TMTB EOD WRAP

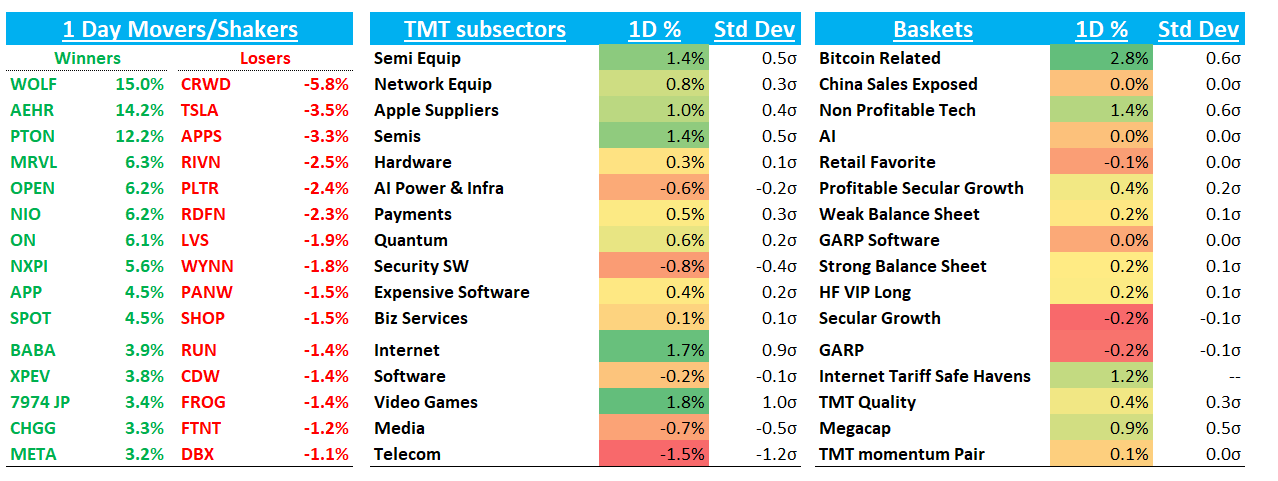

QQQs +28bps as winners continue to run in Tech: CRWV +8%; SPOT +4.5%; ETSY +2.3%; RBLX +1.2%; NFLX +1.8%, etc. etc. On the macro front, treasuries rallied given some weaker econ #s from ADP (weaker), ISM (softer and inflation expects worsened) and Beige book while fed expects shifted slightly in a dovish directly. BTC continues to lag a bit down 1% to $105k.

INTERNET

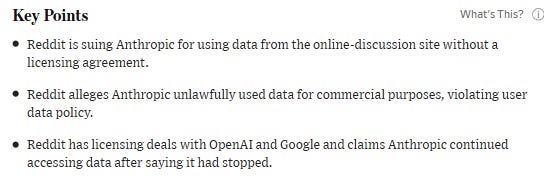

RDDT +6.6% as they are suing Anthropic, Alleges Unauthorized Use of Site’s Data. WSJ:

I think any news that reminds investors of strategic value of RDDT’s data is good for the bull case.

Here’s our view from our Sunday weekly on the stock:

RDDT is likely the most crowded short in internet after being the most crowded long in SMID early in the year as focus has shifted from large rev beats to declining US DAUs. We recommended taking some profits under $100 a couple weeks ago and stock has rallied close to 20% from the bottom helped by a few fairly positive mgmt meetings with New Street, ISI, and GS over the past week. We’ve written about why we think stock is a structural short, but we’re being patient on when to add back. We won’t take sizing back to the level we were post the q as there was a clear set up there for the short - an example where timing and set up matter in terms of “ease” for a short, but stock is still expensive and we’re thinking about starting to nibble back soon but we’re…we’re being patient/careful on RDDT as co is likely to beat top line handedly again.

Not clear to me when/where is right point to add back - like I said above, sometimes the timing and set up make things easy, sometimes it’s harder despite nothing really fundamentally changing! That’s stocks for you. We nailed the trade post-earnings but right now the set up isn’t as clear to us, so we’re being patient on adding back.

ETSY +2.2% continues to grind higher - we get Yipit data tomorrow morning. . We think today was a decent spot to take some profits and move up stops on the remainder (we’ll use the 20d on this one) as stock +30% in a little over a week since we wrote it up and hitting up against some resistance on the chart:

Our intuition tells us this has some more to go however so we’ll keep some on.

CVNA +1.6% Co was presenting at William Blair post close

META +3% continues to break out as ad names were strong today. PINS +2% / TTD +2% also outperformed

SPOT +4.5% / NFLX +2% / RBLX +1.2% continue to do their thing hitting new highs.

EBAY +1.5% slow grinder but hitting new highs every day. Some thoughts from this past weekend:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.