QQQs - 2% and now close to flat on the year. BTC - 5%; China - 1%. Oil +1% Market sold off as hotter econ data exacerbated worries of unsustainable fiscal policy and yields rose 3-6bps across the curve.

Readers who have been a here a while know that I like to look at individual price action in names as tea leaves for where the broader market is going. One question we like to ask is: Are stocks going up/down on good/bad news? Are moves outsized in one direction? We view morning news items as mini-earnings and reactions to those items are important as a barometer for where the market wants to head near-term. Other things we look at: are stocks holding onto earnings gaps or following through; are stocks hitting new highs then falling below those highs, etc. We also like to look at market leaders for potential shifts in momentum.

With that being said, there are an increasing amount of worrisome tea leaves for us that are influencing our near-term view on the market. A few I have seen in recent days:

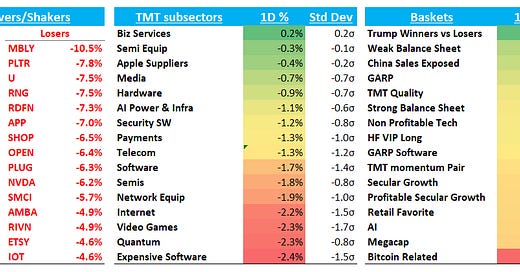

The leaders of the mo rally post Trump election are now rolling over. Take a look at TSLA, APP, PLTR — 3 of the most impt mo leaders - which are now below ST moving averages. TSLA broke above all time highs and now is decidedly below that. Whereas we saw outsized moves in the positive direction in late 2024, now we are seeing things like APP -7% on BAML’s call out this morning. And PLTR now down 10%+ following MS neg note yesterday. These stocks were like teflon from Nov through late Dec and that shine has worn off, which is likely a sign animal spirits are cooling

SW price action is horrendous. CRM has failed to hold the earnings gap. TEAM and SNOW were down 3% on upgrades this morning. MDB and ADBE are following through to the downside afer misses. Leaders like NOW are failing at ST moving average resistance. No bueno

NFLX has failed to rally on several pieces of good news starting in late dec: positive 3p data; good xmas/squid game numbers and a great golden globe showing.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.