TMTB EOD Wrap

QQQs flat on relatively boring Friday Thursday. NFLX with solid #s after the close hitting all buyside bogeys and more. Not surprising to see the stock up 4%. My sense is lots of $$ flowing into these tariff/safe havens and will continue...set up for these tariff/safe havens is inline/inline commentary will be good enough and will get bought up. Imagine beats will be rewarded more handsomely...the tariff/china exposed names trickier and we’ll have to read the tea leaves in real-time for those... obviously macro still clouds over everything, NFLX a special case as probably one of most recession proof names with their $7.99 ad tier. We’ve written about this dynamic over the last week and half and think NFLX print will help continue to trend (we remain on our toes in case any change in the current Trump v. China stand of…)

On the macro front yields rose 3-5bps, Trump continued to threaten Powell, and talked relatively hawkish on tariffs during/after his meeting with Italy PM. Fed expects continue to px in 88bps worth of incremental cuts this year,..

Hope everyone has a great and relaxing long weekend…

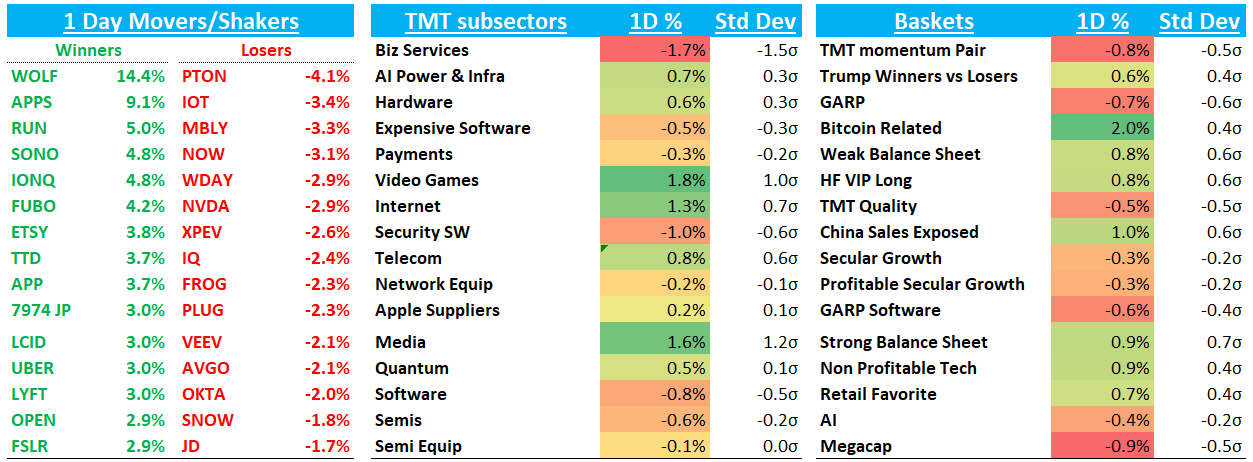

Let’s get to the recap…

Internet

GOOGL -2% as US judge ruled they hold illegal monopoly in ad tech…Reuters:

Google illegally dominates two markets for online advertising technology, a judge ruled on Thursday, dealing another blow to the tech giant and paving the way for U.S. antitrust prosecutors to seek a breakup of its ad products.

U.S. District Judge Leonie Brinkema in Alexandria, Virginia, found Google liable for "willfully acquiring and maintaining monopoly power" in markets for publisher ad servers and the market for ad exchanges which sit between buyers and sellers.

TTD +4% in sympathy to the GOOGL ruling

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.