TMTB EOD Wrap

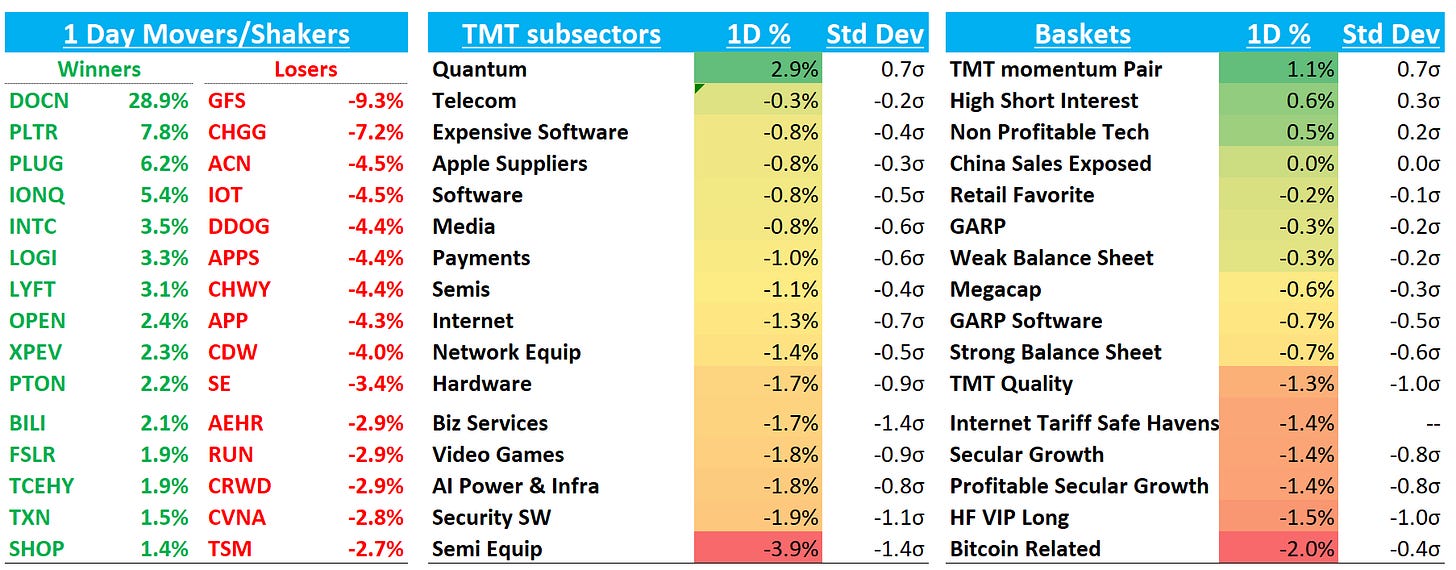

QQQs - 70bps giving back some gains from yesterday as a stagflationary ISM services had investors taking down gross although volumes pretty subdued on this tuesday in August. 2 year yields ticked up 4bps after the spike in services ISM prices, while 10 year was flat. Fed expects continue to price in close to 60bps worth of incremental cuts this year with Sept cuts at 100%. The rest of the week is pretty quiet on the macro front with big next release the CPI #s on 8/12.

Earnings post-close:

AMD -3% looks solid. Q2 revs came in ahead led by strength in gaming and Q3 guide of $8.7B met buyside bogeys and beat street at $8.3B. The guide doesn’t include any China revenue. GMs inline at 54%. Expectations were high (although mainly around 2026) and stock has had a big rally — this print does nothing to change bulls hopes of 2H acceleration + big 2026 GPU upside. We’ll see how specific CEO Lisa Su gets on the call around demand. Wouldn’t be surprised to see stock continue to digest a bit given GPU ‘26 estimates have ramped from 9-10B to 14-16B in a little over a month, but this print won’t shake bulls confidence and many waiting on sidelines to buy dips.

ANET +14% solid numbers, especially on the GM side. Call going well so far guiding $10B in revs in 2026 and campus now targets $750M - $800M up from $750 (not many expected a raise): Q2 beat with revs/GM/EPS of $2.21B/65.6%/$0.73 vs. Street $2.11B/63.0%/$0.65.

Q3 guide solid at $2.25B/64.0%/47.0% vs. Street $2.12B/61.5%/44.2%.

SMCI -14%: Missed on the top and bottom lines: revenue came in at $5.76 billion vs. $5.89 billion est. and non-GAAP EPS was $0.41 vs. $0.45 est., while gross margin compressed to 9.6%. CEO Charles Liang blamed intense pricing pressure as the AI server space crowds, but maintained a bullish FY ’26 sales outlook of “at least $33 billion.” Not good enough given the raises and positive datapoints we have seen across the AI semi space recently

ALAB +8%: Another strong beat and raise. Some leaned short heading into the print and #s slightly ahead of buyside. 2Q revenue/gross margin/EPS of $192m/76.0%/$0.44 vs. Street at $173m/74.1%/$0.32….3Q guide for revenue/gross margin/EPS of $206.5m/75%/$0.385 vs. Street at $181m/73.6%/$0.34

SNAP -15% logged its slowest growth in a year while rev and EBITDA missed while guiding revs/ebitda about inline with sell-side. Q2 revs/EBITDA of $1.345B/$41M vs Street $1.35B/$49M; DAUs of 469M in line.

Let’s get to it…

INTERNET

MELI flat after mixed earnings: Revs beat but EBIT fell short of expectations. But mgmt sounded positive and confident around Brazil and MX acceleration, which comforted bulls that despite higher opex, GMV isn’t decelerating.

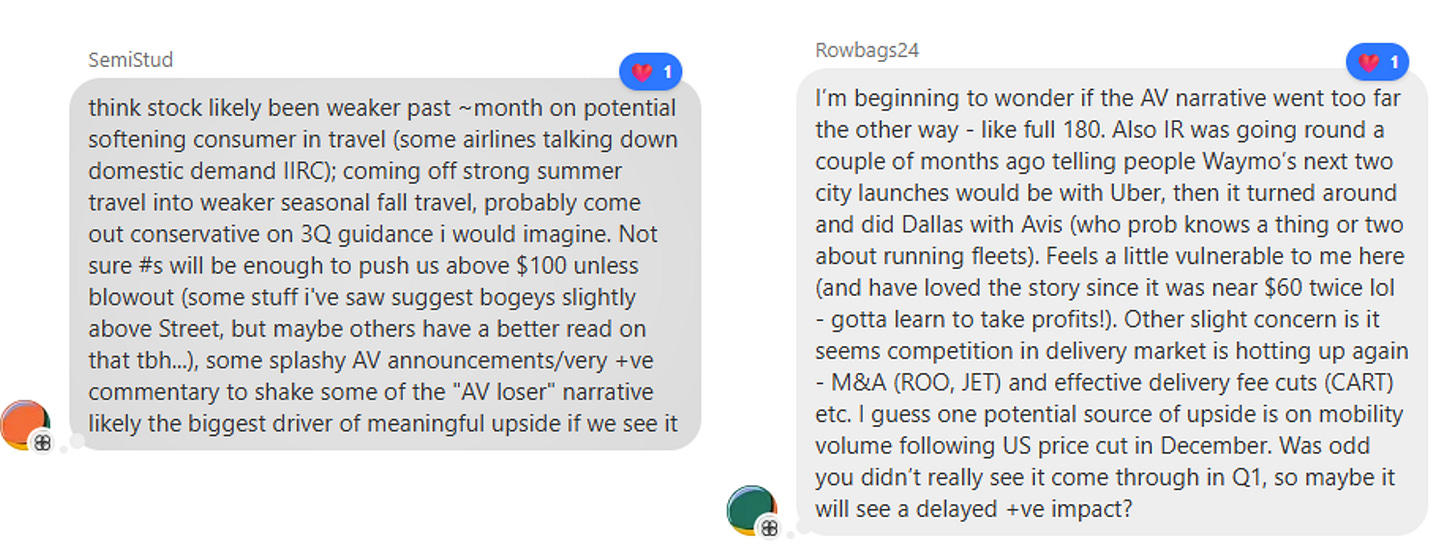

UBER +1% ahead of earnings this week as 3p continues to point to a mobility beat. Some good commentary in TMTB Chat today:

We had some thoughts on the narrative shifts this weekend too in our preview in case you missed it:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.