QQQs +60bps were weighed down by AAPL -3%, which caught a pair of downgrades (Jefferies + Loop) and # cuts at JPM and MS removed it as a top pick — a quad-fecta of neg news. Stock was teflon as recently as late Dec, but now down 15% from highs as investors worry about the upcoming Q1 guide following a slew of negative data, mainly coming out of China. QQQs rallying another 40bps post-close on the back of NFLX + MSFT/Stargate stuff (see below.)

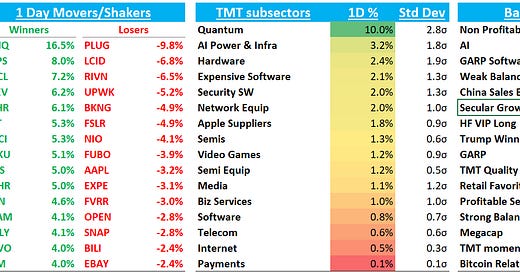

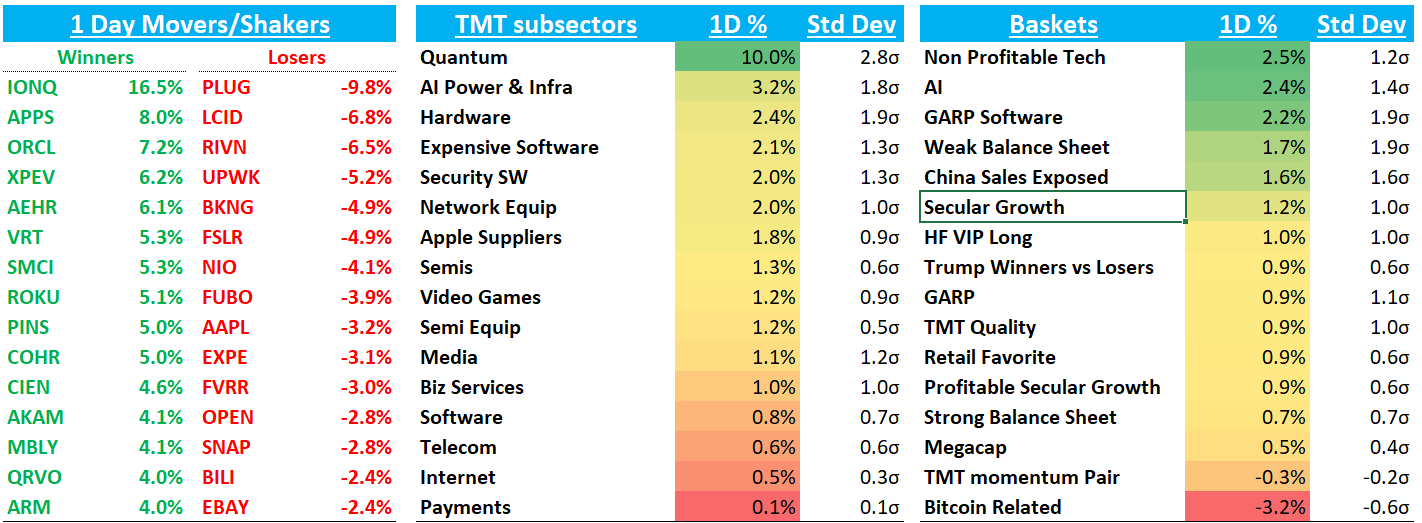

Some signs animal spirits back in vogue today as Quantum basket rallied 10% and space stocks ripped as Trump talked up going to Mars yesterday. We continue to be in a little window of macro-freedom until Fed next Wednesday and bulls are taking advantage - NFLX’s goldilocks print will likely help sentiment into earnings tomorrow.

The big news today was Trump announcing new AI investment push with OpenAI, Softbank, and ORCL (Bloomberg):

Trump will be joined by Softbank’s Masayoshi Son, OpenAI’s Sam Altman, and Oracle’s Larry Ellison to announce an initial $100 billion investment — which could scale up to $500 billion over the next four years — on Tuesday afternoon, according to a White House official.

Big numbers there if they come to fruition. ORCL +7% on the news (also helped by TikTok coming online). Post-close Softbank said they will begin deploying $100B immediately and ORCL up another 4% as they said 10 DCs currently being built and plan for 20. MSFT flat on the news as some speculated this means ORCL/OpenAI getting closer as OpenAI and potential neg implications of Azure/OpenAI partnership, but post close OpenAI said relationship with MSFT growing and announced a new pact and said OpenAI recently made a new large Azure commitment. From PR:

Microsoft has rights to OpenAI IP (inclusive of model and infrastructure) for use within our products like Copilot. This means our customers have access to the best model for their needs.

The OpenAI API is exclusive to Azure, runs on Azure and is also available through the Azure OpenAI Service. This agreement means customers benefit from having access to leading models on Microsoft platforms and direct from OpenAI.

Microsoft and OpenAI have revenue sharing agreements that flow both ways, ensuring that both companies benefit from increased use of new and existing models.

In addition to this, OpenAI recently made a new, large Azure commitment that will continue to support all OpenAI products as well as training. This new agreement also includes changes to the exclusivity on new capacity, moving to a model where Microsoft has a right of first refusal (ROFR).

In other words, this means will pure Azure pnl without any of the capex burden — ORCL and Softbank take on some capex burden while MSFT maintains right of first refusal on any OpenAI new capacity…

Let’s get to the recap…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.