TMTB EOD Wrap

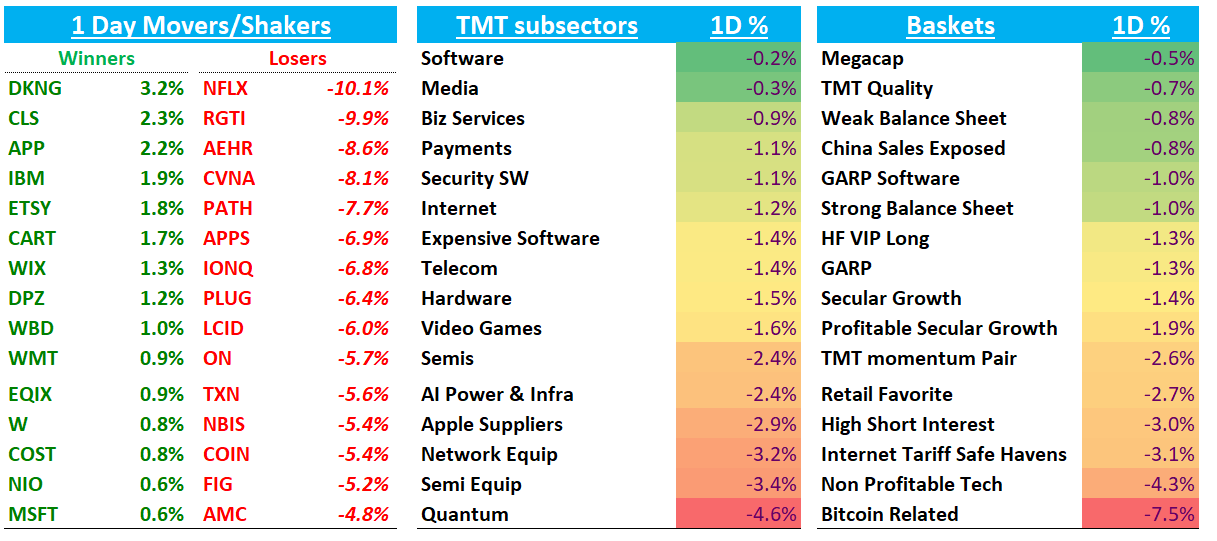

QQQs - 1% as weakness/volatility underneath the surface finally came for the indexes. Gold down again and now dn 8% in 2 days, biggest 2 day loss in > 10 years. BTC slipped below $110k. Momentum was down 4% today, close to a 3 z-score event and worst 2 day stretch since Jan and down double digits over the last week. Software outperformed again today at the expense of AI names.

The High Beta Mo’ Pair is down close to 12%, which is about half way through your average momentum correction episode:

The Mega Cap vs Non-profitable Tech pair now up 15% in the last week:

What’s driving the weakness the overall today? A combination of a few things:

First, we’ve seen sell the news reactions over the last week, which started with ORCL down double digits since Thursday’s analyst day despite raising guidance. TSM followed after a solid print and very bullish AI commentary. This all follows some tepid reactions across the last two weeks to OpenAI deals with NVDA, AVGO, and ORCL (AMD px action notwithstanding). All of these announcements created a high bar for near term outperformance headed into earnings season.

We thought the set up entering today was primed for possible strength in AI names as you had a bevy of good news: APH/GEV/VRT results were all strong; Anthropic + GOOGL deal; APLD signing $5B deal with a hyperscaler, the DoC supporting foreign purchases of AI; and AMZN/AAPL/NFLX/Analog weakness all potentially helping flows into AI.

However, we immediately saw green to red reversals in GEV, VRT and APLD — all continuing the recent sell-the-news action:

NFLX -10% and TXN -6% misses didn’t help things to start off earnings season.

Add to that, the simmering narratives over the last couple weeks: “bubble” and “circular financing” talk drawing plenty of skepticism while spec/frothy names continued to rally; slowing user growth/time engagement at ChatGPT making the rounds, Karpathy’s (former TSLA/OAI) podcast appearance over the weekend talking down AI expectations of AGI/capabilities, and the BABA white paper out earlier this week talking about a GPU pooling system that reduces # of H20 chips needed by 80%+.

Adding fuel to the fire are the macro cross-currents: — an ongoing gov’t shutdown. Trump vs. China, regional bank weakness, and subprime concerns. And we haven’t even mentioned the factor see-saw which has been paining L/S HFs all month long: one day its retail shorts outperforming, the next day is cyclical shorts, another day beta net an issue, another day AI winners, and so on. This has all caused the beginning of some de-leveraging among HFs until things settle down a bit.

Does this change our view of the AI trade?

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.