TMTB EOD Wrap

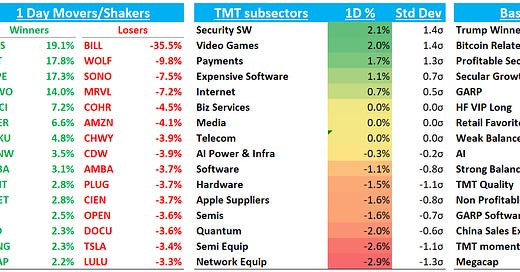

QQQs - 1.25% as semis led the way lower. Reasons for the downdraft this Friday: 1) higher wages in NFP report despite a weaker overall jobs number 2) Michigan 1 year inflation expectation spike and 3) Trump saying he would unveil reciprocal tariffs as soon as Friday and would arrive during the week of 2/10. And maybe some PTSD around futures open the last two Mondays. Yields spiked 5-7bps across the curve. BTC roughly flattish while China +1.5%.

Let’s get straight to the recap…

Internet

PINS +19% on a solid Q4 and a much better Q1 guide that has bulls hoping for accel back to high teens and potentially 20% on the table again. Comps get easier going forward and bulls liked how the call went, but to push past $45, seems like PINS will need another quarter of execution to show progress is real. Got an upgrade at Bernstein this morning. ROKU/RDDT +4-5% in sympathy.

EXPE +17% on one of the best prints from EXPE I can remember in a while - big beats on room nights, GBs and EBITDA while VRBO accelerated. Q1 guide seemed ok after adjusting for easter/leap year/fx. Stock still only 10x EBITDA for potentially accelerating growth going forward. Bears will continue to harp its a show me story and that launch of AI agents in ‘25 present a potential headwind.

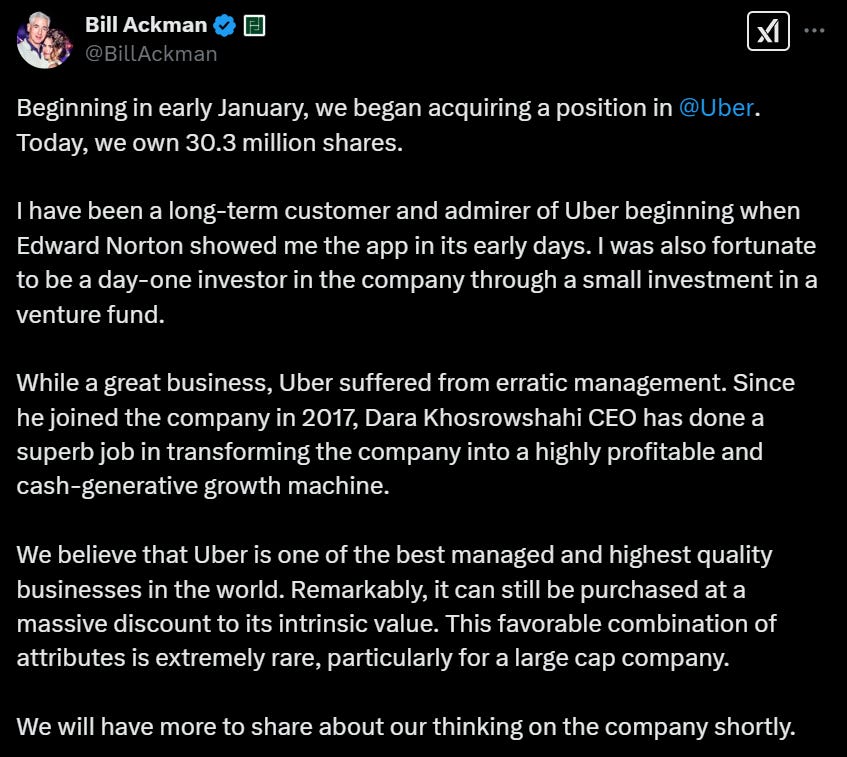

UBER +6.5% and now +16% post initial swoon post -print as Pershing took a big stake

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.