TMTB EOD Wrap

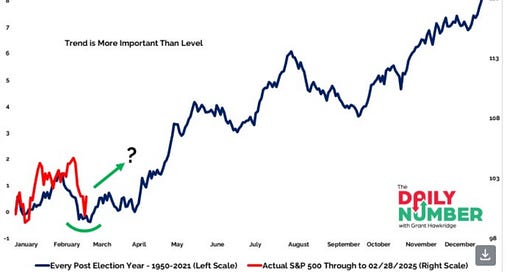

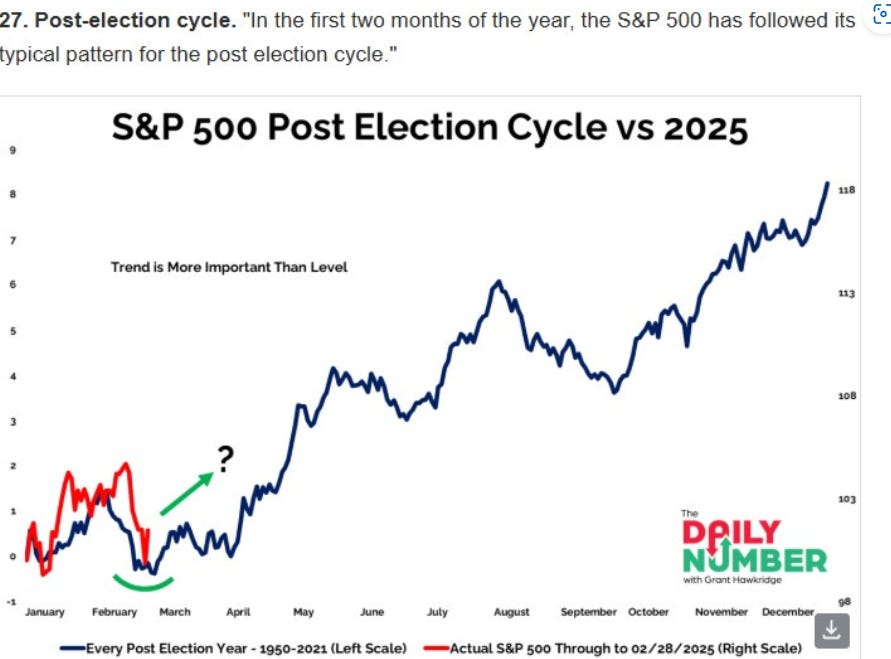

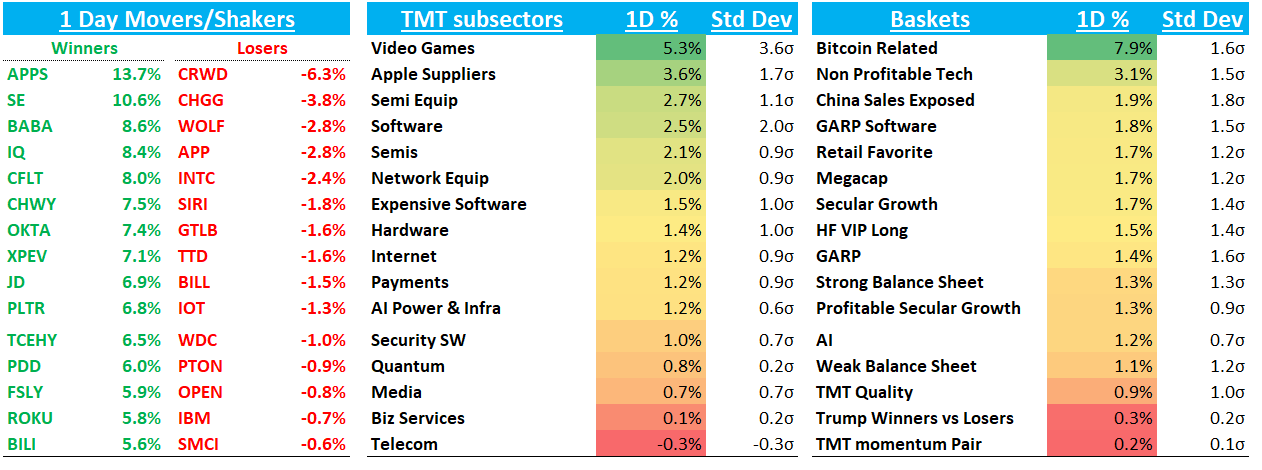

Would you look at that: Fundamentals are back in vogue! Well, at least for a day, but nice to see. QQQs +1.3% with some nice price action in Tech as MS TMT Day 3 wrapped up. Yields were down early after a weak ADP report, but a decent ISM and big surge in German Bund yields saw that 10 year finish up 3bps. Fed expects shifted slightly in a hawkish direction, now only pricing 70bps worth of cuts while the dollar tumbled 140bps. Seems like we are past peak “tariff tantrum” for the time being. All eyes on NFP now heading into Friday. Continued chop continues to be the base case for us for the time being, which would align with post-election seasonality:

Eurozone rallied after a momentum shift in approach to discal spending from Germany. China +5% looks set to take a new leg higher despite Tariffs as they stuck with their “about 5% growth” target implying they will say accommodative in their stimulus.

In tech, saw some healthy price action as stocks were reacting as you would expect given news flow. Stocks that sounded good at MS outperformed: META, CFLT, CHWY, DELL (we’ll send out some summaries in a bit) while OKTA + SE saw some nice follow through after yesterday’s big gains.

Let’s get to the recap…

Internet

META +2.5% as Chief Product Officer sounded good at MS although we didn’t get a ton of incremental info and he sounded pretty reserved on AI search

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.