TMTB EOD Wrap

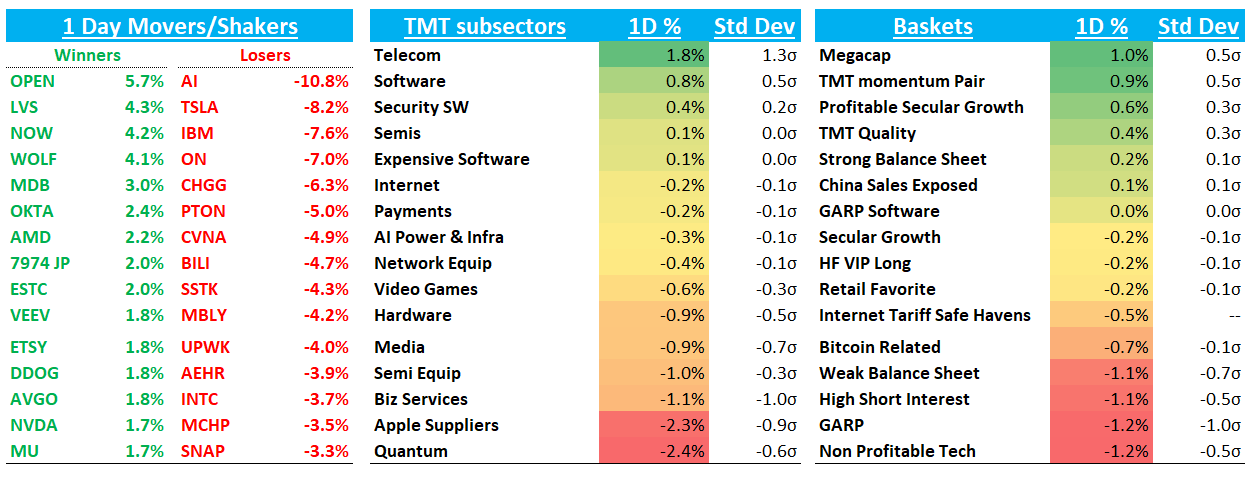

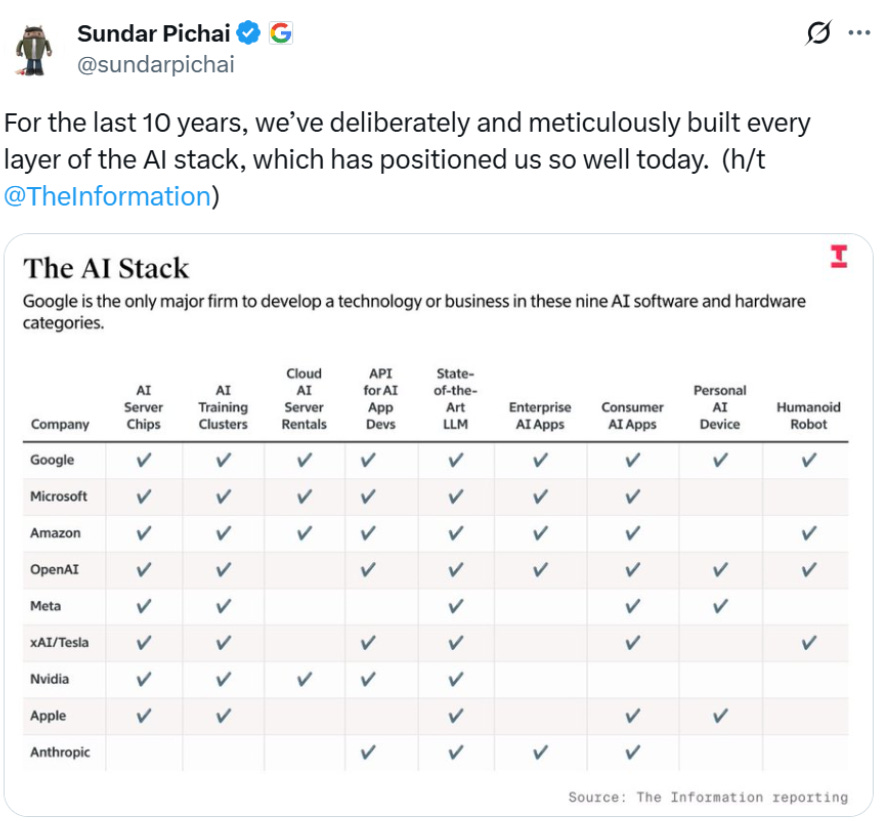

Good Afternoon. QQQ +20bps as AI semis led the way higher after GOOGL raised capex and GCP accelerated significantly, talking up AI demand and token growth while Trump, Jensen and Lisa Su provided some bulled up commentary at the AI summit yesterday. Some more good news on the AI front:

Earnings reactions continue to skew to the downside — GOOGL’s +1% and NOW’s +4% a bit underwhelming for the bulls (both had their reasons for not being higher, to be fair. See below). Here’s what we wrote this weekend, which continues to play out:

This is the opposite of last earnings cycle back in late April, where misses were bought and beats ripped hard. That doesn’t mean stocks can’t work on good prints, it just means valuations are near full right now so prints need a bit more oomph (and no hair) to get the stocks higher. It also means it will be extra important to pay attention to positioning heading into prints.

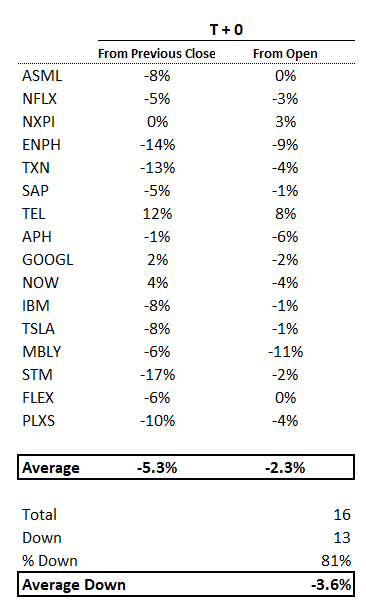

The stats back that up - investors have an itchy take profits finger right now, especially on prints that aren’t clean. Misses are getting sold hard the day of earnings. Look at the following:

This says that 4 in 5 prints so far have traded down from the opening tick the day after earnings. And of those ~80% that have traded down, they have declined an average of 3.6% from the opening print.

It just feels like the market is a bit tired and digesting, but we don’t see any cause for alarm yet, just sharpening our pencils on earnings and positioning as we head into the heart of earnings season next week.

Post-close, INTC +1% beat and raised on revs but EPS missed: $12.9B vs $11.9B with strength in Client and DC. GM a bit light. Q3 Revs guided to $13.1B at midpt ahead of street at $12.6B, but EPS a bit weaker. Re-affirmed $18B capex. Waiting for the call for more commentary around 18A and GMs outlook. Yawn!

INTERNET

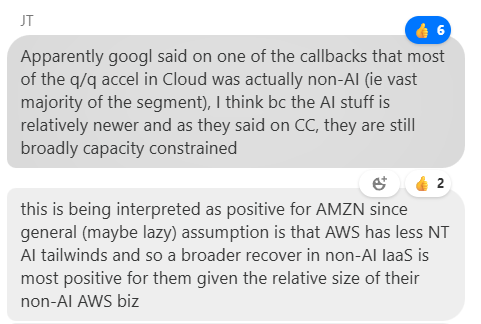

AMZN +1.7%: strong price action here helped by GCP acceleration and read-through.

Also a bit of good news on the Kuiper front as it seems Trump doesn’t want to help any musk related companies. Finally: 3p was like 400-500bps off on GCP growth - maybe they’re off on AWS growth estimate as well?

GOOGL +1% despite the across the board beat and acceleration driving home the narrative that GOOGL is an AI beneficiary (at least right now): they’re in a sweet spot where the search biz is holding steady enough that AI Mode/AI Overviews are driving enough revenue to help the whole biz accelerate. The price action today comes down to high expectations (HFs are long) and this earnings season has shown price action r/r skewed to the down, especially when positioning is offsides. Also long onlys are waiting on the sidelines for Mehta DOJ remedies. Still think this continues to grind higher — can throw a 20-22x multiple on $10.50 — as long as search continues to accel, and the DOJ date in August could be a clearing event to bring more money in the name, although we're likely to look at some sort of option structure closer to the date to hedge a possible left tail risk.

RDDT +2.3% as Clev was out raising numbers on improving ROI sentiment among partners - not a ton new from their initiation report several weeks back but checks continue to be strong into the print. Commentary around DAUs is what matters more though - we’ll be checking into the data closer to the print.

RBLX +10bps as Canaccord raised PT to $125 on strong engagement and monetization + long-term innovation. GOOGL' called out their partnership in the call yesterday.

SPOT +1% on Oppenheimer upgrade on MAU Runway and Ad monetization upside

DASH +1% as 3p data continues to look good for Q3 tracking MSD+ above street so far

PINS -40bps despite GOOGL calling out retail strength...In FT: Fake rooms: Pinterest boards may be a fantasy, but AI is spoiling the fun

META +25bps despite Clev taking up Q2 numbers

CVNA -5%: didn’t see anything here…

SEMIS

Analogs taking a beating today after STM reported weaker than expected GMs, calling out weakness in autos. Analogs now 3 for 3 in missing expectations after NXPI and TXN earlier in the week (although NXPI sounded the best). ON -7% took the brunt of the pain given their large Auto exposure, although NXPI (flat) remained unscathed.

AVGO +2% / NVDA +1.7% / AMD +2% on higher Google Capex and just all around good AI vibes as Google was bulled up, Trump laid out his AI action plan yesterday and AMD CEO Lisa Su called out strong demand. NVDA CEO Jensen spoke to All-in yesterday saying he thinks we’re a few hundred billion into a multi-trillion dollar infrastructure buildout. Full videos available on the All-in Youtube page here. Go on…

MU +2% as Digitimes said Samung delaying HBM4 to 2026:

Hynix also had some bullish commentary around HBM4 demand in 2026

CRWV -4%

SOFTWARE

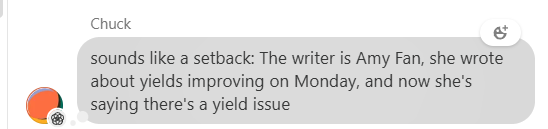

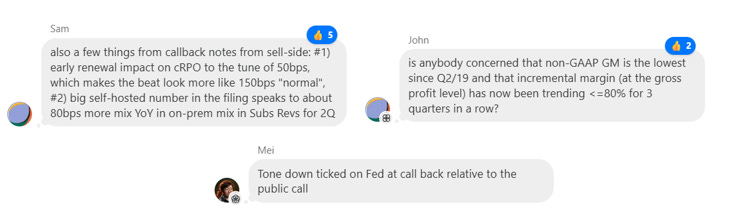

NOW +4.5% selling off a bit after being up +8% to start the day as investors digested lower Q3 guide, stock trading at 40x, fed headwinds and that the print didn’t settle the debate if ‘26 growth would be +/- 20%. More color from our wonderful readers in TMTB chat, which has been a really great place for discussion this earnings season:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.