TMTB EOD Wrap

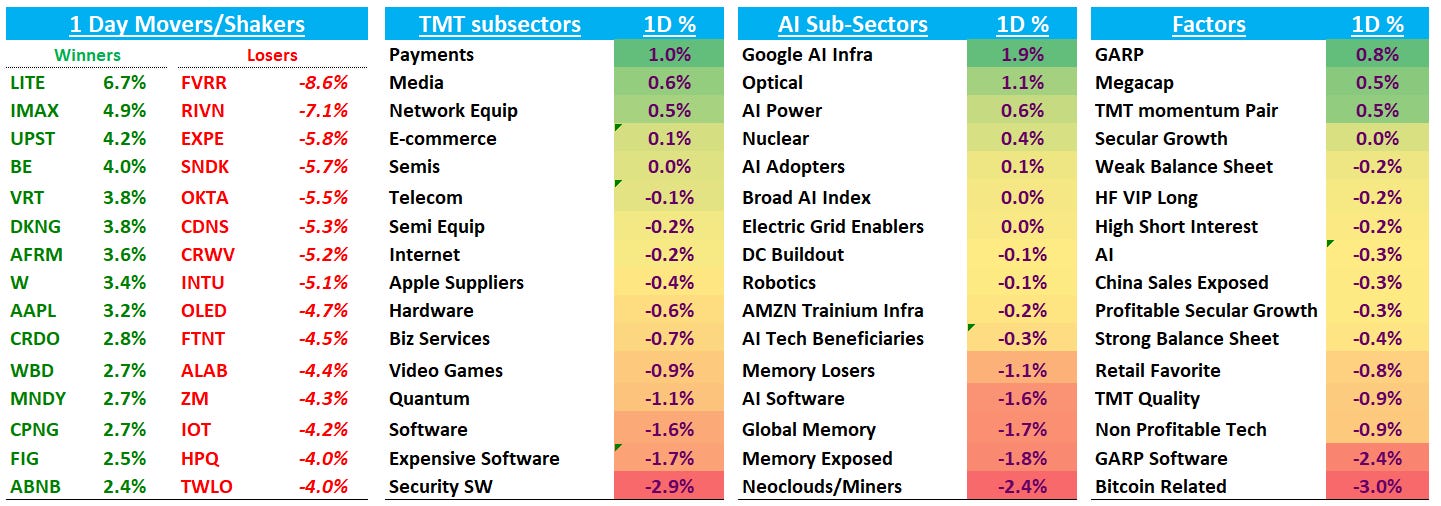

QQQs -10bps in a fairly slow day after some jitters in the early morning. IWM flat and SPY +15bps outperformed. 2 year ticked up slightly while long end of the curve stayed flat. BTC -2% continues to struggle. Within Tech, AI infrastructure and optical names outperformed, with “Google AI Infra” +1.9% leading AI sub-sectors (despite GOOGL -1.2% down) and semiconductors modestly higher, while memory and software lagged. Security SW down ~-3%. Factor wise, not a hugely important day: GARP and TMT momentum held up, while high short interest, non-profitable tech, and Bitcoin-related exposures underperformed.

Post-close Earnings:

PANW -5%. A bit muddied given integration/M&A and still going through the numbers, but organic net new NGS ARR looks like it missed buyside expects coming in at $280M vs. expects closer to $290-$300M. Chronosphere represented $200M in Q2 NGS ARR, CyberArk >$1.2B NGS ARR. Guides Q3 NGS ARR $7.95B & RPO $17.9B. FY NGS ARR raised by $1.5B to $8.57B, RPO raised to $20.25B. OM margin guide a bit weaker at 28.5-29% vs 29.5-30% prior.

CDNS +4% looks decent on a clean beat and raise and steady FY guide.

Q4:

Revenue: $1.44B vs $1.42B

Operating Margin: 45.8% vs 45.3%

EPS: $1.99 vs $1.91

FY26 guide:

Revenue: $5.9–6.0B (midpoint $5.95B) vs Street $5.94B

OM: 45.25% midpoint vs 45% Street

EPS: $8.10 midpoint vs $8.03 Street

Let’s get to it…

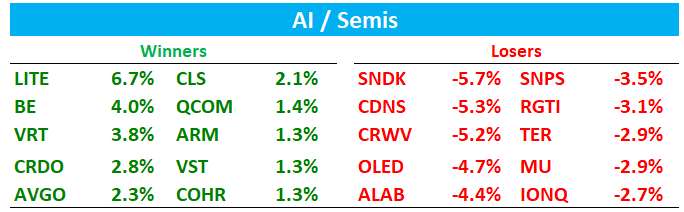

AI / SEMIS

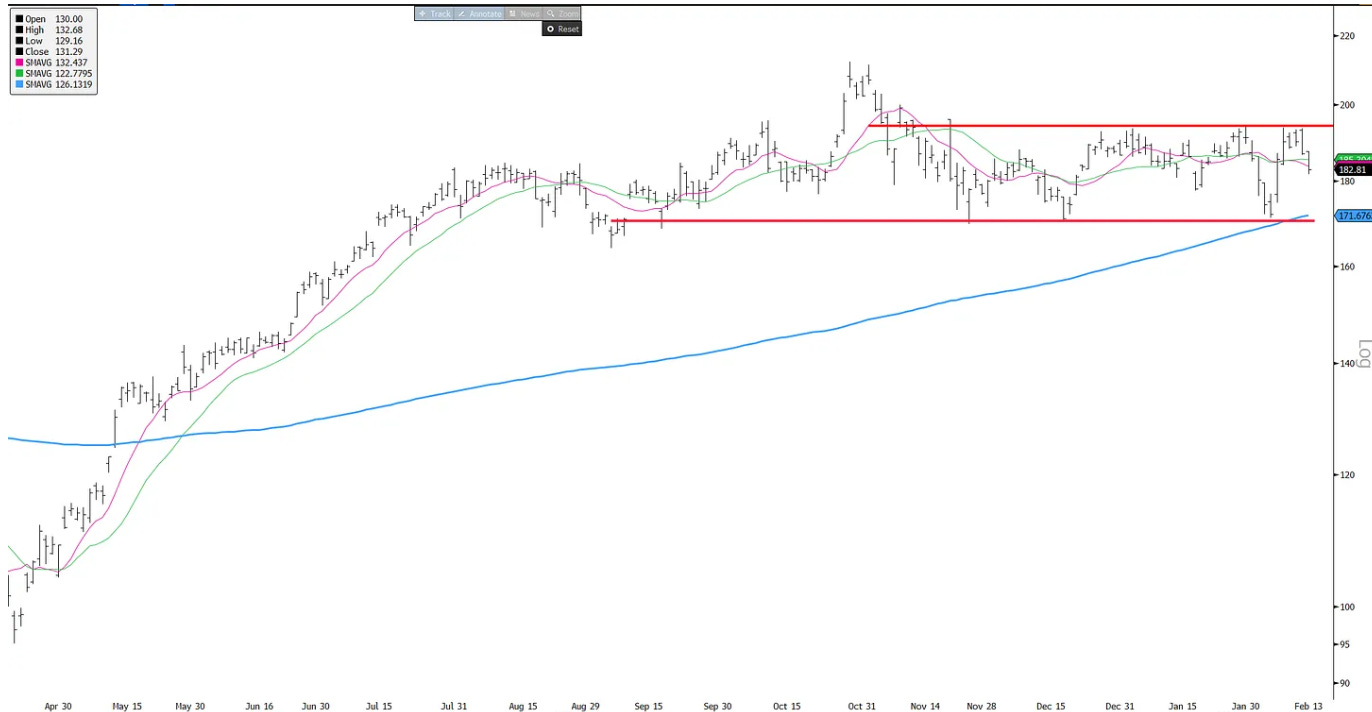

NVDA +1% as good news continues to pile up despite continuing to chop around between the $170 - $185 range.

Lots of questions around what ails it (along with AMD/AVGO) vs. other names like TSM which are sitting near highs. This sentiment says it all:

Given we have memory/semicap/optical/HDD/Power names also near highs, don’t think its broader fears around more compute. Best way I can explain it away is that investors continue to prefer upstream co’s in the supply chain who are finally capturing price (at the possible expense of GPUs/ASICs). Another theory is that upside relatively easier triangulate for NVDA vs. other companies. These narratives make sense, until they don’t. That is, price can change narrative quickly. My sense is NVDA will at one point play catch up to the upside although that’s the pretty common consensus at this point.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.