TMTB EOD Wrap

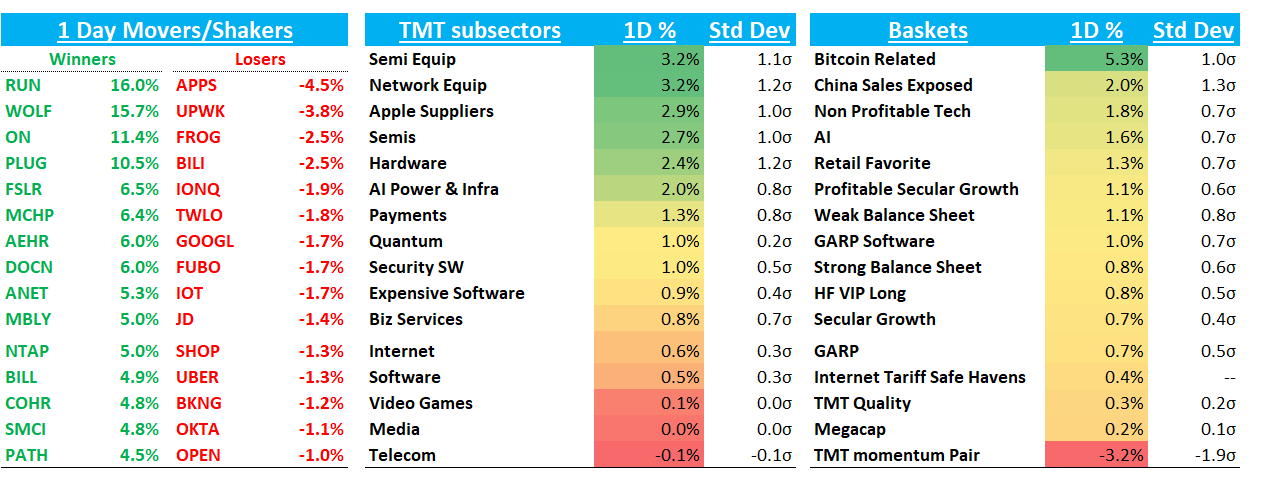

Good evening. Risk on continues as QQQs +80bps led by semis: both AI semis AND Analogs. AI semis helped by some bullish NVDA notes, bullish TSM CEO commentary, and META’s deal with CEG as we head into AVGO’s earnings on Thursday and AMD/ANET/NVDA Paris AI days next week. In analogs, ON CEO sounded good at BAML and analogs strong following through on MCHP’s positive pre-announcement last week.

The AI trade is alive and well - got a nice new ATH in a large cap semi AVGO and just check out Dreamweaver Coreweave +25% today and now up 200% in less than a month…

Close my eyes, the racks begin to glow,

Liquid-cooled rivers where the GPUs flow.

Forty bucks the ticket on that IPO flight—

Now the ticker blazes past one-fifty tonight,

Core Weaver,

Investors watch you warp the s-curve’s height.

Core Weaver,

Your clusters turn dark data into insight.

Core Weaver,

The market knows this jam has just begun—

Yes, fly us through the blazing silicon sun.

Yup, this market definitely a lot more fun than tariffs!

Let’s get to it...

INTERNET

PINS +4% as JPM upgraded saying PINS is effectively using full-funnel ad tools and automation to tap into broad ad budgets and risk/reward attractive. We agree on r/r

GOOGL -1.7% after Asian press said Apple reportedly plans to adopt Perplexity as an alternative to Google Search on the iPhone, as well as a replacement for ChatGPT integration in the Siri voice assistant – Economic Daily…while this not exactly new news, investors on GOOGL are skittish and some were hoping for a tighter Gemini integration announcement at WWDC next week

DUOL -2.5%: UBS called out Sensor tower growth saying May DAUs grew 33% YoY - unchanged vs April, but a 5ppt decel on a 2-Yr basis. UBS’s take was this was a decent result considering the backlash of DUOL's "AI-first" memo in late April, but “if you assume DUOL's June DAUs follow the same MoM growth as last year and DUOL's reported growth remains 7ppts faster than Sensor Tower like last quarter, it implies 40.3% YoY growth vs 2Q guidance for 40-45% YoY growth.”…we added a little to our small short today given stock fell below the 10d/20d

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.