TMTB EOD Wrap

QQQs -20bps as Powell was overall dovish, but not any more than what was expected. Here’s Vital Knowledge:

The forward guidance language evolved in a dovish direction, suggesting this isn’t just a one and done situation– “In considering additional adjustments to the target range for the federal funds rate” is the new outlook, which is a subtle (but important) change from “In considering the extent and timing of additional adjustments”

The 2025 dot moved down 30bp to 3.6%, suggesting 25bp rate cuts at the last two meetings of the year (10/29 and 12/10)

The 2026 dot shifted down 20bp to 3.4%, suggesting the Fed (right now) is only planning a single 25bp cut next year (the Street is pricing in 2.9% for 2026, but the fact the Fed isn’t blessing such a low figure at this time isn’t a huge deal)

Yields rose 2-5bps across the curve.

Now that’s behind us, let’s get straight to the good stuff….

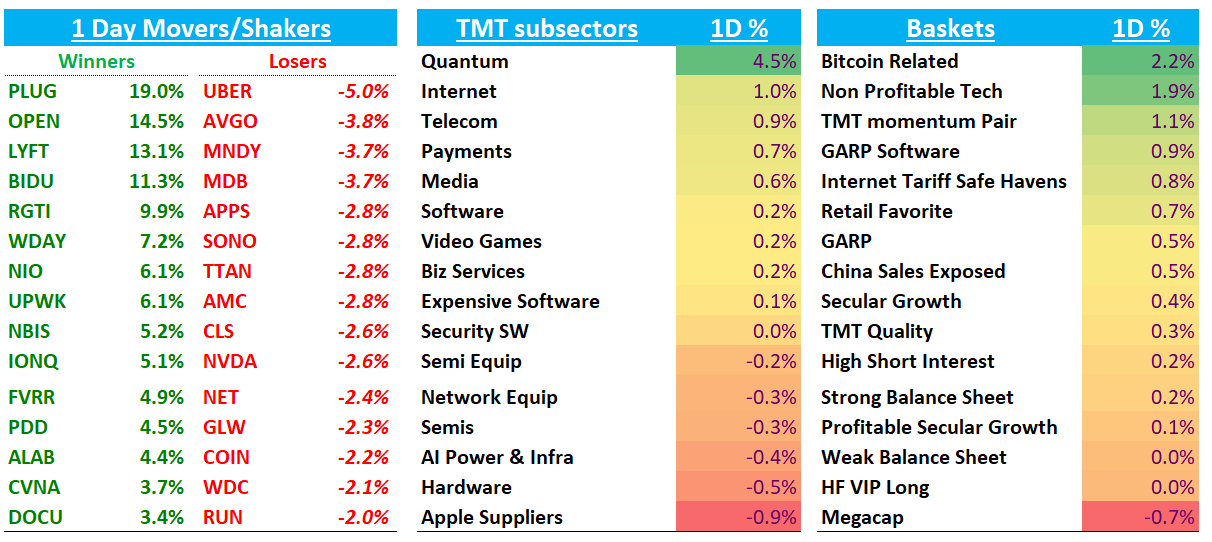

INTERNET

LYFT +13% / UBER -5% as Waymo announced they are partnering with LYFT for Nashville. Waymo says that LYFT will initially be handling fleet management only, such as vehicle cleaning and maintenance via the LYFT subsidiary Flexdrive. Lots of discussion today around whether aggregators will find value in an AV world, which is the main debate around both stocks, especially UBER. Bulls will say in FSD, Uber/Lyft are the fastest path to scale because AV fleets need ~25 rides/car/day and aggregators uniquely deliver dense, time-varying demand, lowering CAC and ramp time. They stay capex-light while monetizing routing, pricing, payments, and trust/safety, and their multimodal networks (AV + human drivers + delivery) smooth peaks, keep ETAs low, and preserve take rates. Non-exclusive AV partnerships should favor the platform with the most demand liquidity, which means UBER and then LYFT. Bears will counter that autonomy turns vehicles into interchangeable API supply, shrinking aggregator value-add and pressuring take rates. Once AV operators reach route density, they can redirect riders to their own apps, renegotiate rev-shares, or multi-home across platforms, compressing margins and taking share. Don’t think this debate will be settled any time soon as still very nascent…

Another tidbit saw today: yesterday UBER Freight announced they were partnering with TSLA on their dedicated EV fleet accelerator program to boost adoption of EV semi trucks - some were saying that might be signs of closer relationship potentially w robotaxi, although that seemed a bit of a stretch.

NFLX +2% as Loop upgraded to buy and raised PT to $1,350 calling out stronger engagement trends and higher long-term margin potential and raised EPS to $65 vs prior $55 in 2030

AMZN -1% was weak as Clev said that AWS continues to underperform driven by lagging position in AI, but didn’t seem much new from what they said last week.

ZG +2% as Bernstein upgraded to buy highlighting mid-teens revenue growth & momentum in Rentals and Showcase.

CVNA +3.7% as 3p data pointed to units accelerating to 50% in the latest week and continue to track to low to mid 40s vs street in highs 30s

RDDT finished flat after being down 6% at one point. Didn’t see much for the early weakness other than this:

Then a Bloomberg article hit saying Reddit Seeks to Strike Next AI Content Pact With Google, OpenAI

Reddit Inc. is in early talks to strike its next content-sharing agreement with Alphabet Inc.’s Google, aiming to extract more value from future deals now that its data plays a prominent role in search results and generative AI training.

Reddit, more than a year and a half after its first data-sharing deal with Google for a reported $60 million, is in talks for deeper integration with Google’s AI products, according to executives familiar with the discussions. It’s proposing a new kind of partnership that would encourage users to become active contributors to Reddit’s popular online forums, so Google traffic could help the company grow and generate content for future training.

Sounds like RDDT trying to negotiate from a position of strength. Recall, CEO was at GS last week saying he could get “tens” of multiples from current deals which is way more than anyone is expecting. My sense is that comment was exaggeration from those in the room, but think his point was that they’ll be able to structure deals that better benefit them.

News also out Anthropic trying to take the RDDT suit back into Federal court so they can argue scraping of data protected by copyright law. I’ll spare you the details from my rabbit hole dive into the current lawsuit and also the OAI vs. NYTimes lawsuit, but we’ll likely get decisions on these very important suits in ‘26 and both have potential to have significant ramifications both for RDDT & other web properties and content creators along with the LLMs. Unclear whether we get settlements in any of these cases, and my guess is the OAI vs NYTimes suit eventually goes to the Supreme Court. We’ll continue to track any developments in both cases.

WIX 2% continues to act well and re-rate higher (Base44 + web traffic tracking decent in Aug/Sept)

META -40bps as META Connect starts at 8pm est.

BIDU +11% more follow through from the Arete double upgrade yesterday as their Kumlun unit the biggest beneficiary from any NVDA AI Chip ban in China. Kumlun currently mfg’d by Samsung and also uses Samsung HBM, which is another nice feather in the Samsung bull case.

Other China names strong: GDS +7.5%; VNET +3%; BABA +2.5%…we had some commentary on China strength in our Morning Wrap.

MELI +2% nice follow through following the positive M-sci data from yesterday saying taking share in Brazil + MX

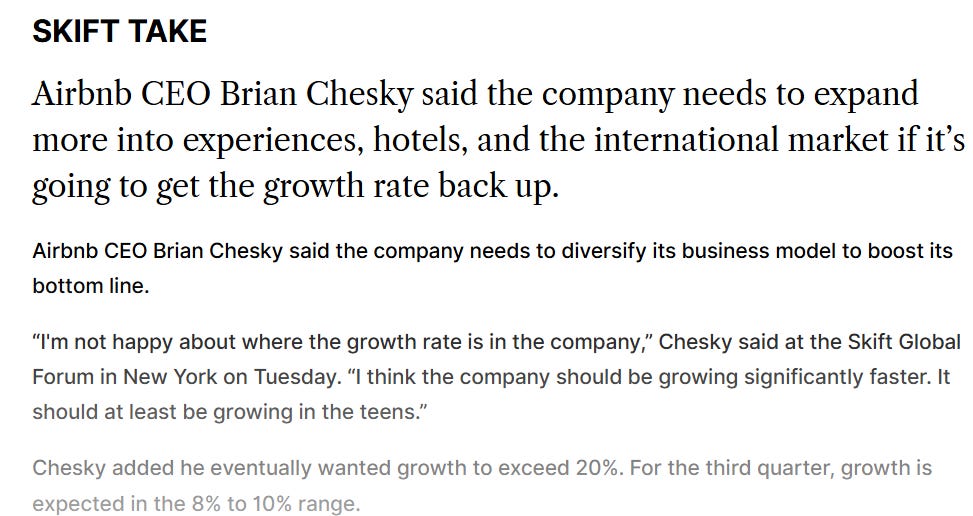

ABNB +1.2%:

SEMIS

NVDA -2.4% on more negative Chian headlines, this time the FT saying that China has banned China tech companies from buying NVDA’s AI chips, specifically the RTX Pro 6000D. Unclear if this will extend to H20/B30 or if it’s a negotiating tactic by the Chinese gov’t but only time will tell. China is clearly a massive opportunity for NVDA and shipping there would make numbers go up - it’s unclear how much buyside explicitly has modeled — I think there’s still hope that some sort approval will get done, but no one has a clear answer and we’ve gotten incremental negative news flow on that front over the last week so that’s where we sit currently. AMD -1% in sympathy

ALAB +5% as Citi boosted PT to $275 on stronger AI ramp and said Scorpio X is emerging as a long-term growth driver as hyperscalers increasingly adopt PCIe and look toward UALink adoption by 2027. Management commentary suggested Scorpio revenue is already exceeding guidance and should rise further in Q3 and Q4, with Series X expected to account for meaningful contributions in 2026. Citi also highlighted the upcoming OCP conference (Oct 13–16) as a potential catalyst, expecting hyperscalers to emphasize open networking ecosystems like UALink, which could incremental revenue to their estimates

MRVL +3% as heard MRVL wanted to talk to Harlan at JPM so they scheduled a fireside chat with CEO next Wed.

Quantum — RGTI +10%, IONQ +5% - names continues their ascent as Digitimes had an article talking up NVDA invesments in the space

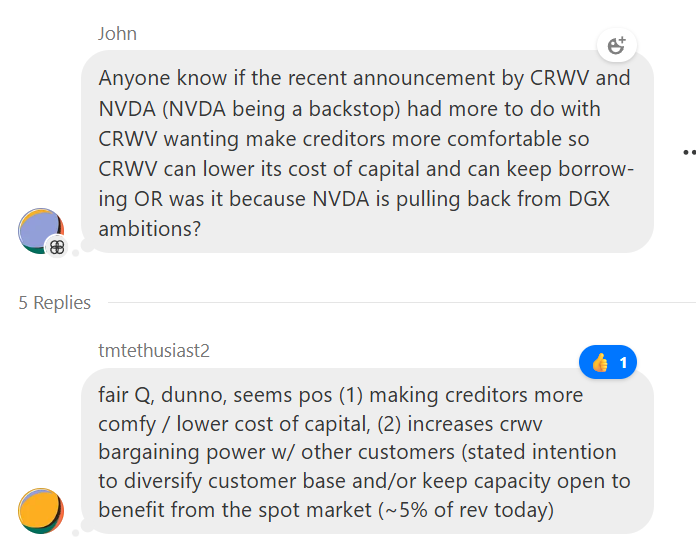

CRWV +2% as they announced next GBP 1.5 billion phase of its investment in AI data center capacity and operations in the United Kingdom, bringing the total investment in the country to GBP 2.5 billion

NBIS +5% as GS raised numbers. GS now sees 2030 revenues of $8.5bn and notes the deal could reach $19bn per Nebius’ release. 2028/29 revenue already assumes $3–4bn from MSFT, and the 2030 forecast bakes in an extra ~$2.6bn. Management said this is the first of multiple large AI lab deals, with financing split between deal-generated cash flow and new debt issuance.

STX +1% / WDC -2% going opposite ways for once…SNDK +2.5% no stopping this beast

AVGO -4% / CLS -2.5%; Didn’t see anything here today other than taking a breather after big outperformance recently. Let me know if I missed something please.

MU +1% on a couple of PT raises. Susq was out arguing the market has yet to fully recognize Micron’s ability to generate around $20 in annualized EPS. We get EPS next week, but since their pre announcement in August, NAND sentiment has firmed on HDD shortages while DRAM pricing has stayed resilient

BE +9% as RBC says found permit application for 50mw at foxconn facility in CA. We covered the bull cases in our EOD wrap yesterday in case you missed it. Someone pitched FCEL +10%, who is targeting 100MW by year end as another energy play:

Out of my wheelhouse and a bit thin, just passing along. Feels like a new “AI beneficiary” that I never heard of pops up every day. PLUG +19% also rallying on similar read-throughs. A sign risk moving further out the speculative curve when I start mentioning names like this lol…

Analog strength: TXN +1.5%; MCHP +2%; ADI +1%. After hosting TXN’s IR head Mike Beckman at its U.S. All-Stars event, JPMorgan said the company’s message was constructive but largely consistent with recent commentary. Management pointed out that 4 of 5 end-markets grew in Q2, with industrials leading the recovery, consumer and comms already improving, and autos healthy YoY though still not fully normalized

SOFTWARE

WDAY +7% as Eilliot took a stake and got an upgrade from Piper and WDAY as bulls liked the $4B in additional buyback and better than expected margins of 35% in FY28 vs expects which were in the low 30s. Bears not convinced and will continue to point to slowing core biz & lower subscription growth while AI structural fears remain as WDAY lacks of AI product story.

MDB -3.5% as CFO did his best to thread the needle between managing MDB’s existing guidance framework vs putting out LT targets by giving a 3-5 year guide (20%+ Atlas) and said guide wasn’t a ceiling, implying there was plenty of upside (supposedly CFO implied as much). Next q’s number likely going to be 30%+. Bulls say the LT framework finally sets a credible floor on growth/profitability, LOs are underweight a 20% grower at scale, and Atlas could print high-20s/30% near term; AMP should help productize demand and capture app-modernization, making the targets look sandbagged and leaving the stock biased higher into the next print. Bears say the stock is +50% since FQ2 while guidance implies high-teens total growth, modest EBIT expansion, and teens FCF margins, leaving little room for multiple expansion if Atlas decelerates; FCF < EBIT (pay-as-you-go mix, low deferred rev) still invites skepticism, and the slides lacked an “uber-bull” case. Most sw investors still skew long here.

ORCL -1.7% some giveback as some continue to pushback on feasibility/financing of the OAI deal — seems like they will take a small stake in any Tiktok deal to get any business that flows from US Bytedance

MNDY -3.5% as they guided to about $1.8B FY27 revenue (~+19% YoY, a tad lower than street), with some upside potential, and expects NG S&M to be ~40% of revenue by FY27 as hiring growth moderates (~30% YoY in FY25 to ~20% in FY26). Seat-based “New products” (CRM, Dev, Service) have risen to 9.4% of ARR on a roughly $1.2B ARR base (vs. 8.8% in FQ1’25 and 6.0% a year ago), with CRM >$100M ARR (74% SMB), Dev $14M, and Service $7M. They talked about a newer, consumption-based portfolio rolling out: Sidekick (beta) as a digital worker for multi-step tasks; Vibe (beta) to build enterprise apps via natural language; Agents (target H1’26) to bring agentic-AI into workflows; and Magic (beta) for rapid onboarding from intent to solution, designed to work with Vibe.

ELSEWHERE

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.