TMTB EOD Wrap

Good afternoon. QQQs +2.3% and up another 25bps post-close after some good reports from NOW + TXN and some headlines saying Trump will exempt carmakers from some US tariffs. Here’s FT:

The move would exempt car parts from the tariffs that Trump is imposing on imports from China to counter fentanyl production, as well from those levied on steel and aluminium — a “destacking” of the duties, according to two people with knowledge of the matter. The exemptions would leave in place a 25 per cent tariff Trump imposed on all imports of foreign-made cars. A separate 25 per cent levy on parts would also remain and is due to take effect from May 3….Complete vehicles and parts that comply with the terms of the USMCA will have the 25 per cent tariff applied only to their non-US content.

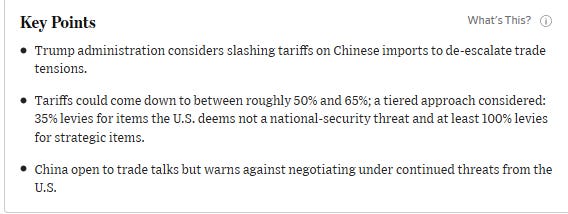

WSJ also had an article today, which detailed some potential avenues for de-escalation…:

Stocks were strong although well off their intra day highs as Trump backed off his Powell threats and opened door to some potential negotiation with China. Some other headlines from the day…

BESSENT: NO UNILATERAL OFFER FROM TRUMP TO CUT CHINA TARIFFS; FULL CHINA TRADE DEAL MAY TAKE 2-TO-3 YEARS

US TREASURY SECRETARY BESSENT: CHINA SITUATION NEEDS TO BE DE-ESCALATED FOR TRADE DISCUSSIONS TO PROCEED

BESSENT: CHINA'S CURRENT ECONOMIC MODEL IS BUILT ON EXPORTING ITS WAY OUT OF ECONOMIC TROUBLES, TRUMP ADMINISTRATION WANTS TO HELP CHINA, AND U.S. REBALANCE

BESSENT SAYS 'AMERICA FIRST DOES NOT MEAN AMERICA ALONE'

BESSENT WON'T SEEK CURRENCY TARGET IN TALKS WITH JAPAN: NIKKEI

TRUMP: WE'RE GOING TO HAVE A FAIR DEAL WITH CHINA

10 year fell 2bps but 2year rose 5bps. Dollar rallied 1% for its biggest 1 day gain since December

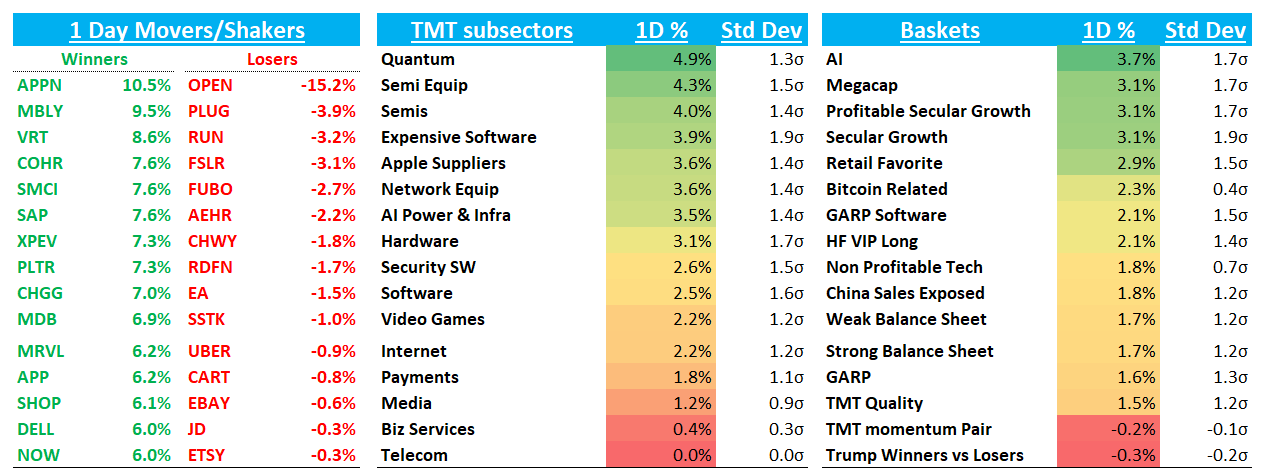

Tech was helped by some strong reports from SAP, VRT/GEV, PEGA, and APH.

Post-close, NOW came in better than bogeys, which comes on the back of the much better print by SAP last night. SAP said that there had been no deterioration in conversion rates so far in April. I imagine NOW sounds decent on the call as well as CEO Bill McDermott usually takes a glass half full view of things. Couple that with some better reports from PEGA and MANH, and I think investors will begin to feel a bit more comfortable coming back to sw space (especially getting back into NOW given used be a favorite among sw investors…). Afterall, it’s a space with solid business models where multiples have come in significantly, and no Tariff/China exposure. Hesitancy from investors has centered around DOGE cuts — which now seem to be in the rearview mirror — and slower enterprise spend, which after SAP and NOW seems to be better than feared (although granted, SAP and NOW tend to be two of the better sw companies out there). Charts are beginning to look better in the space. PLTR to me looks the best, breaking past $100 today (narrative here = AI beneficiary, $1T defense spending bill, no tariff/china exposure, benefits from geopolitical turmoil…but expectations high as street modeling continued accel in the biz on tougher comps).

We suspected we’d see big moves in laterals off initial prints and we saw that in software today after better demand commentary from SAP as many names were up 3%+, outperforming QQQs. Semis also outperformed. Not surprisingly, tariff/china safe-havens underperformed: CHWY -2%; MELI +50bps; CART -1%; EBAY -60bps; SPOT +40bps; NFLX +90bps; EA -1.5%; but still some strength out there: TTWO +1.5%; DASH +2.5%; RBLX +2% helped by a positive catalyst watch at Citi. While we took profits on the safe haven trade over the last 3 days and don’t think outsized exposure here makes sense short-term, we aren’t convinced we won’t get another chance to re-engage in the future — as this environment requires: we’ll read the tea leaves as they come... In the meantime, we still like RBLX and TTWO for their idio/fundamental stories.

Let’s get to the rest of Tech:

Internet

META +4% / AMZN +4% / SHOP +6% bouncing back as they benefit from any easing of China tariffs

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.