TMTB EOD Wrap

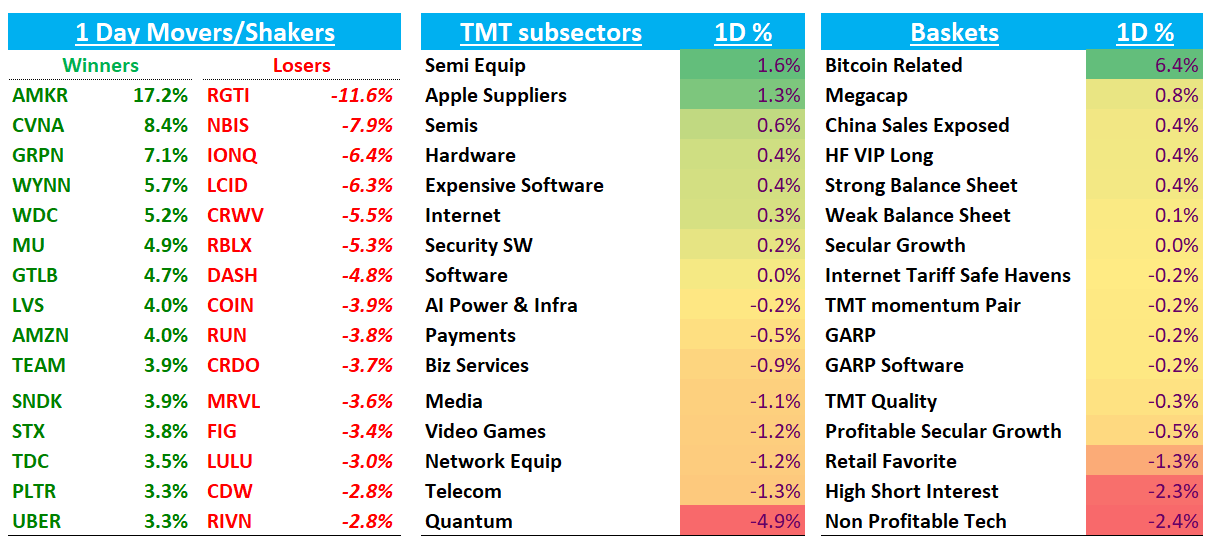

Good afternoon. QQQs +48bps finished well off their highs. BTC slumped 3%. The chance of no rate cut in December went from 5% last week to 30%+ today. Headline looked better than underneath the surface as there were 100 more decliners than advancers in the SP500 today. Large cap, some AI semis/power names, and semi-cap led the way higher.

Individual price action has become a bit more mixed over the last couple of days, but leaders continue to rally with memory/HDD names, NVDA, AMD, BE, etc. all sitting near highs along with AMZN and GOOGL. The leadership does seem like its narrowing to quality with higher areas of spec like Neoclouds, Nuclear, Quantum, etc. all down big today. We showed this chart a couple of weeks ago , but MacroCharts had an interesting comparison to previous bubble tops. He notes that this year’s historic rally has been a “close race between two horses”: Big Tech/AI Semis vs. speculative stocks and notes that Quality tends to dominate as we get further along in the cycle (meme/speculative names peak a lot sooner). Here’s his charts from 2000 and 2021, showing that:

We want to see the QQQs continue to hold the 10d if we’re going to make a nice move higher into Dec (key AI catalysts are AMD Analyst day 11/11, NVDA earnings on 11/18, and RBC conf on 11/19 where MU likely pre-announces). As always, we remain on our toes on the lookout for tea leaves leaders are losing steam.

Let’s get to the good stuff…

AI / SEMIS

Good WSJ read - The AI Revolution Will Bring Prosperity

IREN +11.5% although it faded most of the day as they signed $9.7B cloud deal with MSFT. The five-year agreement will provide Microsoft access to Nvidia Corp. accelerator systems in Texas built using the GB300 architecture for AI workloads and includes a 20% prepayment.

Lots of questions around Neoclouds CRVW -5.5% and NBIS -8% underperforming. The glass half empty read for the Nelcouds from the IREN/CIFR deals would be something along the lines of: 1) AWS/CIFR and MSFT/IREN deals add credible, at-scale alternatives, diluting Neoclouds’ incremental hyperscaler wallet share and eroding scarcity; in other words: tougher pricing/terms in the future. They also tighten competition for power/interconnects/GPUs, potentially pressuring margins versus lower-touch “space-and-power” options and adding more competition for approvals from the likes of ERCOT, etc.

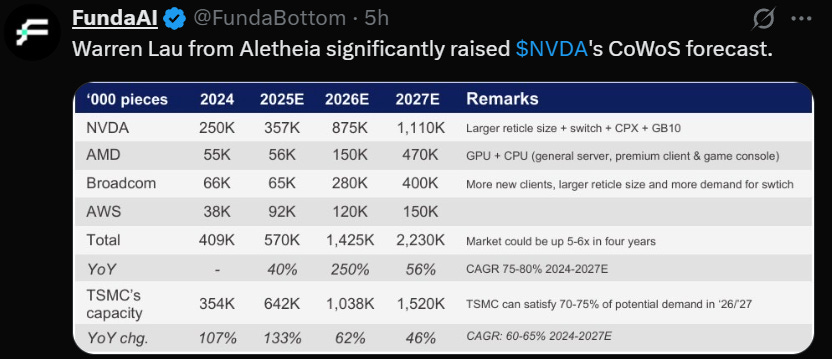

NVDA +2% on some positive sovereign news: signed a 260k GPU chip deal with Korea and Trump said deal with China ensures NVDA can compete in the China market although seems like Blackwells off the table. WSJ had an article out in the afternoon: Trump Officials Torpedoed Nvidia’s Push to Export AI Chips to China talking about how Trump’s advisors all counselled against a Blackwell concession.

WDC +5% / STX +4% with some nice follow through after last week’s earnings despite UBS’s Tim Arcuri talking up some bear points such as Toshiba ramping in ‘27 and SSDs potentially become more competitive.

TSM +1.5% as we got news from Asian press of price hikes of up to 10% next year, ahead of schedule. Some good thoughts from JT in the chat:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.