TMTB EOD Wrap

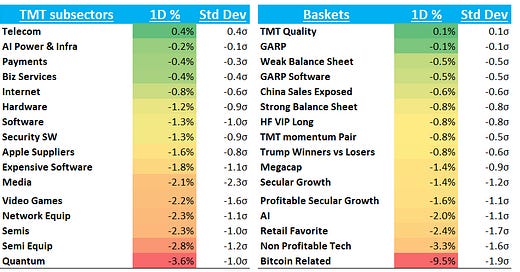

QQQs -1.2% as the momo unwind continued. BTC -6% finally breaking below $90. Yields plummeted today with yields falling 7-11bps across the curve. Fed expects continue to shift dovishly pricing in close to 60bps worth of cuts this year up from 30bps a few weeks ago). Dollar hit fresh multi week lows while Crude dipped below $70. Part of move attributed to confidence board which dipped to 98 from 105 last month which investors took as evidence that DC policy uncertainty is eroding confidence and slowing economy. Outside of tech, spy -50bps/iwm -30bps outperformed.

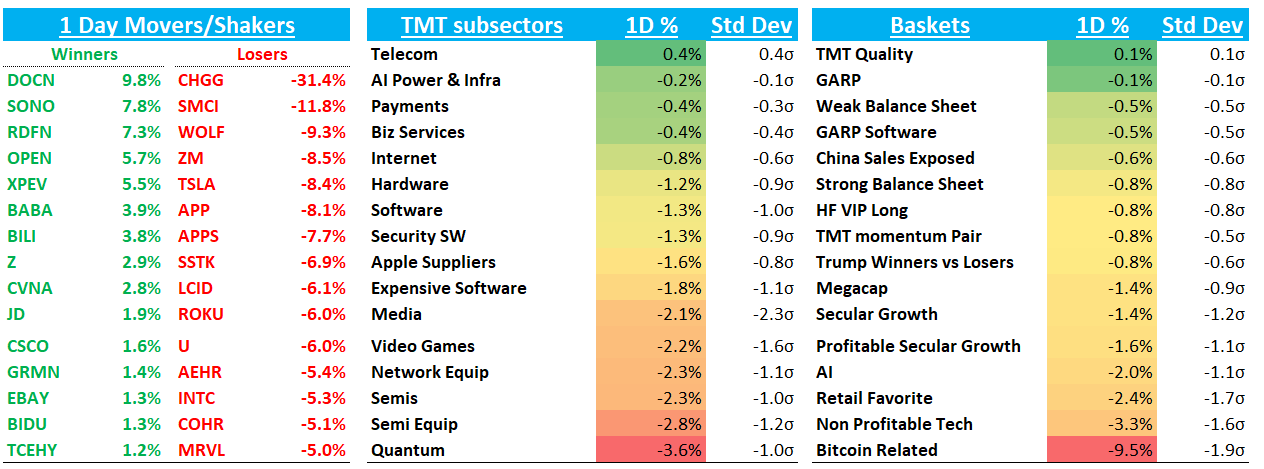

Plenty of red on the screen today in Tech, and price action isn’t great: stocks still breaking through earnings gaps to the downside (ROKU, APP, UPST today), some stocks still going down on good news (XYZ -5% on an upgrade today), and outsized moves to the downside on bad news (ZM -8.5%, CHGG - 31%, TSLA -8.4%).

However, not all is horrible and there were plenty of positive tea leaves today (more than yesterday):

Finally seeing some stocks act well on good fundamental news: CVNA +2.8% on good 3p data at Yipit. ANET +20bps despite CSCO/NVDA partnership as MS defended the stock. CSCO +1.6% on the news. CHWY +26bps on a positive M-sci mention

Dip buyers again stepping in at good r/r’s: Today, AMZN dipped below our add price of $205 and stock bounced nicely to finish flat on the day. We nibbled here.

Yields have plummeted and the 10 year and sits at 4.3% now down 50bps from the highs. The dollar is at 3 month lows, dn 4% from its highs. Crude is under $70. HYG (high yield index) up today. Europe/China continue to act well. We’ve seen narratives switch quickly in both stocks and macro this year. While a growth scare entered the narrative late last week, at what point does this recent yield move become positive for stocks? At what point does Trump blink to a falling market?

On that point, we saw some positive price action in yield sensitive stocks today: RDFN +7%; OPEN +5.5%; Z +3%; W +4%; CVNA +3%; HD +4% on a nice beat; European autos rallying and above 200ma for first time since middle of last year…is this a precursor for a move in other yield sensitive/animal spirit names?

CFLT and TWLO both held their earnings gap again. PLTR sitting right at earnings gap support.

Lots of oversold stocks while defensives like T are way overbought.

Post-close got some good news with better WDAY print, SMCI filing 10-k, and AXON ( a momo name) +12%

There’s actually a stock hitting 52wk highs: EBAY did it today.

All of this doesn’t necessarily mean all clear (as we said yesterday), but it’s preventing us from getting too negative and giving us confidence in adding to names that are hitting our levels (AMZN below $205, MU near $90, CRM near $300, META under $650). As always, things can move quick and we are staying in pnl protection mode, but feeling a bit better after today.

Quick earnings hits post-close:

INTU +5% with a nice rev beat (+17% vvs street at 13.5%), QB +22% beating; solid upside to consumer and Credit Karma; EPS better as well. Better op margins at 26.4% vs est 25.1% and a guide up to 28% for Q1 op margin vs cons 26.7%. Q3 guide of 12-13% above 11% buyside bogey; EPS inline while reiterating FY guide

WDAY +10%: Solid Q as cRPO came in at 15%+ above 14% y/y bogey. Guiding Q1 sub revs in line at 13%. Other sw names up in sympathy (CRM +2%)

CART -10%: Solid Q4 as GTV beat but transaction revs and GP slightly below street. GTV outlook slightly above bogeys but EBITDA guide below ($220-$230M vs street at $237M)

SMCI +22% after filling 10-k

Let’s get to the recap:

Internet

AMZN +4bps: stock dipped below our r/r add price of $205 briefly and bounced nicely to finish in the green. We got Alexa AI day tomorrow and Yipit was out today saying following AWS’ early Dec intro to “Buy with AWS” they’ve seen a significant increase in marketplace spending particularly in Jan’25.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.