TMTB: EOD Wrap

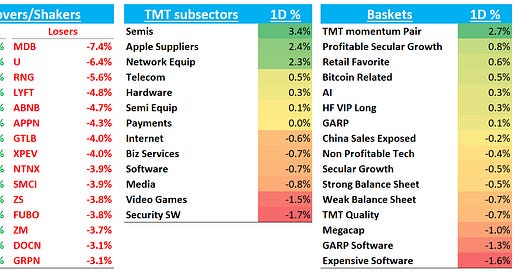

QQQs +77bps dragged up by AVGO +24% and semis +3% despite NVDA -2%. Investors were already in a love fest with ASICs following MRVL’s (+10% today) print and Hock Tan made clear to everyone why they should be bullish: a $60-90B SAM in ‘26/’27. The market moves fast: semi AI investors continue to shift their focus away from NVDA to custom asics and networking. It’s not that NVDA’s stock or story is broken by any means, but after a huge run in the last 2 years where NVDA had the whole GPU market to themselves, more exciting stories are popping up elsewhere. AVGO print helped drag up other semis that benefit from both NVDA GPUs or ASICs: TSM +5%; ARM +2.6%; ANET +5%. As we suspected, MU +4% got a decent bid today as tech investors love their pattern recognition and saw similarities between the mixed sentiment set up going into both prints. AMD -3% not as lucky as more share for MRVL/AVGO means less to around for AMD — investors continue to use it as a funding short.

Semi strength drove a rotation out of software and price action has turned decidedly worse for the group this week. There are always tea leaves: it all started last Friday with GTLB selling off on what we thought was a decent print. That was a warning. The ORCL and MDB misses this week just added fuel to the fire. Then over the last couple of days we’ve seen those stocks continue to follow-through to the downside (MDB another -8% today). Now seeing things like CRM sell off on an upgrade (although nothing particularly new or intg from the KEYB ug today). Still, plenty of charts look fine and we still like certain AI Agent stories, particularly CRM, as we head into 2025 but group was due for some digestion, inline with weak Dec. seasonality.

Lots of talk of poor breadth but plenty of leaders keep breaking out and acting well. Case in point: TSLA +4% continues to be a monster breaking out to new highs after positive 3p data from Yipit this morning and news Trump team likely to get rid some self-driving regulations. UBER -2.4% / LYFT - 5% continue to get hit. Two opposite ends of the spectrum as TSLA +70% getting re-rated higher on robotics, FSD, and Elon buddy buddy with Trump while UBER -30% since robotaxi getting re-rated lower on Mobility risks. Things move quick in tech. That’s why we love it!

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.