TMTB EOD Wrap

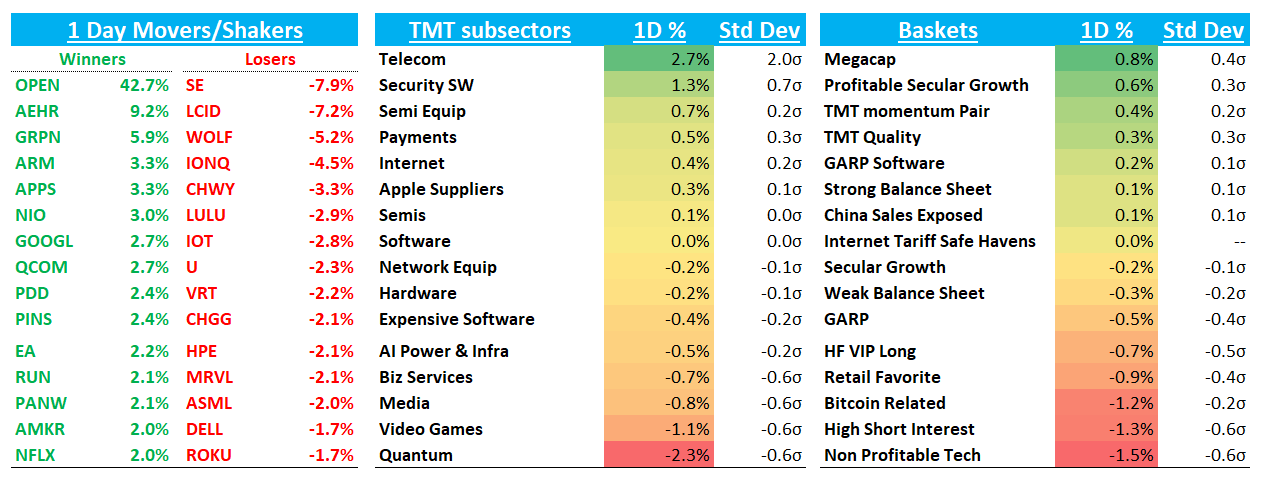

QQQs +50bps led higher by Internet Megacaps (highly shorted names sold off in the afternoon, as did frothy sectors like Quantum -6%) ahead of a busy week of earnings. Yields fell 2-5bps across the board after the Japan election outcome. Fed expets continue to hover around 45bps worth of cuts for the rest of the year. BTC -1%.

Post-market, NXPI -5% on a slight rev beat and guiding next quarter above, but a bit light of buyside expectations. Industrial Mobile and Infra all above street. Guide $3.15B but buyside looking for $3.2B+. Call tomorrow 8am - focus will be around any color they provide on Q4 and sustainability of the recovery off that level.

Let’s get to it…

INTERNET

GOOGL +2.7% continues to rally into the print as Investors get more comfortable with the trajectory of search as the two big 3p firms have come out over the last two days calling out an acceleration in search in July. Heard Cleveland was also out today calling a solid finish to Q2, which jives with what we’ve heard from most sell-side checks. FundamentalBottom had some good checks out today, basically saying the same thing: better than expected Q2 and full year trends, saying that AI overviews are expanding rapidly and early feedback points to that they are additive over time. All of this have bears on the back foot and sentiment from HFs has shifted dramatically more positive over the last couple of months, with LOs holding out a bit given structural issues and the Aug DOJ remedies. Bogeys here about 200bps above street at 8.6% for search growth and Paid click growth to be 3%+ (anything higher than that likely looked at favorably and will help the AI monetization narrative). We had some more in-depth “long-lean” thoughts on the set up into the print yesterday in our weekly.

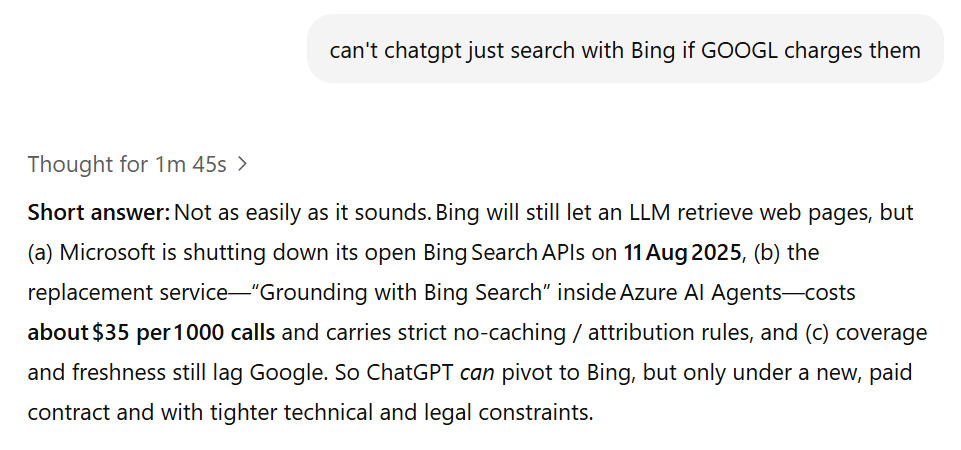

I liked this tweet that had me thinking about GOOGL’s advantages over other LLMs given their advantage of having the best search engine:

Went down a quick rabbit hold with o3:

Interesting…

NFLX +2% nice rebound following Friday’s -5% performance…

My wife and I have been on a K-drama binge and haven’t watched a non-Korean show on NFLX over the past few months.

Other large cap strong: AMZN +1.4% and META +1.2%. A strong GOOGL print likely lifts these some more.

RDDT -1.3%: Still feeling out the set up here into the q - revs likely to crush again, but July user data so far has flatlined after the June improvement (Q2 US net adds prob flattish) — in other words, need more data to prove our AI overviews thesis helping RDDT. As we wrote last week, we took down sizing as easy money largely made on the ROC/perception turn + better checks + short covering, and waiting for more tea leaves to see if possible to size up again. If July was improving then the mgmt narrative of June better, July better would be an easy one to buy, but if net adds flat, then saying June improved but July flatlined doesn’t really sound super exciting, and a harder read for me to know what stock does in that scenario, even if Q2 beats and Q3 guided ahead, especially given the recent stock rally/improvement in sentiment. Staying fluid on this one.

IF YOU LIKE WHAT YOU ARE READING, PLEASE SHARE AND RECOMMEND TMTB TO A FRIEND OR COLLEAGUE WHO WOULD ALSO ENJOY READING. READER SHARING IS OUR MAIN AVENUE OF GROWTH

PINS +2.4% as Nowak at MS upgraded, turning more constructive on recent ad checks saying product investments beginning to show signs of payoff. Andrew at Hedgeye was also talking about seeing 10% ROI improvement. Set was definitely better last week as stock now a long from the fast-money crowd, but we still think numbers likely too low in 2H.

ETSY +1.2% as MS upgraded to old despite a PT that still $10 below current px

CVNA -1.5% as JPM note said BITDA bar high near-term.

DUOL -4% continues to break down as 3p checks have continued negative into Q3

UBER +60bps: hey it’s green!

SEMIS

We wrote about the semi set up yesterday in our weekly , with Aug/Sept seasonality the worst 2 month stretch of the year for SOX and Sectorial 232 tariffs due Aug 1 vs. AI vibes which are likely to stay hot…

ALAB +19% as heard Semianalysis was out saying ALAB potentially replacing MRVL for work in I/O die for Trainium 4. MRVL -2%

NVDA -60bps as reports NVDA only has limited number of H20 chips and doesn’t plan to restart production

SNDK -1.4% / MU -1% as Digitimes reporting YMTC to pilot fully China made NAND line in 2025 eying 15% global share. Stock short here from the fast money crowd as feedback on ‘26 HBM continues to be mixed.

TXN -1% / ADI -60bps despite upgrade at Seaport

TER +1% as UBS boosted PT to $120 calling out upside to 2H numbers

ARM +3% as UBS lifted PT to $185 from $155 on Snapdragon PC momentum and ARM hiked PT to $175 on AI royalty upside

CRWV +1.5% after offering $1.5B worth of notes

SNPS +1% as Piper upped PT to $660, seeing strong eps u pside from ANSS deal

SOFTWARE

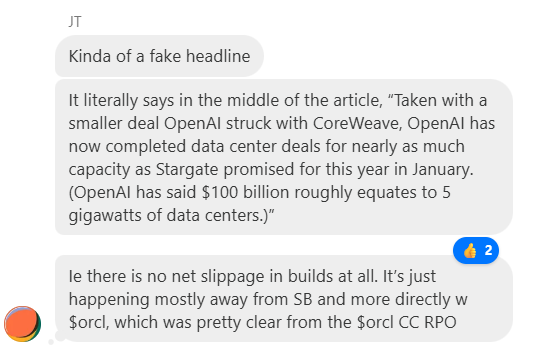

ORCL -1.5% on this WSJ headline: SoftBank and Open AI’s $500 Billion AI Project Struggles to Get Off Ground, saying the venture has yet to secure a single data center site and is now reportedly aiming to open a small facility—possibly in Ohio—by year-end….although article seems a bit of click-bait, just seems like Softbank has taken a while to get its act together…TMTB commentators on top of it in the chat:

S +10% / PANW +2% as rumors were floating around about a PANW/S acquisition although Palo Alto denied the story. Rest of Cyber generally strong on the MSFT hacking news

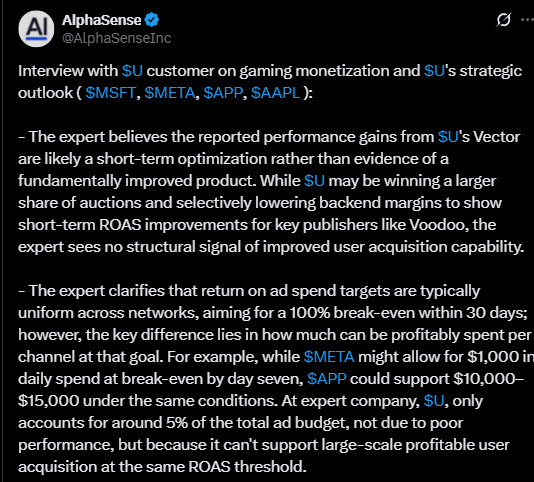

U -2%: Similar to RDDT, we caught the turn nicely on the ROC in checks (always the easiest money), but for next leg higher need to continue to here of further uplift in Vector, which means we thought it was prudent to book some profits. Bull case here is 30-35x $600+ of EBTIDA in ‘26 (street at $440M) which is ~$40-50 stock. We tend to be a little more lax with valuation on a stock like this and more use the chart to guide us on risk mgmt given 1) its smaller with a heavy retail base and right tail “narrative” optionality, which means in this type of market it can disconnect from valuation & 2) potentially early in product cycle and given its underowned and still plenty of skepticism, hard to see stock going down on improving checks/numbers beating. This expert feedback was good and kind of supports view that we need next step up in Vector checks for next leg higher - still TBD and we’ll adjust accordingly, but we like that there is still plenty of skepticism here :

ELSEWHERE

XYZ +7% as they’ll get added to SP500

RKT +7.5%: this is one I always have on my screen to buy when rates are going down as one of names most leveraged to that. Decent bull case here with RDFN acquisition worth digging into although a bit out of my wheelhouse. Also benefits from OPEN pattern-recognition given its another housing stock with high short interest.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.