TMTB EOD Wrap

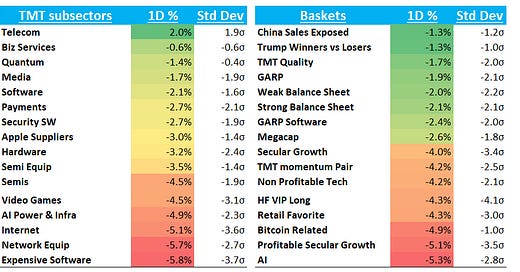

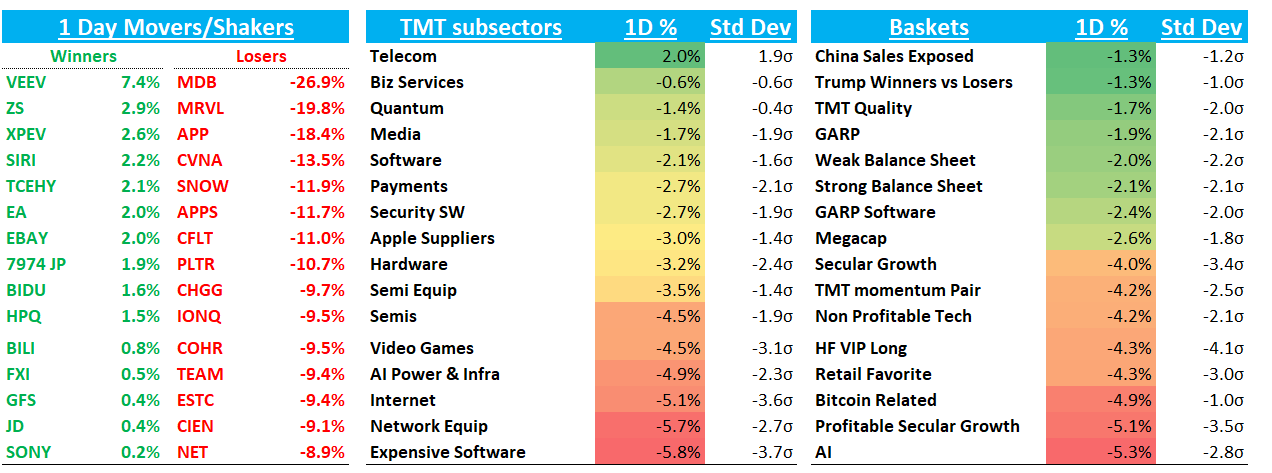

Another big red day as QQQs -2.75% (dn 10% from highs), SPY -1.7%, SOX -4.5%, and ARKK -4.6%. yields were mixed with 2 year sliding 4bps while 10 year remained flat while Fed expects stayed steady at 75bps worth of cuts. Why the sell off? In tech, MRVL -20% and MDB -27% prints didn’t help; on the macro front more uncertainty around trade ware and more signs of slowing growth with Challenger report showing a massive spike in layoffs last month. All eyes on NFP before the open tomorrow - the QQQs are currently pricing in close to a 2% move, which is more than what was expected for the election and just goes to show how impt the print is.

Won’t do a full recap today as on a day like today a lot of moves explained more by de-grossing/flows rather than any fundamental reason. To try to place a fundamental reason on many things misses the forest for the trees as they say. We’ll point out a few things that stood out:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.