TMTB EOD Wrap

QQQs +1.7% continuing strength following CPI print a couple days ago, breaking over 20D and the descending trendline since mid Dec. Still yet to make a higher high, but things feeling better after this week:

Market was helped by some better econ data from US/China and relatively stable yields despite hot US data and hawkish Fed comments (Hammack in WSJ). And it seems like sentiment around Trump has gotten better as of late. Also got some leaders acting better — MRVL hit new closing high today, AMZN only 3% off 52wk high, ANET new closing high, HOOD 52wk highs, and BTC +4% getting very close to new highs. But price action in some areas still anemic - for example: TSM -1.5% not being able to follow through on yesterday’s beat and NVDA still chops around. Still unclear which direction QQQs want to head in, but at least we are seeing some stocks with good idiosyncratic stories work.

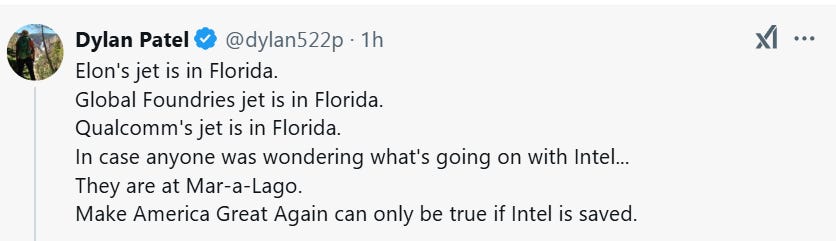

Semis drove the strength today - the big 3 AI names AVGO +3.5% MRVL +6% and NVDA +3% led the way higher following TSM’s strong results yesterday — but the SOX was also helped by two unlikely candidates: QRVO +14% as Starboard took a big stake in the co and INTC, which rallied on speculation from Semiaccurate that the co is a takeout candidate. JPM said the article implied it was Musk who was asked by Trump pre-Gelsinger exit to address INTC challenges and according to a leaked email, Musk sought input from close confidents about a potential deal. JPM notes that deal could make sense for a couple reasons: 1) SpaceX just did a raise at $350B and 2) Elon needs chips for cars, satellites, robots, etc. Citi was out with a note saying AVGO was only one who could afford it… More speculation after the close

BTC +4% to $104k getting close to new highs as Trump said crypto would be a policy priority. Treasuries mixed with 2 year yields rising 4bps while 10 yr yields about flat and fed expects held around 40bps worth of easing for 2025.

Let’s get to the recap:

Internet

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.