TMTB EOD Wrap

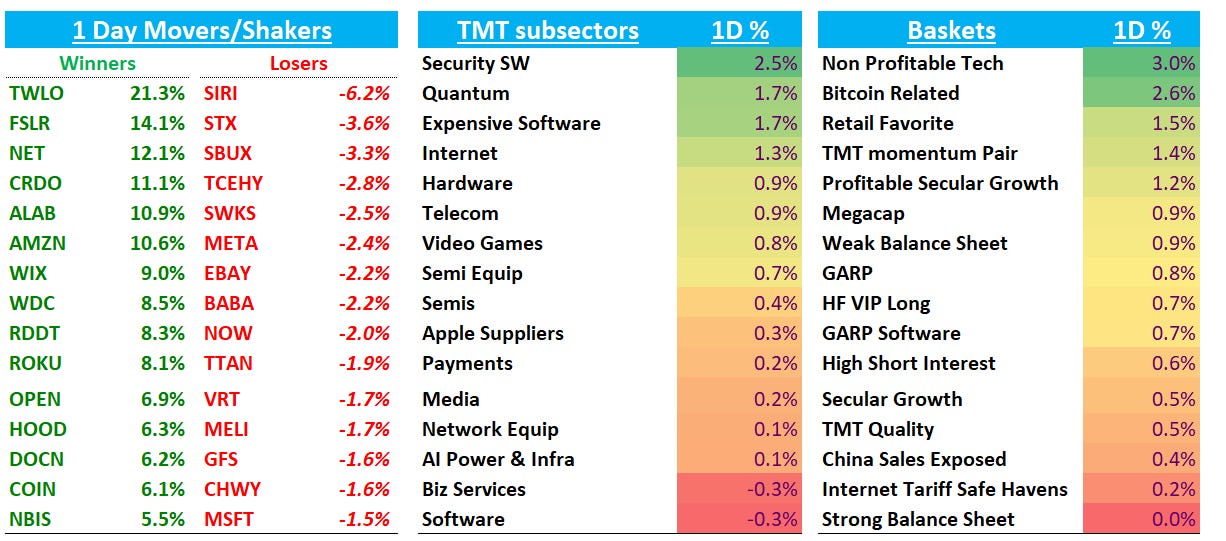

Good afternoon. Early one today as QQQs +65bps helped by AMZN’s +11% print. Some questions around large cap fade today but haven’t seen any great responses. Some pointing out mutual fund year end is today which sometimes causes some weird price action. Some asking “what’s next” as some big catalysts — hyperscaler capex, NVDA effectively pre-announcing which takes some juice out of what is likely a great guide in late Nov, and Trump/Xi summit & US- China trade war ceasefire — are now behind us.

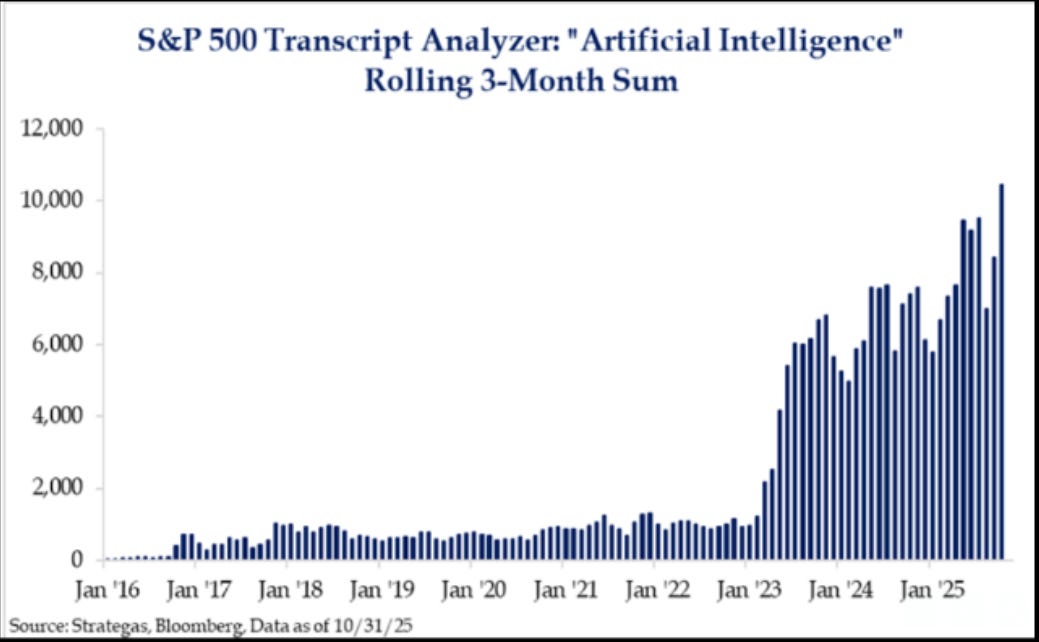

It’s been quite a week - sometimes exhilarating, sometimes exhausting - and we’re through a large portion of earnings although still plenty to go next week. We’ll be here covering it all. AI continues to dominate commentary across the board:

Have a great weekend! Let’s get to the good stuff…

INTERNET

AMZN +11% after a clean beat across the board. Some pointing out that Bezos likes to sell post earning pops - if that’s the case we should get a filing in the next couple of days. Bulls - and there are many - a lot more vocal today and happy to finally get the AWS accel we’ve all been waiting for since 2023.

NFLX +3% after announcing a 10-1 stock split — all we need is them to bring back net add disclosure and this can become a great trading stock again! Reuters also reported they hired bankers to explore a potential WBD bid.

ROKU +8% as bulls increasingly vocal about the set up into 2026 despite top line maybe coming in a bit lighter than heightened expectations. Here’s the bull case we outlined this morning:

META -3% following through to the downside as pecking order in Mega cap land now: NVDA > GOOGL > AMZN > MSFT > META/AAPL. Not saying this is our preference order, just how we hear of investor positioning post-earnings Here’s what we wrote yesterday when thinking about META:

While we think stock likely needs to digest here and it likely becomes a funding short, we struggle to find much downside from here. 20x CY26 $31 = $620

10%<5% downside from here (assuming no macro ad slowdown). We think stock likely capped a bit near-term. It was easier for stock to get a pass on higher expense growth if they were crushing revs, but the just in-lineish print and slightly below buyside guide is a different set up so we’ll have to wait to next q for the narrative to hopefully shift for the better

So while we get the funding short reasons and lack of near-term upside, still tough to see much downside here. If we put on our bear hats, we’d argue that heightened expenses aren’t a one-time hit in ‘26 and EPS growth capped at 10% for the foreseeable future despite 20%+ top line growth, which also increases the downside leverage in case any sort of macro/ad pullback or time/engagement shift to other LLMs. I don’t hear many arguing about META’s ability to sustain rev growth — some I talk to even came away more positive post-print - but it’s clear to see why the narrative is pretty muddied at the moment.

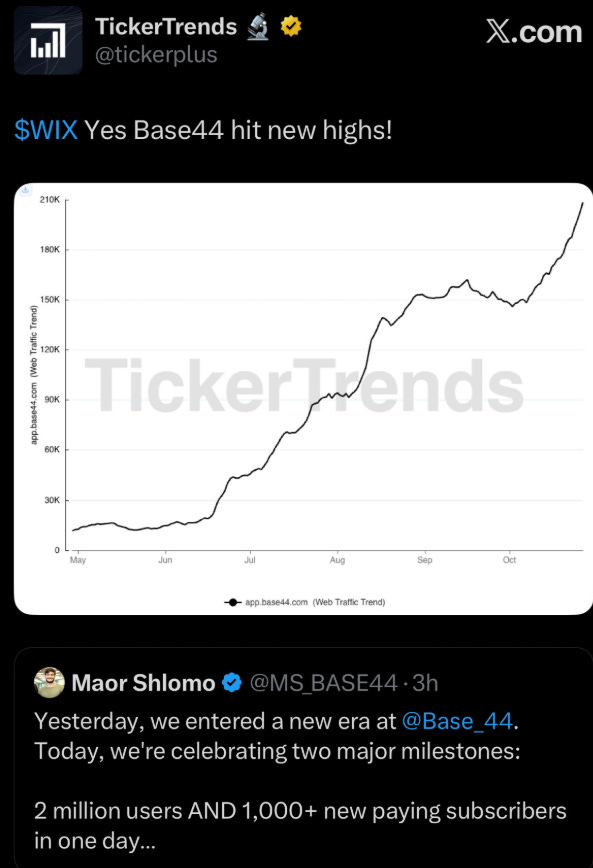

WIX +9% as Base44 continues to ramp. Thanks to TMTB chat reader Orel and TickerTrends who flagged this early for the group earlier in the week. As we flagged a few days ago, stock has pretty much tracked this chart as of late with stock pulling back with Base44 pulled back in late Set/Oct.

RDDT +8% after a solid top line print with DAUs slightly better than expected.

GOOGL -70bps no follow through

RBLX flat despite GS upgrade - more thoughts on the name this weekend

SPOT +60bps as Citi added to 90 day catalyst watch amid potential u.s. price hike

SEMIS

WDC +8% after a strong print where they crushed GMs and pulled forward ePMR/HAMR milestones, and underscored multi‑year hyperscaler demand visibility while stepping up buybacks/dividend. Also shut down talks of adding capacity. STX -4%. Good week for the HDD names. Some good discussion in TMTB chat here:

ALAB +12% / MRVL +5% on AMZN’s positive Trainium commentary

AI names mixed after a week of positive hyperscaler capex commentary: AVGO -2%; NVDA +40bps; AMD +40bps; VRT -2%

Neoclouds strong: CRWV +3%; NBIS +5%

Memory names MU -75bps / SNDK -40bps a bit on the weaker side.

SOFTWARE

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.