TMTB EOD Wrap

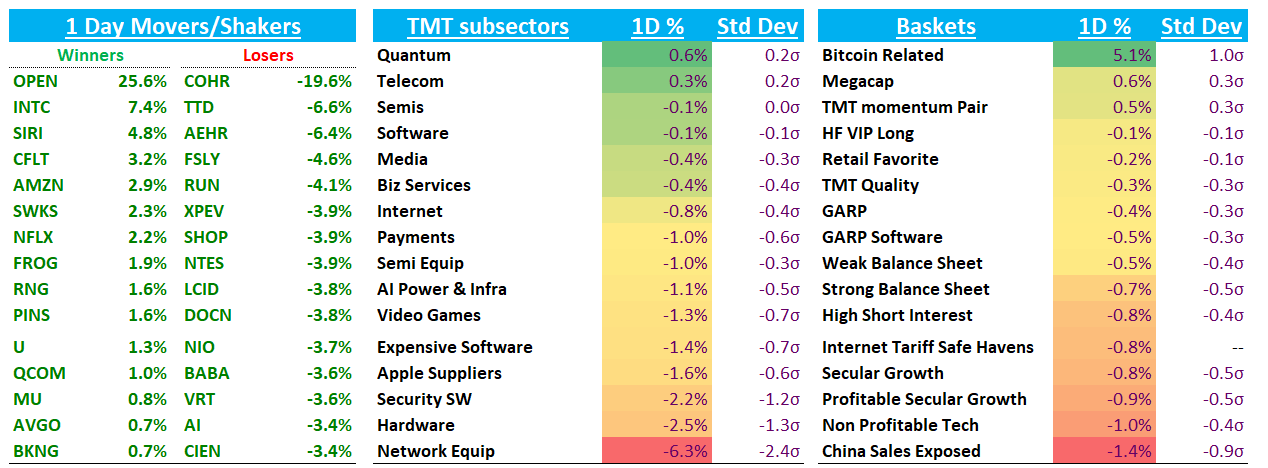

Good afternoon. QQQs were roughly flat with IWM -1.3% underperforming. After the hot PPI, yields rose 5-6bps across the curve and fed expects shifted in a hawkish direction with only ~90% odds of a rate cut in Sept (down from 100% pre PPI) and 55bps of total cuts from remaining 3 meetings. After a couple of days of rotation to more cyclically exposed names, tech investors moved back to Mega-cap, which outperformed non-profitable tech by 150bps today. BTC with a false breakout finishing down 4% on the day after touching new highs.

Earnings post-close:

AMAT -14% with one their biggest guidance misses in recent memory. Q3 beat but Q4 guided lower on Revs GM and EPS driven by capacity digestion in China and uneven demand from leading-edge customers. This marks a sharp tone shift from earlier in earnings season. Expectations weren’t super high here, but just an ugly print overall. Earnings call ongoing…

Management commentary:

“We are currently operating in a dynamic macroeconomic and policy environment, which is creating increased uncertainty and lower visibility in the near term, including for our China business… Despite this, we remain very confident in the longer-term growth opportunities for the semiconductor industry and Applied Materials.”

“We are expecting a decline in revenue in the fourth quarter driven by both digestion of capacity in China and non-linear demand from leading-edge customers given market concentration and fab timing.”

Key Metrics

F3Q Revenue: $7.3B, +3% y/y vs Street $7.2B

F3Q GM: 48.9% vs Street 48.3%

F3Q EPS: $2.48 vs Street $2.35

F4Q Revenue: $6.2–7.2B vs Street $7.39B, +2% y/y

F4Q GM: 48.1% vs Street 49.0%

F4Q EPS: $2.11 vs Street $2.44

SNDK -8% beat but also guided GMs and EPS lower vs. street.

June quarter revenue of $1.90B (+12% q/q, +8% y/y) and EPS of $0.29, topping both guidance ($1.75B–$1.85B, $(0.10)–$0.15) and Street estimates ($1.82B, $0.05). Gross margin came in at 26.4%, within guidance (25.5%–27.0%) and above Street’s 26.0%, while operating margin was 5.3% vs. Street at 4.2%.

For F1Q26 (September), the company guided revenue to $2.10B–$2.20B vs. Street at $2.00B, gross margin to 28.5%–29.5% vs. Street at 29.4%, and EPS to $0.70–$0.90 vs. Street at $0.86.

INTC up another 3% in the post as Bloomberg reporting US discussing taking a stake:

The Trump administration is in talks with Intel Corp. to have the US government take a stake in the beleaguered chipmaker, according to people familiar with the plan, in the latest sign of the White House’s willingness to blur the lines between state and industry.

A deal would help shore up Intel’s planned factory hub in Ohio, said the people, who asked not to be identified because the deliberations are private. The company had once promised to turn that site into the world’s largest chipmaking facility, though it’s been repeatedly delayed. The size of the potential stake isn’t clear.

13-F Filings out today - we recap some at the bottom…

Let’s get to the recap…

INTERNET

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.