TMTB EOD Wrap

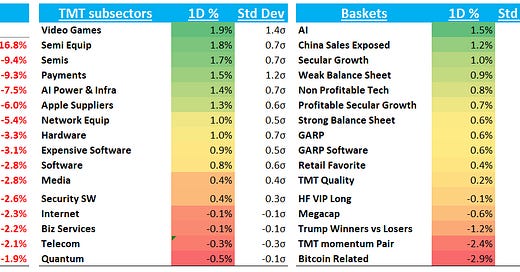

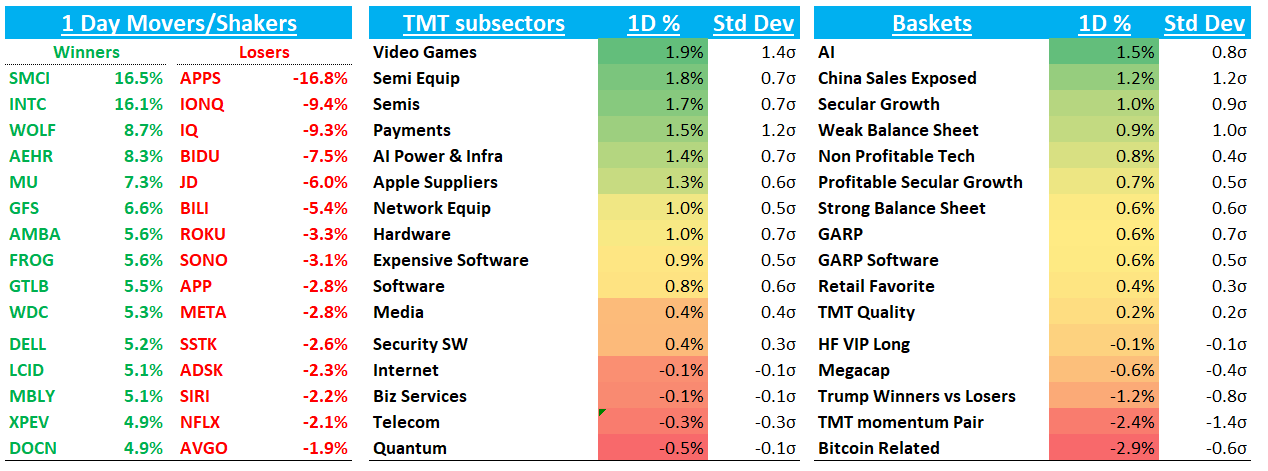

QQQs +23bps to new ATHs in a bit of a funky day where AI/semis outperformed while large cap internet underperformed. BTC - 1%; China +1%; yields up 5-8bps across the curve with the 10-year popping back above 4.5% (some pointed to hot prices paid component of empire mfg report as reason for the move). Fed expects shifted a bit in hawkish direction, with mkt pricing in 36bps worth of cuts while the dollar staged its first rally (45bps) in over a week. Overall breadth was decent in tech as just seemed like some healthy rotation underneath the surface - underlying bid for stocks still seems very present.

We’ll go over CDNS/ANET earnings first, then move onto the recap…

Post-close Earnings:

CDNS -5%: Midpoint of rev guide of 11.6% a bit short of buyside, but backlog is better than street. Overall looks ok, but bulls hoping for more especially after mgmt sounded positive intra q

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.