TMTB EOD Wrap

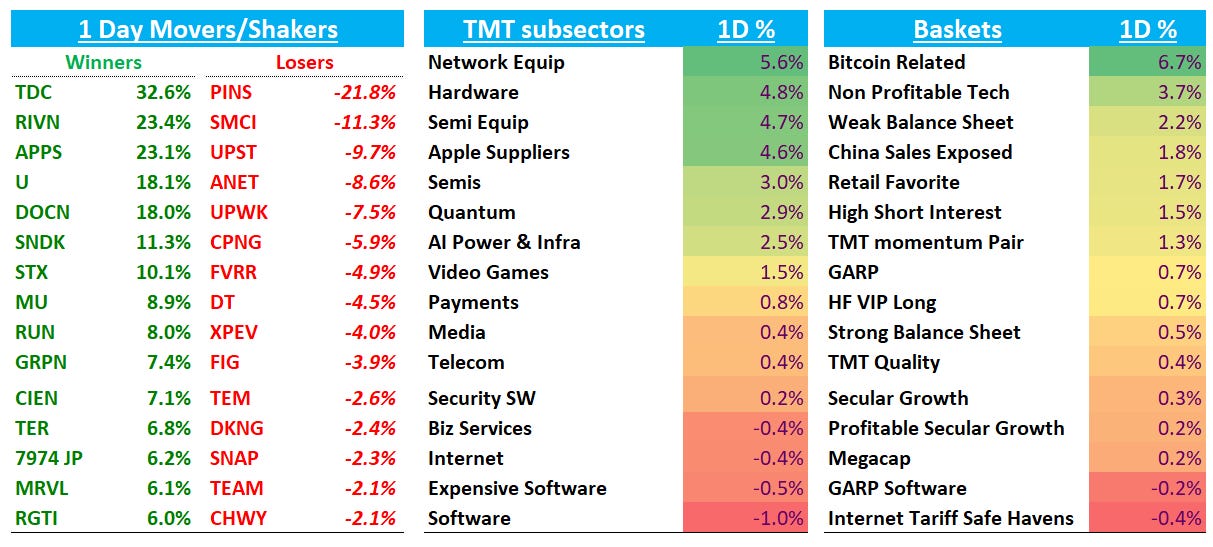

Good afternoon. QQQs +65bps staging a bit of a comeback after yesterday’s big red day after media reports signaled a potential shutdown deal by the weekend, Supreme Court justices expressed skepticism about the White House’s IEEPA tariffs. BTC +3.6%.

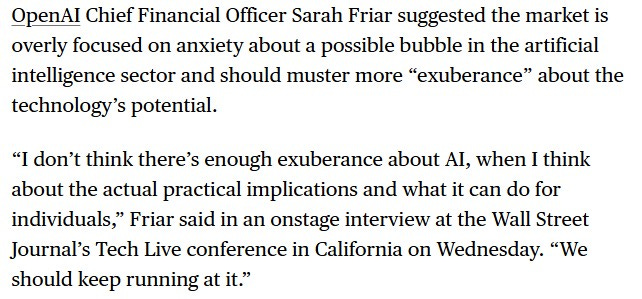

A couple AI articles hit near the end of the day, which seemed to coincide with a late afternoon swoon in some AI stocks, NVDA in particular. First, This WSJ article where CFO said IPO is not in the cards and hopes the federal gov’t might backstop the financing of future data-center deals:

“This is where we’re looking for an ecosystem of banks, private equity, maybe even governmental, the ways governments can come to bear,” she said. Any such guarantee “can really drop the cost of the financing but also increase the loan-to-value, so the amount of debt you can take on top of an equity portion.”

Friar isn’t the type of CFO to randomly talk about something — my guess is discussions are taking place with the US Gov and this is a PR effort to begin to sway opinion. Would the US Gov pull the trigger with stocks at highs or wait until a swoon in AI stocks to step in?

FT then had an article quoting Jensen saying China “will win” AI race with US:

Huang singled out new rules on AI by US states that could result in “50 new regulations”. He contrasted that approach with Chinese energy subsidies that made it more affordable for local tech companies to run Chinese alternatives to Nvidia’s AI chips. “Power is free,” he said.

Despite AI demand datapoints which continue to be very strong — and many AI stocks continue hitting all-time highs— definitely feels like AI vibes have taken a bit of a step lower following a very hot summer/early fall. Investors are asking “what’s next?” after a couple of months where back-to-back-to-back AI deals were front and center almost every day; hyperscale capex & Jensen’s “0.5T” are now behind us as well. AI bulls still very much in control, just sensing a tad bit of chg at the margins in conversations with other investors.

The sentiment doesn’t seem to be seeping into stocks yet, however, although we’re seeing more discrimination in terms of stock picking within AI: investors are preferring certain areas which continue to outperform. Current favorites: memory/HDDs (pricing skyrocketing/most upside to NT numbers), power/DCs (biggest bottleneck/potential for deals), TPUs ramping (CLS, AVGO, LITE). Just look at the price action today with BE +10%, MU +9%; SNDK +12%; STX +11%; WDC +5%; CLS +5%; LITE 25%; VRT 5% leading AI names higher. Next catalysts on the AI docket are AMD 11/11 Analyst day, NVDA’s print on 11/18, and the RBC Conference on 11/19 where investors expect MU to pre-announce.

Lots of earnings post-close - sent some first takes out earlier here

INTERNET

AMZN 35bps: TheInformation had an article out yesterday talking up Anthropic revenue expectations, which is good news for AWS:

Anthropic this summer hiked its most optimistic growth forecasts by roughly 13% to 28% over the next three years and projected generating as much as $70 billion in revenue in 2028, up from close to $5 billion this year, according to a person with knowledge of the company’s financials. Anthropic is gaining share in the Enterprise market with an API business roughly double the size of OpenAI ($3.8B vs $1.8B). Anthropic expects enterprise sales will continue to generate over 80% of revenue through 2028.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.