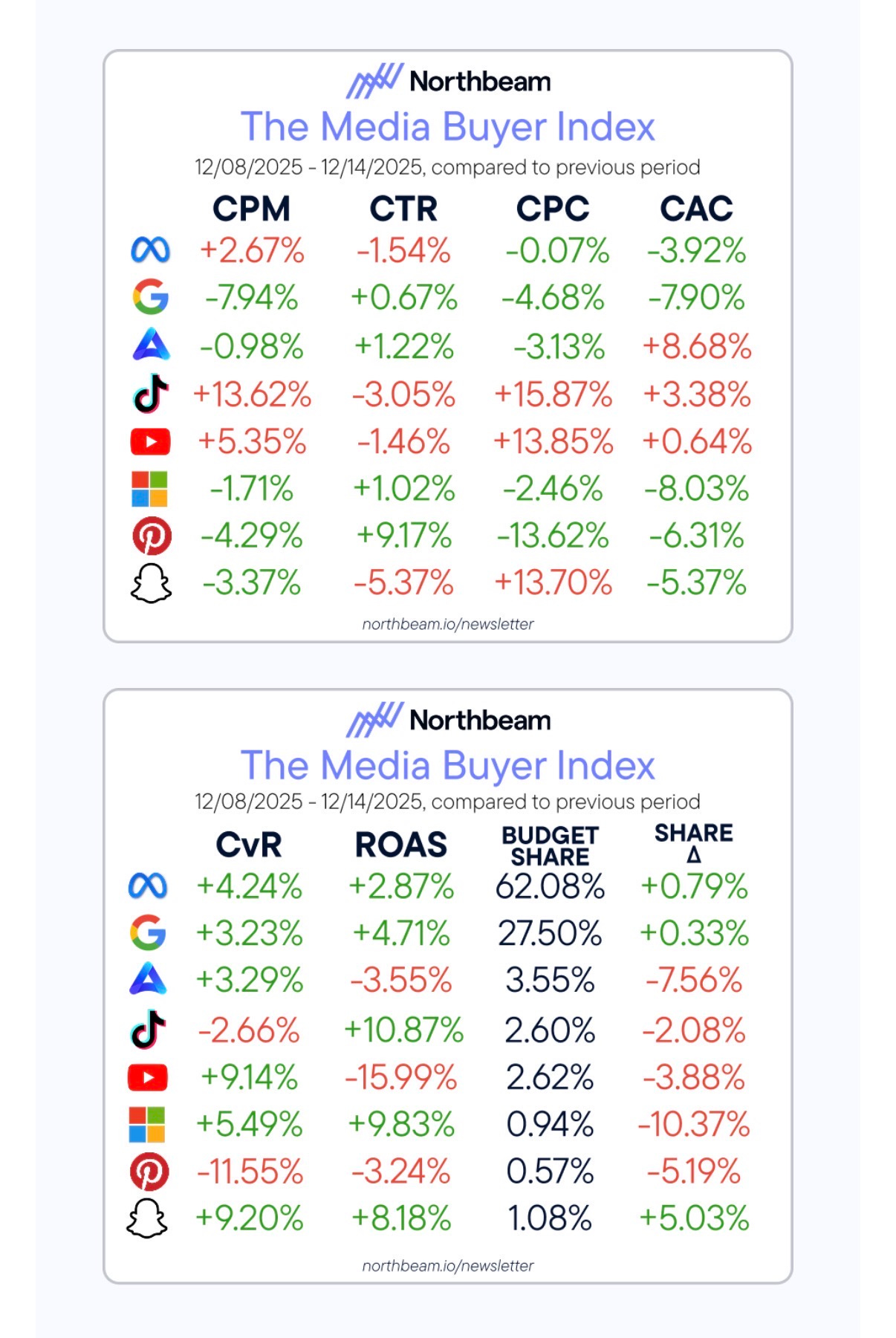

APP +5% despite some mixed Northbeam data

ACN -1.4% as bookings beat (+10%y/y vs +4% consensus) but tweaked down to FY26 rev guide ex Fed (vs expectations for a raise to the low end) and also a took down on GAAP margin guide. AI bookings accelerated slightly sequentially (+22%q/q vs +20%); however, ACN will stop disclosing Gen AI bookings + revenue moving forward.

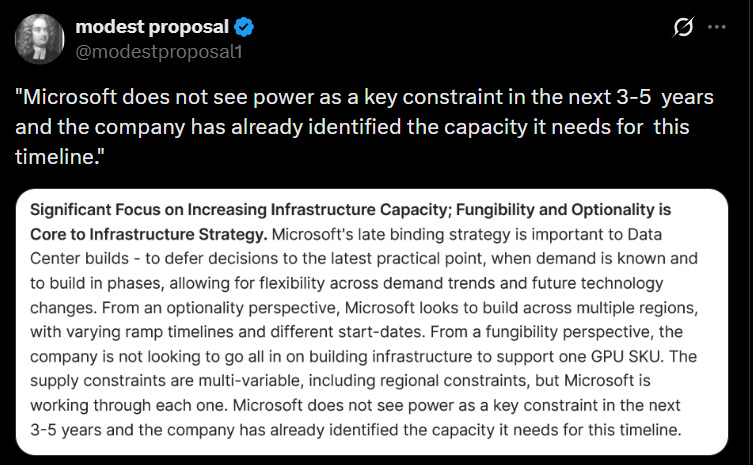

MSFT +1.6% as MS had a good note following their visit to Redmond. Interesting take on Power…

As a reference, here is what Satya said just a few weeks ago on the BG2 pod, which seems a bit contradictory: “The biggest issue we are now having is not a compute glut, but it’s power, it’s sort of the ability to get the builds done fast enough close to power. So if you can’t do that you may actually have a bunch of chips sitting in inventory that I can’t plug in”

Slow day here otherwise…

ELSEWHERE

TSLA +3%: BI recapped Musk’s internal xAI meeting yesterday. Elon Musk told xAI staff that surviving the next two to three years is the key to beating competitors and potentially reaching AGI by 2026, fueled by rapid data center scaling and $20–30 billion in annual funding. He highlighted synergies with Tesla and theorized about space-based data centers manned by Optimus robots to support this growth. The meeting also featured product demos, including updates to Grok Voice and new video editing capabilities.

PYPL -1.2% as MS downgraded to UW and said stock is a melting ice cube and its only getting warmer citing a slower and more complex turnaround in Branded Checkout than previously expected.

DIS +1% as Wells Fargo named new Media Top pick replacing SPOT saying concerns around a Parks slowdown are overstated

RIVN +15% as Baird upgraded to Buy ahead of R2 Launch cycle. Baird also pointed, to the company’s recent Autonomy Day, where Rivian unveiled internally developed chips, which the analyst views as an important positive for long-term differentiation and competitiveness.