TMTB EOD Wrap

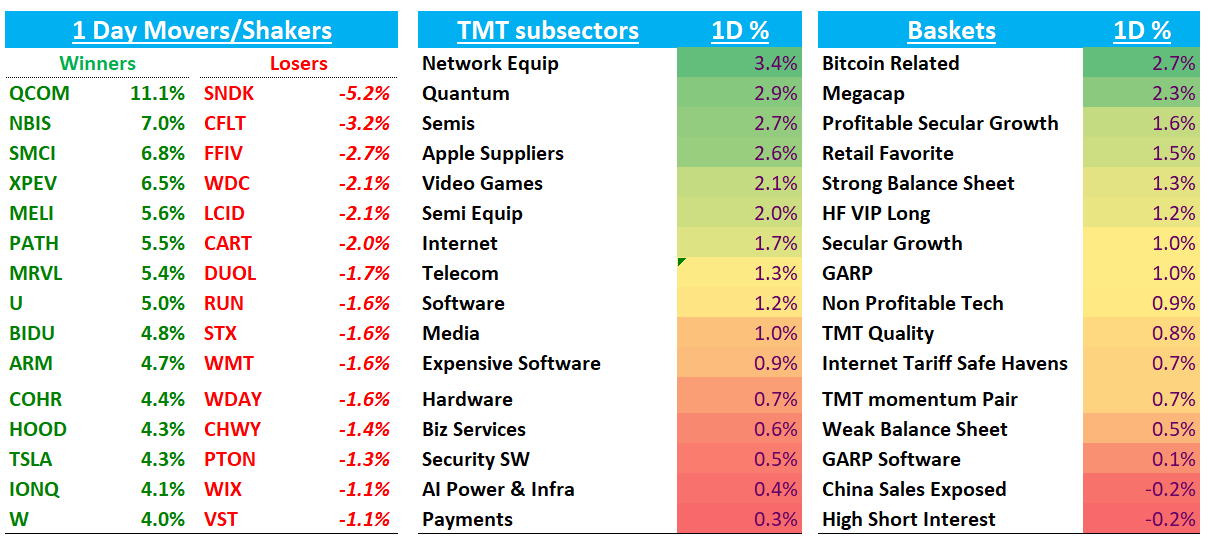

QQQs +1.8% as AI names led the way higher after Trump/China optimism over the weekend. Fed expects held steady with investors anticipating a 25bps rate cut and end of QT on Wednesday. 10 year +2 bps while 30 year was down 3bps. Strong breadth across the board with Semis, large cap internet, and Software all up as QQQ outperformed IWM by 150bps.

Post-close Earnings:

CLS +8% with a solid beat and Q4 guide slightly above where the buyside was. Initial FY26 outlook of $8.20, which is above street at $7.15

Q3 revenue/EPS of $3.19b/$1.58 vs. Street at $3.02b/$1.48

Q4 Guidance: revenue/EPS of $3.45b/$1.73 vs. Street at $3.08b/$1.50

““Furthermore, we are announcing our 2026 annual outlook with revenue of $16.0 billion and non-GAAP adjusted EPS* of $8.20, representing growth of 31% and 39% respectively. The demand outlook from our largest customers, who continue to make significant investments in AI data center infrastructure, remains strong, supporting our 2026 annual outlook with indications of these dynamics continuing into 2027.”

CDNS +1% with a solid print with rev upside and FY raised by slightly more than the print. 3Q results topped expectations with revenue/OM/EPS of $1.34B / 47.6% / $1.93 vs. Street $1.32B / 45.5% / $1.79.

FY25 outlook raised — revenue to $5.28B (from $5.24B) and operating margin to 44.4% (from 44.0%).

FFIV -6% as Q1 and Full year guide weighing the stock. FFIV posted F4Q (C3Q) revenue and EPS of $810M and $4.39, beating Street at $795M and $3.97.

However, F1Q (C4) guidance of $755M and $3.60 came in below Street at $794M and $4.04.

“While demand drivers and the Company’s current pipeline support mid-single-digit revenue growth in fiscal year 2026 against its exceptional 10% growth in fiscal year 2025, F5 anticipates some near-term disruption to sales cycles as customers focus on assessing and remediating their environments following the recent security incident. Taking this into account, for fiscal year 2026, F5 is guiding to total revenue growth of 0% to 4%, with any demand impacts expected to be more pronounced in the first half, before normalizing in the second half of fiscal year 2026.

Let’s get to the recap…

SEMIS

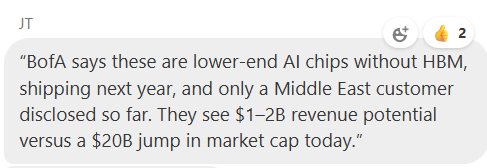

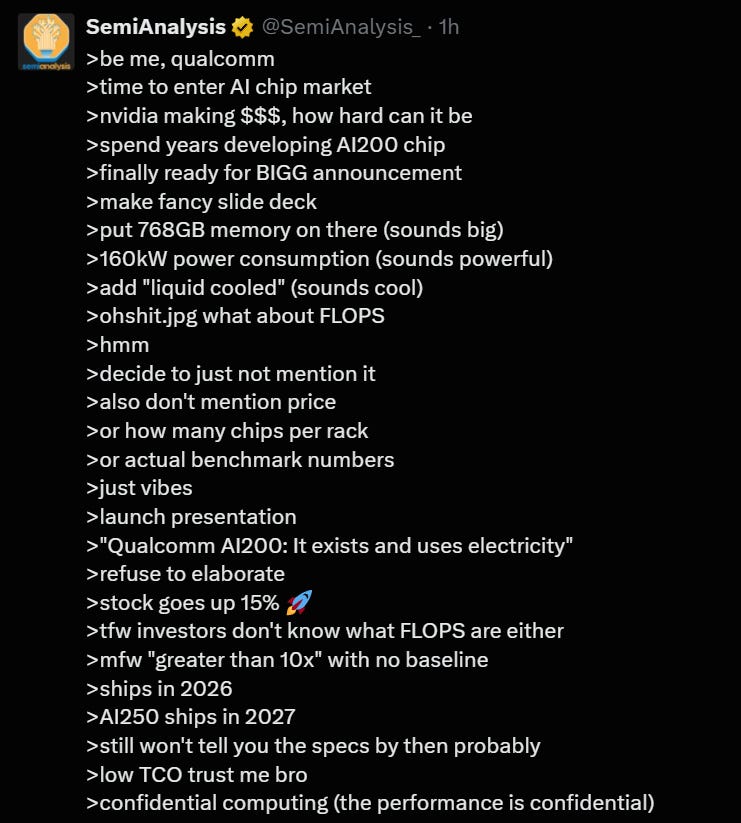

QCOM +11% after announcing they are getting into the GPU game with their AI200 chip announcing a 200mw win with HUMAIN. Citi think sthat will add $1B in revs and 25c opportunity or 2-3% accretion.

Stock was being used as a funding short for many so big squeeze in the name toady with stock popping to +20% at one point. Lot of push back against how competitive chip actually is and SemiAnalysis sums it up below:

MU +50bps underperformed as Digitimes reporting Samsung launching aggressive 30% price cut strategy in HBM and initial quotes 6-8% lower than SK Hynix

AMD +2.7% as US Department of Energy announced $1 billion supercomputer AI partnership with AMD

NVDA +3% as short-term vol exploded ahead of Jensen’s DC visit tomorrow in speculation there might be some bigger announcement on the way related to Sovereign buying or export controls.

TSM +1% as Needham raised PT on n3 Upside and higher 2026 capex. Needham noted that despite management’s prior indication that new fabs would focus on N2, it now appears TSMC may add 20–30k WSpM of N3 capacity across Fab 15 and Fab 18, likely completed by mid-2026.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.