TMTB EOD Wrap

QQQs +13bps as fed expects moved in a slightly hawkish direction with the market now assuming only 35bps worth of cuts vs 45bps before FOMC and Powell. The Fed’s statement sounded dovish but Powell’s press conference was a bit more hawkish. Although he noted downside risks to labor market and how Servies inflation has continued to ease and said a “reasonable base case” is that tariffs will only have a brief upward impact on prices, he also said the economy was in a solid position while inflation remains “somewhat elevated” (even without tariffs). Powell said the Fed is “already looking through the inflationary impact of tariffs by not hiking rates.” Two dissents (Waller and Bowman).

Ok, enough macro, let’s get to the good stuff which as this afternoon saw some massive beats from META (Biggest beat in several years and guide implying accel at the high end) and MSFT (39% Azure #). Zuck was incentivized to back up his recruiting pitch and he did so with flying colors. Remember this quote: “And then, of course, we want to back up with just an absolutely massive amount of compute which we can support, because we have a very strong business model that throws off a lot of capital.”

META’s capex commentary implies $107B, way above street, which should help AI semis tomorrow and their ad print should names like PINS + RDDT, while the Azure print likely helps consumption names despite a CFLT blow up. The Hot AI Summer continues…

A very shortened recap today given I’m hopping on some earnings calls shortly. We’ll have more tomorrow.

INTERNET

RBLX +5.5% as M-sci was out calling out a continued acceleration in bookings in July vs already elevated June levels. EPS early tomorrow

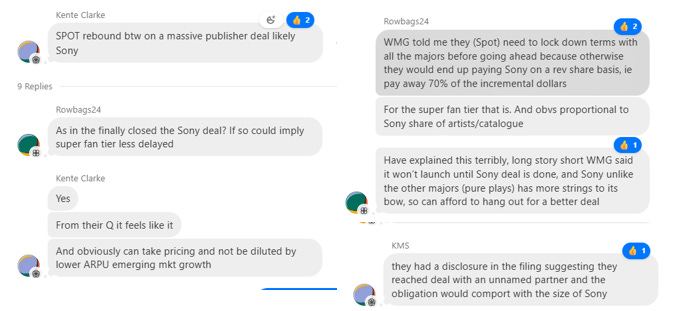

SPOT +5% bouncing back nicely. TMTB Readers with the deets:

GOOGL +40bps: CNBC reported that Sundar had an all hands meeting and said:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.