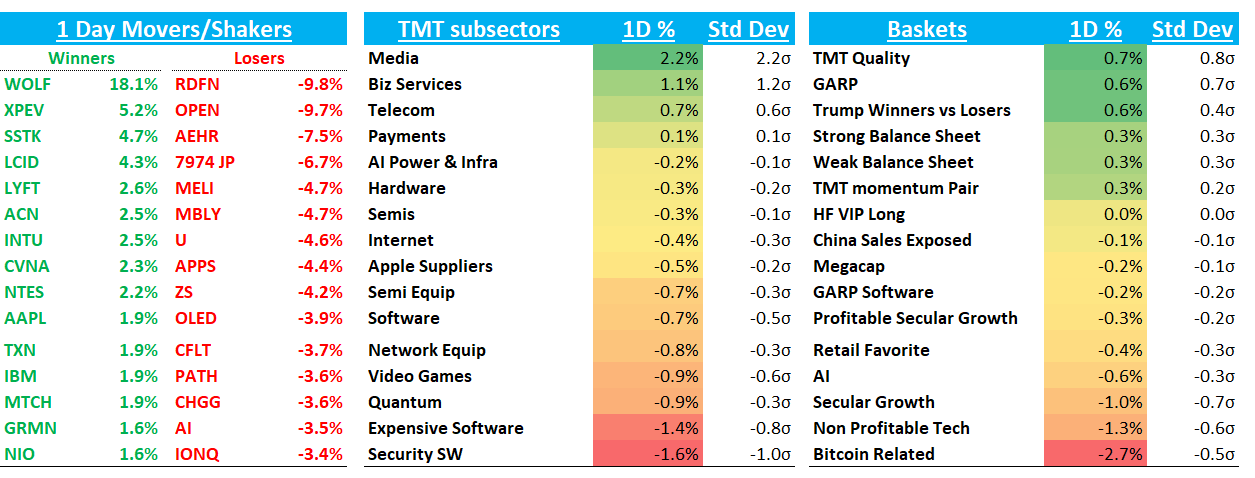

QQQs flat with a nice intraday rally to end the month while SPY +67bps. Market implying a 2.5% move through Friday as we get “Liberation Day” tomorrow and then the unemployment report on Friday. Yields fell 2-5bps across the curve as market pricing in 75bps worth of fed cuts for the year. Oil +3% as Trump’s geopolitical tariffs could curb global supply (he’s imposed additional tariffs on buyers of Venezuela oil and threatened some against Russia).

Let’s get to the recap…

Internet

AMZN -1.2%: Mizuho out with a mixed/neg note on AWS after the close.

Mizuho notes 3 key developments after talking with a leading channel partner: (1) Deal cycles experiencing modest deceleration - considerably different from 2022's environment when economic conditions extended closing times by half; (2) Discounting has begun appearing in long-term AWS agreements but remains "not wide-scale" compared to the "50% across the board" seen previously; (3) Heightened GCP competition in financial services with aggressive pricing tactics, offering "10% to 20%" AI discounts and up to "30%" off for extended commitments.DASH flat as M-sci said GOV tracking above street and high end of guide

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.