TMTB EOD Wrap

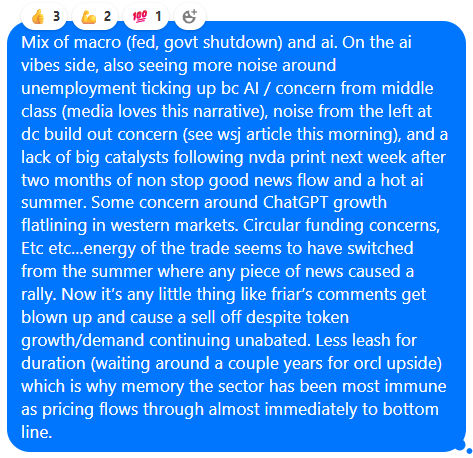

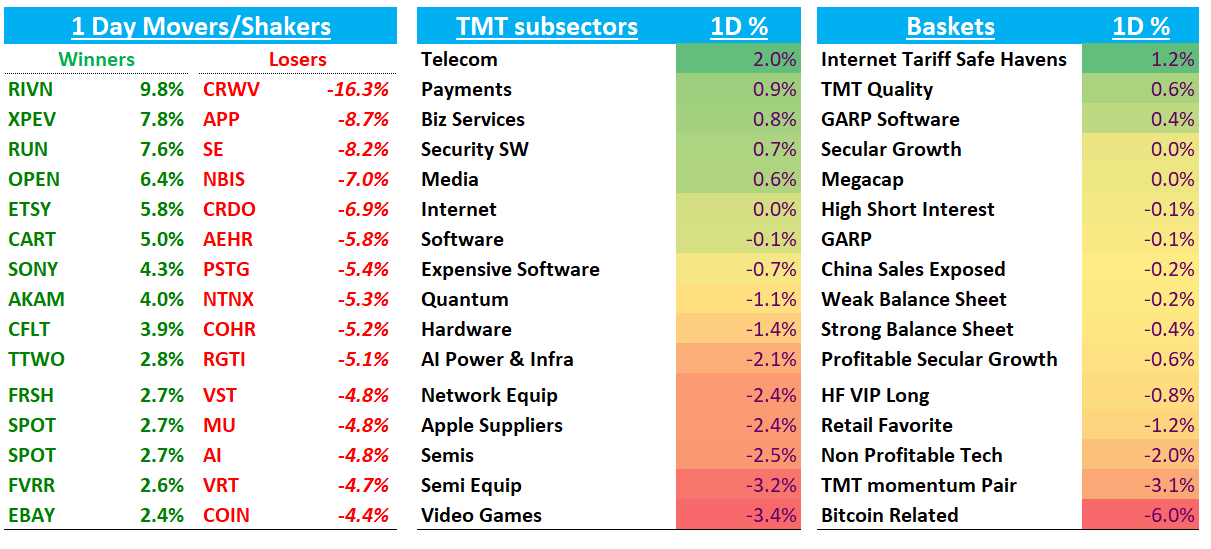

QQQs -27bps. Laggards led the way vs. winners today - not only in Tech as the AI trade continues to take a breather but also in the broader market with Healthcare and Energy leading the way higher. Lots of noise around AI trade but most tech investors I talk to think it’s just typical ebb and flow in the trade we’ve seen over the past 2-3 years. Some off the cuff thoughts from us in the chat today about what’s been happening…

We don’t have strong view or feel of what happens next near-term - think with a little bit of time and more digestion we’ll get a clearer feel/picture. I think most had been set on the bubble paradigm (with both bulls and bears hoping for similar price action in different ways), but that doesn’t seem to be the right one with current demand backdrop and valuations where they’re at (MS and BofA had a couple of good pieces out the last two days saying something similar).

The smartest “vibe” guys I talk to feel similar to me - coming up a bit empty of what’s the next near-term move/shift in narrative or paradigm to hook onto in the AI trade. All eyes on NVDA print next week, although many feel a lot of the excitement of that has already been pulled forward with Jensen’s 0.5T slide.

Onto the recap…

INTERNET

META -70bps as Chief AI scientist Yann Lecun exiting to start his own start up. META had an interesting post diving into their Generative Ads Model. Key takeaway:"

“In Q3, we made improvements to GEM’s model architecture that doubled the performance benefit we get from adding a given amount of data and compute. This will enable us to continue scaling up the amount of training capacity we use on GEM at an attractive ROI..“Looking ahead, GEM will learn from Meta’s entire ecosystem including user interactions on organic and ads content across modalities such as text, images, audio, and video. This stronger multimodal foundation helps GEM capture nuances behind clicks, conversions, and long-term value, paving the way for a unified engagement model that can intelligently rank both organic content and ads, delivering maximum value for people and advertisers.”crease in ad conversions on Facebook Feed in Q2.”

ETSY 6%: Didn’t see anything specifically but 3p data continues to track slightly above on GMS

CART +5% with some nice follow through post earnings as BMO raised to Buy on compelling r/r.

CVNA +1.4% as 3p said units accel’d MSD in latest week back in the low 40s

AI / SEMIS

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.