TMTB EOD Wrap

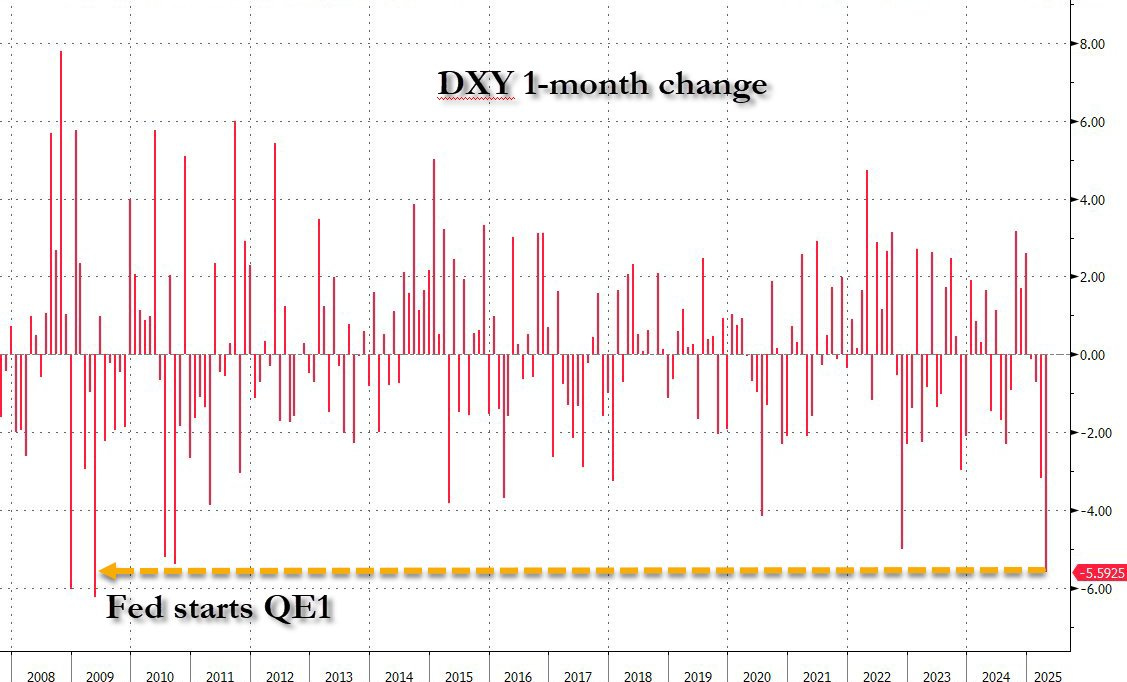

QQQs -2.4% to start the week. China outperformed flat. Treasuries saw mixed action with 2 year yields dropping 5bps while the long end of the curve rose 8-11bps. Dollar sank ~1%, hitting multi year lows. Biggest monthly drop in the dollar since 2009/ QE1:

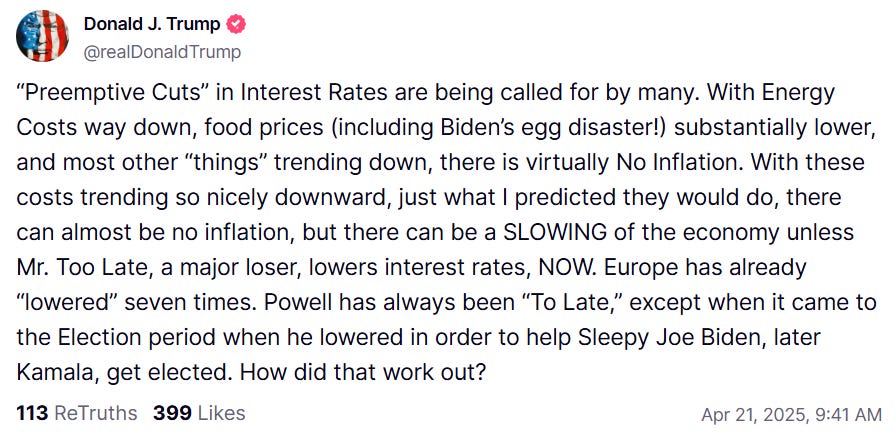

What drove the sell off in equities today? Well, an early tweet by Trump’s attacking the Fed didn’t help:

No deals seem close to being announced with any major trading partners. The U.S. global standing has taken a big hit. The weak USD and long-end treasuries alludes to foreigners taking their money back home. The economy seems to be inching hurtling towards recession. Here’s Neil Dutta from RenMac:

And investors are increasingly worrying about supply chain impacts of basically halting trade with China. Trump and co seem gung-ho on sticking to the plan, but we’ve seen them blink once already and if things get bad enough, one would think the pattern would repeat. At this point, investors seem tired of tweeting rhetoric and want to see some real progress on trade deals, which would likely come in potentially striking a deal with at least one nation that would serve as a sort of template for others or holding a high-profile call/mtg with China. Regardless, the progress on tariffs is slow, a lot of damage to US reputation has been done, and tariffs will be higher than they were 3 weeks, regardless of what happens.

For us, it remains a low gross environment with higher bars for trades, lower/nimble sizing, and not overstay our welcome (we thought today wasn’t a bad spot to book some profits in tariff/China safe haven trade). No one I talk to wants to step in and defend anything with conviction because everyone remains uncertain around how bad things can get from a big picture perspective so its tough for any one to have any real confidence in EPS/Cash Flow #s….

Overall, GS said HF gross remains elevated at 200%+ (95%+ percentile) while nets are currently mid 40s, which would be 1-2% percentile over the last 3 years

In Tech, the big story today was Cowen and Wells Fargo calling out AMZN pausing a portion of leasing discussions on the colo side, mirroring what we’ve heard from MSFT over the last month. You can read the full note here, which didn’t sound overly bearish as META/GOOGL/ORCL/AAPL continue to remain active, but investors remain skittish and are reading most datapoints with glass half empty lens. Really not surprising to see a co like AMZN take a slightly more measured approach given the significant headwinds facing top line/ebit bc of tariffs… AI power + semi names took the burnt of the hit with NVDA -5%, CRWV - 9%; VST/VRT -7.5%, ANET -5% and so on…

Let’s get to the recap…

Internet

Tariff/China safe havens continue to outperform: NFLX +1.5% after a solid set of #s on Thursday afternoon, EBAY -1%. However, some cracks in this trade beginning to show with DASH -5% and SPOT -2.7% (video games were also notably weak). We took some exposure off in the tariff/China safe haven trade bc at some point weakening macro brings all houses down (and also one of our rules is not to get greedy in this environment and book profits) — NFLX probably the most recession resistant given their $7.99 ad tier…. SPOT was weak despite getting upgraded at Wolfe and also a pretty bullish MS note calling out a $900 PT.

META - 3.5% hitting new lows despite the QQQs still 7% above lows…. FundamentalBottom was out with some checks today which said something similar, calling out sharply reduced Q2 budget expectations from March —> April, especially in those exposed to China e-comm.

Investors continue to worry not only about Temu/Shein exposure at META, but also significant exposure to SMB advertisers with mfg in China (what happens to all the drop shippers?). Our friend Kevin Rippey at ISI had a good piece over the weekend looking at viability of SMBs with mfg exposure to China, and his conclusion was “>20% of e-commerce goods sold could be generating negative contribution margins under the current tariff regime…even before considering other negative economic shocks stemming from the Tariff Tantrum – there is roughly a $35B hit to US digital ad demand or ~15% of total US Digital Ad spend.”

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.