TMTB: EOD Wrap

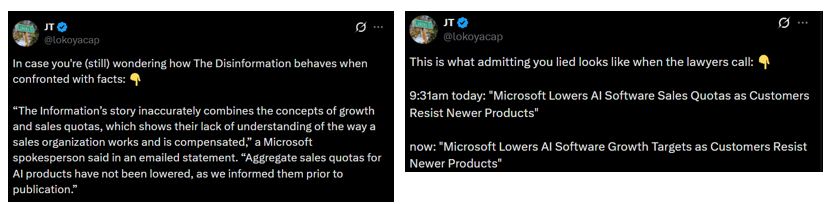

Good afternoon. QQQs +25bps in a fairly quiet session that started with some excitement created by a backwards looking TheInformation on MSFT. JT has the details:

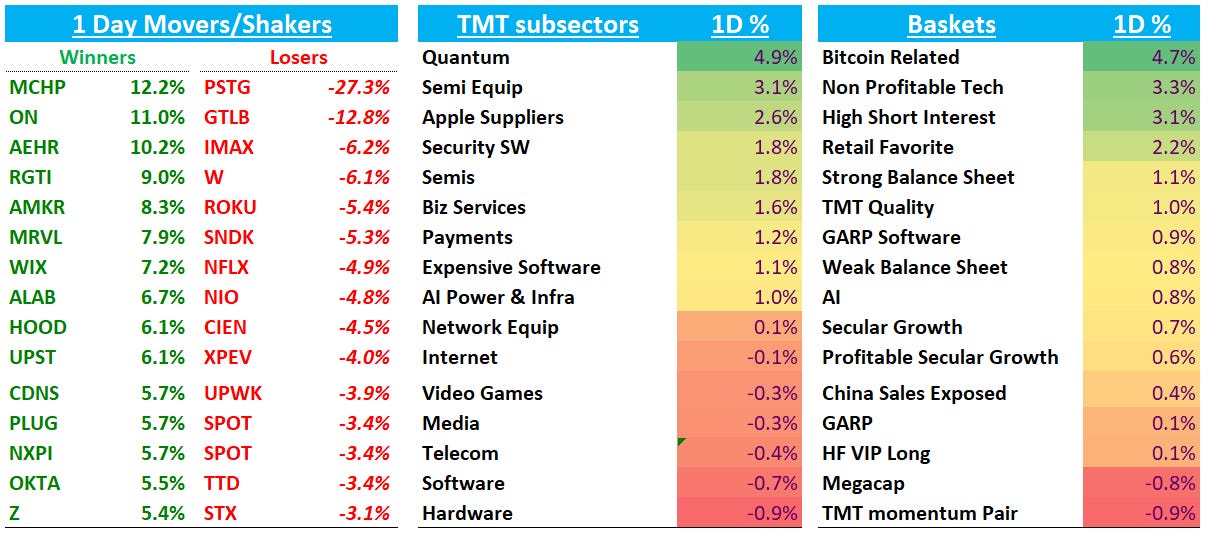

Stocks sold off but rallied to recover all losses despite MSFT -2.5% not recovering at all. BTC +4% caught a bid as well, helping High Short Interest (+4.0%) and Non-Profitable Tech (+3.3%) outperform. Semiconductors were the standout (+2%), but like yesterday leadership shifted away from the usual AI darlings to cyclical/industrial names. MCHP ripped +12.2% after raising its quarterly guidance, citing strong bookings and backlog. This dragged other analog/industrial peers higher, with ON +11% and NXPI +5.7%, who also sounded good at UBS yesterday. The Semi Equipment subsector also showed continued strength, up 3.1%.

Getting late here, so let’s get straight to it…

INTERNET

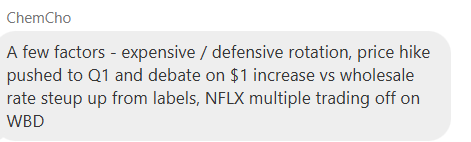

SPOT -3.4%: lots of questions on this name which likely speaks to plenty long. Not a lot of great answers on the weakness, but a TMTB reader chimes in:

Some also mentioned WMG’s deal with Suno that was announced on Nov 25, 2025 for the recent weakness, which settled WMG’s copyright lawsuit against Suno, an AI music platform, replacing litigation with a licensing partnership that allows Suno to legally train AI models on WMG’s catalog (with artist opt-in) — as part of the deal Suno acquired Songkick, the live music and concert discovery app from WMG. A glass-half full read of the partnership for SPOT would be that 1) By acquiring Songkick, Suno is trying to build a destination for AI music - meaning users spend less time on Spotify and more on Suno and 2) This gives WMG and other labels more leverage - partnering with AI tech firms gives labels more control over the “next generation” of music formats and if “interactive/generative music” becomes the next big thing, labels and AI websites might control that experience directly.

SHOP +2% following through - Yipit was out after the close said SHOP had one of strongest net merchant adds this year in October. IR was at UBS and sounded good.

RBLX -2% as Russian communications authority Roskomnadzor announced that it is banning access to the Roblox platform in the country, citing concerns over inappropriate and corrupting content being made available to children (including “LGBT propaganda”). Russia had oer 13M DAUs as of October 2024, which is about 8% of total DAUs; however as a % of bookings it should be a lot less.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.