TMTB EOD Wrap

QQQs finished the day -53bps as yields fell 2-3bps across the curve.

Main news of the day which took tech stocks lower during the morning session was a TheInformation article which implied GMs for ORCL’s training workloads would be lower than believed by the street:

But internal documents show the fast-growing cloud business has had razor-thin gross profit margins in the past year or so, lower than what many equity analysts have estimated.

In the three months that ended in August, Oracle generated around $900 million from rentals of servers powered by Nvidia chips and recorded a gross profit of $125 million—equal to 14 cents for every $1 of sales, the documents show. That’s lower than the gross margins of many nontech retail businesses.

As sales from the business nearly tripled in the past year, the gross profit margin from those sales ranged between less than 10% and slightly over 20%, averaging around 16%, the documents show…In some cases, Oracle is losing considerable sums on rentals of small quantities of both newer and older versions of Nvidia’s chips, the data show.

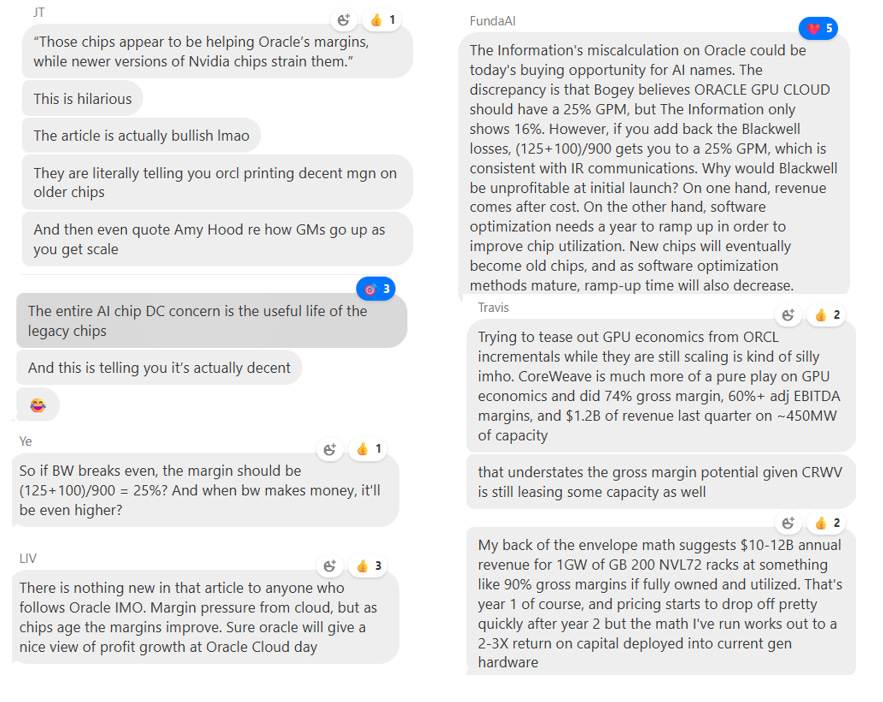

TMTB Chat, Gugg, Mizuho and a couple others were all out pointing out the flaws in the argument. Here’s TMTB chat led by always sharp JT, with some commentary as good as any you’ll find on the street:

Difucci at Guggenheim was out saying similar, saying Oracle’s AI-training contracts should deliver at least 25% gross margin over their life—even if early quarters look lighter due to upfront build and depreciation. He also notes ORCL can price lower bc they can provide better performance at a lower cost, not because they are giving it away.

CNBC was out post-close saying Jensen said ORCL will be “wonderfully profitable” (h/t JT)

Stock was down close to 7% at one point, bringing down other AI names with it, but finished down a modest 2.4%. Price action speaks to how skittish investors are around these “circular” deals at the moment.

INTERNET

NFLX +2.4% as Seaport upgraded to buy — stock following its pattern of bouncing of the 150d, which has been a great time to buy. Here’s what we said in our weekly:

However, the r/r on NFLX at $1,150 is looking more interesting to us. Not a ton of upside on ‘26 #s ($35 x 35 is <10% upside, but if you roll fwd to ‘27 and $40+ EPS, can get close to $1,500 or 30% upside). The stock is also hitting against the 150d, where it has been a great place to buy over the last 5 years…Despite not being super exciting and without a great ST hook, Q4/Q1 are usually the best times to own NFLX…We don’t think it’s a bad spot to start nibbling.

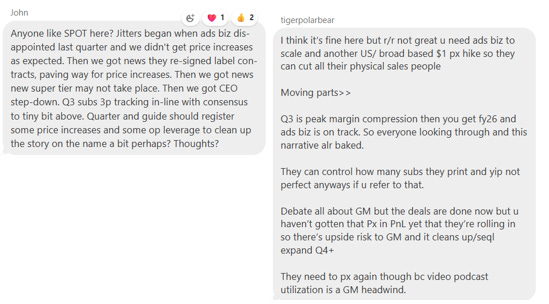

SPOT flat: Some good discussion in TMTB chat here:

OTAs underperformed today: UBER -2%; BKNG -3%; EXPE -3%…Some good discussion in TMTB chat today here:

China names weak: BABA -3%; BIDU -4%; GDS -6%; VNET -6%

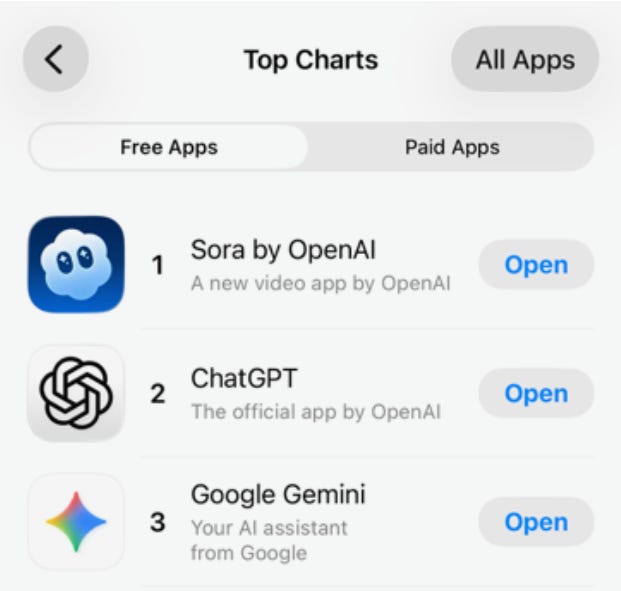

GOOGL -2%: Didn’t see any reasons for the u/p other than Gemini moving back down to #3 on the app store, with ChatGPT reclaiming the #2 spot.

HSBC also initiated at Buy. Push pull here is that near-term valuation seems a bit capped unless you roll the #s over to ‘27 when $13 of EPS at 22-23x can get you close to $300 — and it seems a bit early for the long onlys to be rolling

RDDT +1% as Wells Fargo raised ad estimates

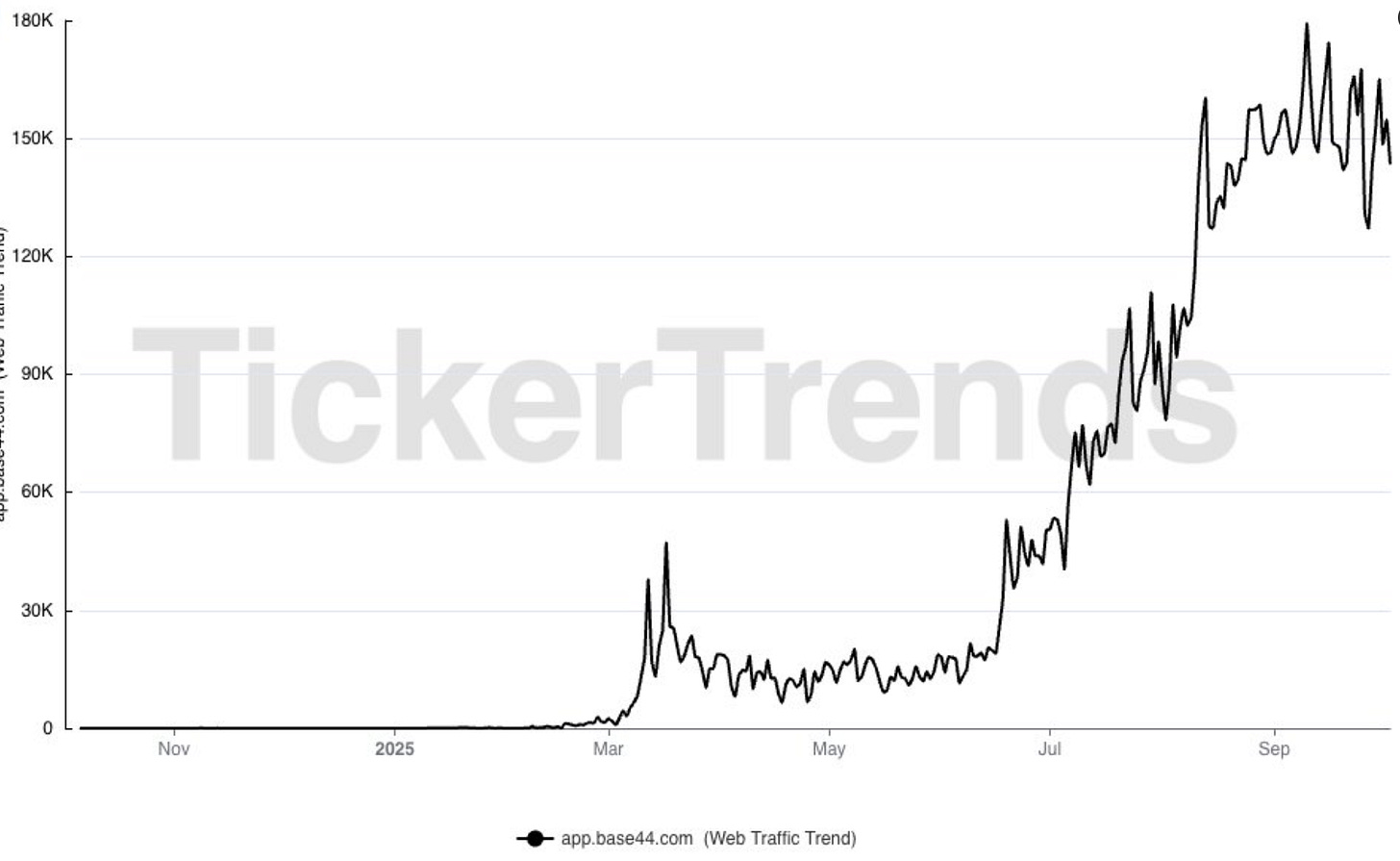

WIX -6% as Base44 traffic has flat-lined and begun to dip. Flat traffic means the daily NNARR # that CEO called out in August likely now much lower. Stock has now retraced 50% of its move off the bottom and narrative seems to be shifting back to “AI loser” despite the growth boost Base44 might provide.

SEMIS

AVGO +25bps as Bernstein held a call with CEO Hock Tan…haven’t had time to listen yet although got this nugget:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.