TMTB EOD Wrap

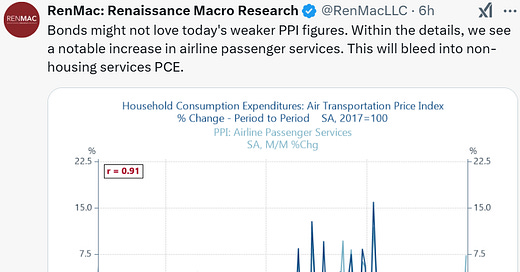

QQQs - 45bps. Market initially rallied on an easier PPI but underneath the headline #, things didn’t look as cool:

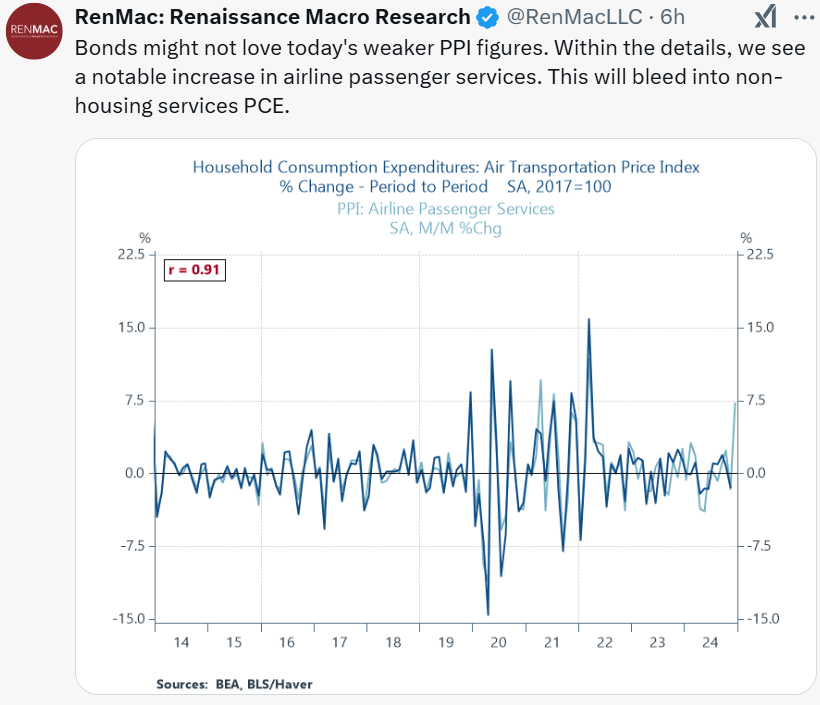

That along with KEYB cutting Data Center #s on NVDA after some mixed supply chain checks drove the market lower in early morning. It continues to be a tough tape and a lot of uninspiring px action (several red to green reversals today and Megacap weak) but not all is bad: some green shoots for price action — MTCH up on a dg; sw rallying nicely, NVDA only dn 1% on a big # cut. Despite yields being flat, some green shoots in the macro action as well: Fed expects moved slightly in a dovish direction with market now pricing in 30bps worth of cuts this year. The dollar also reversed 67bps, the first red close since 1/6. BTC +2.3%….Are these clues for tomorrow’s CPI print? We’ll have to wait and see — CPI # will likely have an outsized influence on direction/macro narrative going forward.

Let’s get to the recap…

Internet

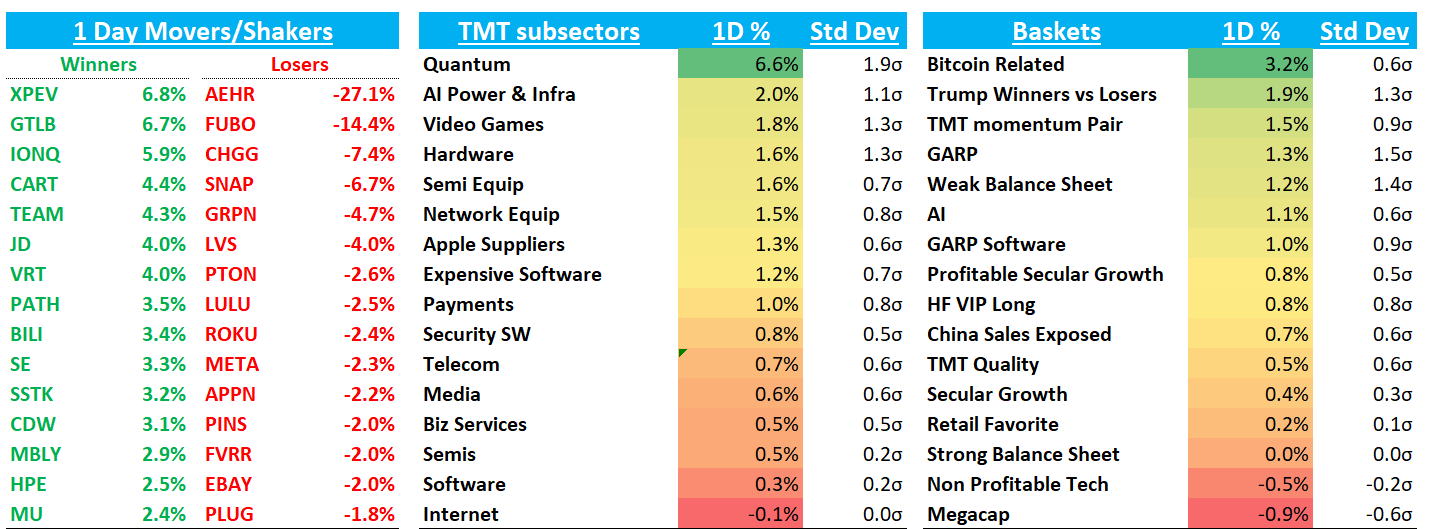

Ad names generally weak as Bloomberg reporting China was weighing a sale of TikTok US to Musk as a possible option. Not surprising to see reports like this begin to come out, especially once a ban is in place. It wasn’t surprising that China/TikTok was vehemently against a US sale before the ban and also unsurprising that they would potentially loosen their stance a bit once ban is cemented. Very possible we hear of Supreme Court decision tomorrow at 9:30am. Some Tiktok users going to Chinese apps RedNote and ByteDance-owned Lemon8 - both are currently the top two apps in the US app store.

META -2.5%: yesterday we wrote this would likely sit in the funding short camp if it wasn’t for potential TikTok revs, so unsuprising to see underperform today with news of a potential sale out

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.