TMTB: EOD Wrap

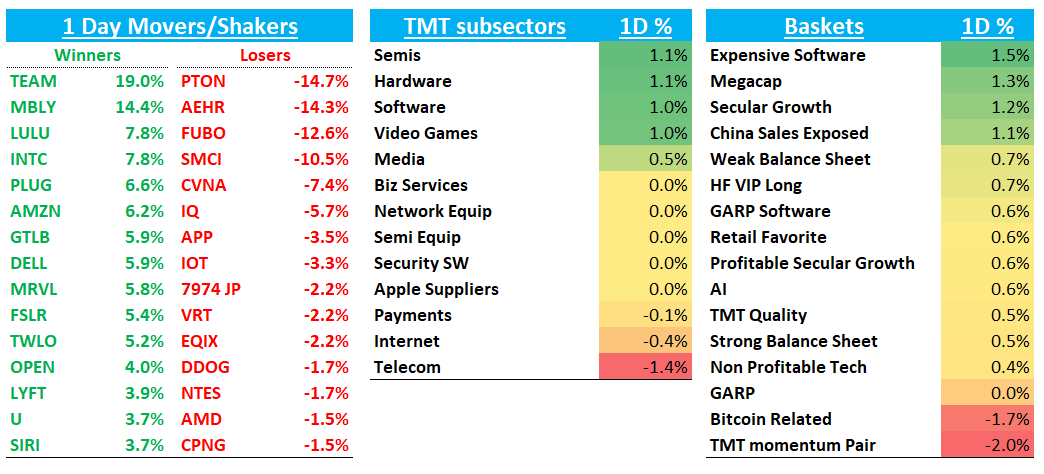

Good afternoon. QQQs +75bps helped by AMZN +6% as sw and semis outperformed on the day. NVDA +3% post close on news they will join the Dow (replacing INTC) while Bezos filed to sell 16.4M AMZN shares post-close as well, although that seems like the # of shares left from the original 25M tranche filed in July. Likely has $200 limit like he had on the first 9M he sold in July, which means maybe a bit of a NT cap on the stock.

In terms of macro today, fed expects moved slightly in a dovish direction w the market now pricing 45bps worth of cuts over the final two meetings. Despite this, 10 year finished up 9bps at 4.37% (treasuries had initially spiked on the Oct jobs report but then came for sale). Seems like yields moving not only on econ data now but taking their cue from fiscal policy linked anxiety, which means might get some big moves depending on who wins the election on Tuesday (h/t VitalKnowledge).

Pretty slow news day other than some major earnings releases, but let’s get to the recap…

Internet

AMZN +6% as investors liked the big EBIT beat and raise despite AWS coming y/y growth # coming in a bit weaker (RPO and backlog were better, however). Like we said above, Bezos has $3B likely waiting to be sold at $200 so will be interesting how stock acts over next several days

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.