TMTB EOD Wrap

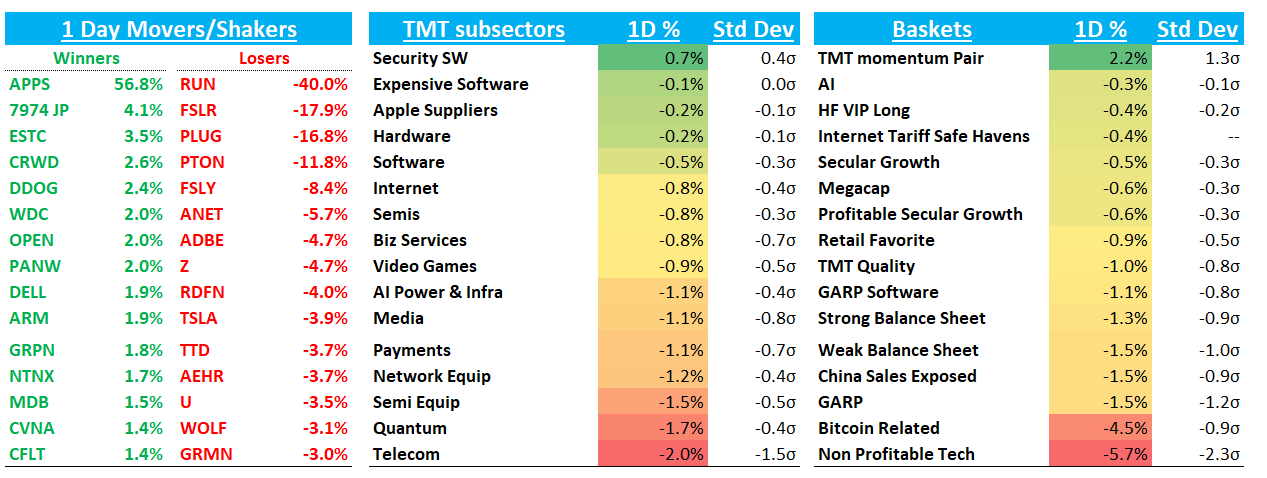

QQQs -1% as selling continued throughout the afternoon as it seems like US might begin offensive participation in the Iran vs. Israel tensions, as well as some weaker econ numbers (retail sales/NAHB housing survey). Higher oil + July 9th deadline getting closer also not helping things. Yields took a step back falling 2-6bps across the curve, Bitcoin fell 4%, and dollar rallied 75bps. Crude was up 4% sitting at around $75.

Let’s get to it…

INTERNET

RDDT +6% led the way higher but sold off from its initial spike higher (was +15% at one point but met resistance at 150d). In addition to our write-up talking about the 180 in narrative, Mgmt supposedly sounded good in Cannes meetings (although I haven’t gotten any details - if you were heard more, please let me know).

Here’s the link to the back and forth I had with ChatGPT’s o3, which helped me gain conviction in the trade and confidence to send out the idea to you all yesterday — I think it’s a great example of how you can use AI to help flesh out an initial idea/hypothesis. The work done by o3 would have taken me so much longer to get to the same conclusion (assuming I could have gotten there) even in my best analyst days.

META -70bps as Yipit said revs tracking 2% below street saying street not modeling fx headwind correctly while sell-siders were generally positive on the Whatsapp ad rollout, with $6B incremental rev # being thrown around.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.