TMTB EOD Wrap

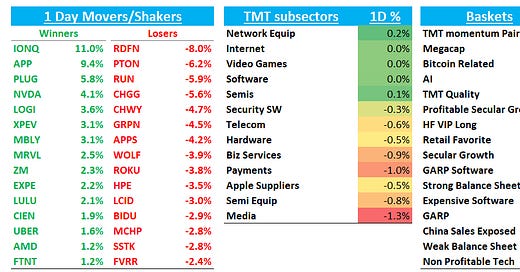

Good afternoon - QQQs +15bps as treasuries got hit hard today with yields up 7-10bps across the curve and 10 year hitting 4.2%, which hit some rate sensitive names such as housing and telco stocks. China also some more profit taking with FXI -1.5%. The market is now pricing in 42bps worth of cuts over the last two FOMC meetings of the year w a 90% probability of a 25bp cut on 11/7. Despite SOX being flat, NVDA +4% followed TSM with 2nd large cap AI semi to hit 52wk high - MRVL and AVGO not far behind, which bodes well for the QQQs

Let’s get to the good stuff…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.