TMTB EOD Wrap

QQQs -190bps came under pressure today on a weaker AMZN report coupled with a very soft jobs report as a headline miss coupled with very bad revisions causing some to begin to throw out the “R” word for the first time in a while. Trump’s layering on tariffs (although not particularly new) didn’t help the narrative on the day given the stagflationary econ #s this week. All that griping against Waller a couple days ago now reversing…

Yields plummeted with the 2 year falling 27bps and 10 year falling 16bps. Fed expects shifted in a massive dovish direction, now pricing in 63bps worth of cuts up from 35bps before the jobs print.

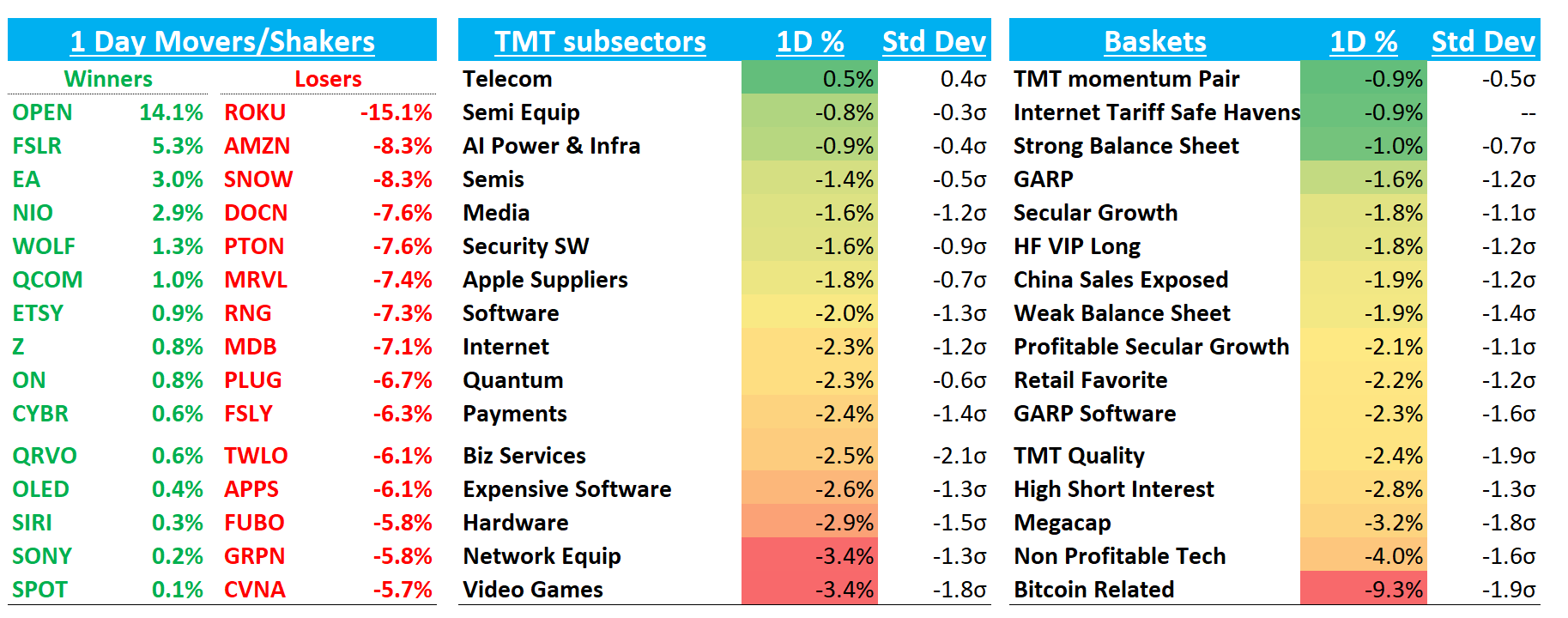

As is usually the case, there have plenty of tea leaves over the last 2-3 weeks of tired price action in Tech which is why we have recommended reducing gross/net, especially in the face of what is one of the seasonally weakest periods in the market/semis. Plenty of charts looking downright ugly. Earnings season has been skewed to the downside and that price action just accelerated today with names like RBLX -9% giving back all their gains from yesterday, NET -3% down on a very solid print, or ROKU down double digits on a beat and raise. As we have been writing - positioning and sentiment have been an extra important driver of moves this earnings season which helped keep RDDT +17% in the green given stock was still shorted by many.

We’ll have more high-level thoughts on the market environment this weekend.

Let’s get to it…

INTERNET

AMZN -8% As Jassy didn’t give comfort to investors about an AWS accel with his long meandering moment in time answers - stock now looks like the worst house among large caps after stellar prints (and conference calls) from META, GOOGL, and MSFT. Two main questions remain unresolved on AMZN. First, investors wanted clearer answers about relative market share compared to Azure and Google Cloud's growth rates. While Amazon provided explanations about application layers, AI workloads, and relative revenue base sizing, these answers were lengthy and investors wanted more direct responses about competitive positioning. Second, investors wanted clearer understanding of how revenue would accelerate in the back half of the year. Instead, we heard Jassy talk about chip availability issues and power management challenges within hyperscalers as AI scales, without granularity on AI workloads, Anthropic's contribution, or specific guidance for third quarter or second half growth rates.

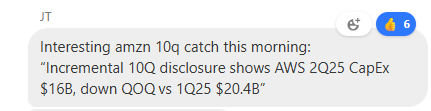

Couple things people were talking about today. First, from TMTB reader JT:

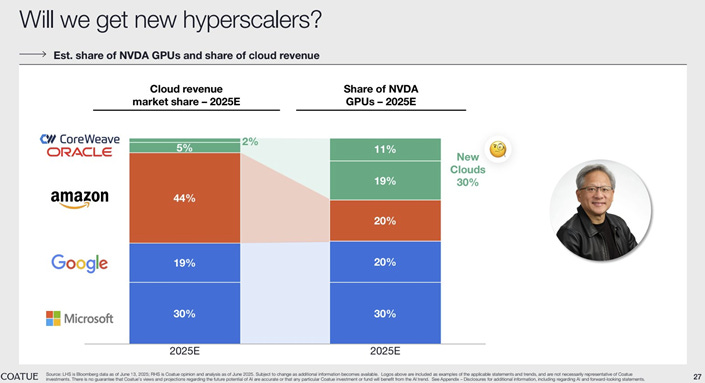

Second, this slide was being passed around from Coatue showing AMZN having much less NVDA GPU share in 2025 vs their hyperscaler mkt share, implying that NVDA is not giving them enough GPU allocation (theories here abound, plenty of discussion in the chat - but maybe AMZN’s focus on Trainium cramping Jensen’s vibes…):

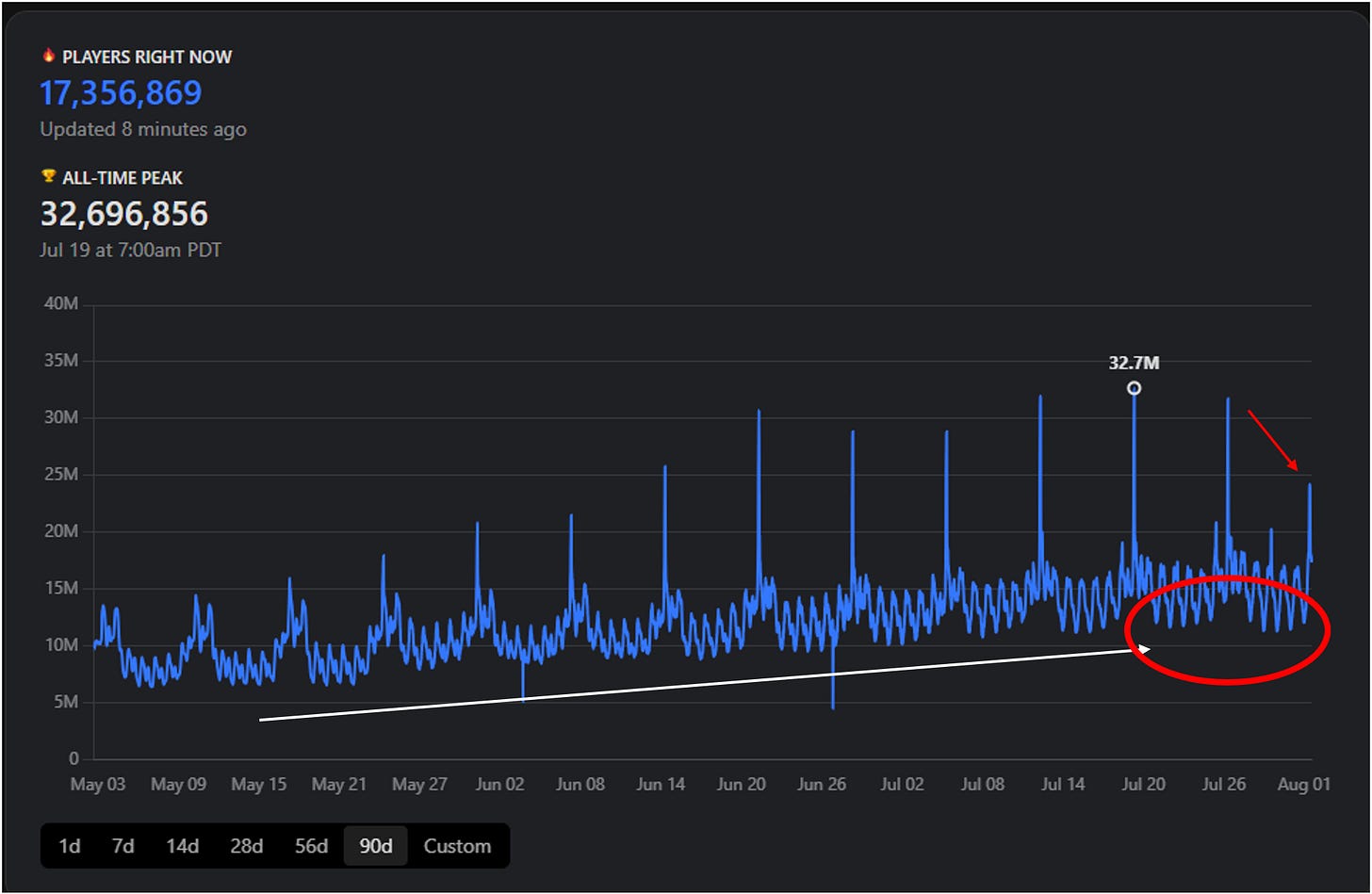

RBLX -9% giving back most of its gains post-earnings. Partly it was because stock was crowded going into the print and we have seen plenty of prints sell off on good news, a trend which accelerated today. We also had Hedgeye capitulate on the short and noted stubborn bear Doug at Cowen even sound positive. Lastly, the latest week in data is showing an average decline in CCUs for the first time since the Grow-a-Garden phenomenon took off in early May. While it’s not a major slow down, it is the first downtick in the data in a few months with stock up close to 200%, so not surprising to see a pullback here especially with plenty of fast money in the stock. Unfortunately, noticed this today and not yesterday.

Bookings still look to be tracking 50%+ in the q, above the guide for 43%. When asked about decay rates by experience, management said it varies widely. They're baking closer to worst-case scenarios into their forward guidance, taking July actuals and assuming aggressive decay rates.

On last thing: during their callback, the company stressed that this guidance wasn't under the new CFO's regime since he'd only been there four weeks, so there's no interpretation yet of how conservative or aggressive future guidance will be under new leadership going forward.

RDDT 17% on a monster beat and raise and solid DAU commentary that implied Q2 exit rate higher than quarterly average and mgmt saying that DAUs increased sequentially in both the US and int’l during July. Big nail put in the 2H decel fears today.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.