TMTB EOD Wrap

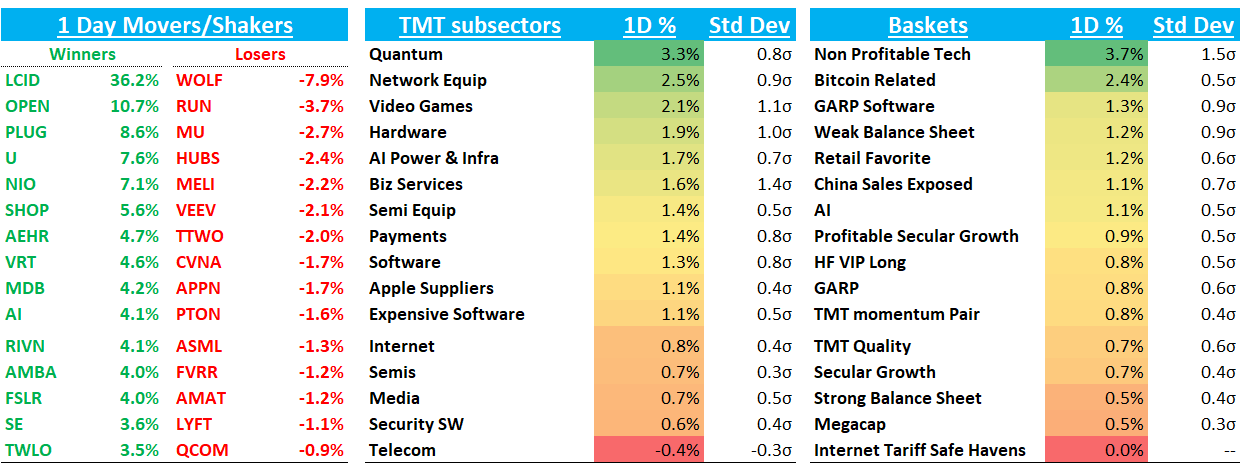

QQQs 80bps hitting new all time highs. The AI trade continues alive and well, helped today by TSM’s stellar print calling out “stronger and stronger” AI demand as well as ChatGPT’s Agent release. OpenAI’s release of a fully fledged ChatGPT “agent” today turns the chatbot into an autonomous worker that chains web browsing, email queries and code execution to complete multi‑step tasks. Demand drivers here just seem to be accelerating — agentic sessions chew through far more tokens than a simple Q‑and‑A, meaning real‑time inference loads will spike. Crypto 2nd hottest place to be as HOOD and COIN hitting new highs today as well, with BULL beginning to gain some mojo.

Not much on the macro front today - yields were flattish while fed expects shifted slightly in a hawkish direction with expects for close to 40bps worth of cuts and sept meeting now 50/50.

Let’s get to the recap…

SEMIS

TSM +3.4% after a beat and raise, saying AI demand getting “stronger and stronger” (just wait until agents cause inference demand to skyrocket), guiding Q3 to +8% q/q vs buyside expects of 5% and ‘25 rev growth seen at 30% vs expects of high 20s. Expectations were high but this was better than expected. Bulls pointed out the +30% full year guide implies Q4 down 10% q/q vs typical seasonality of +7-8% — co. on the call said this was conservative.

MU -3% as GS downgraded Hynix in Asia calling out ‘26 HBM pricing concern. Mizuho was out defending the name mid day after talking with IR, saying they see HBM4 driving share gains and margins and are buyers on the pullback. he firm sees HBM4 ASPs 15–20% higher due to larger die sizes, driving improved gross margins—estimated at 50–55%, well above conventional DRAM—and expects Micron to be the biggest HBM share gainer by 2026.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.