TMTB EOD Wrap

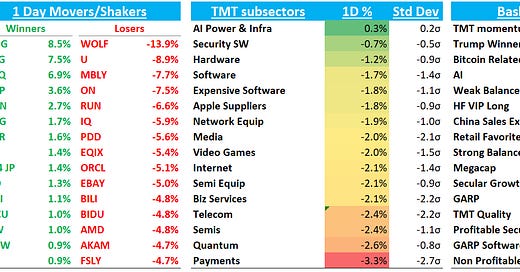

QQQs - 1.6% following a hot jobs report and a big jump in Michigan inflation expectations. Yields spiked 12bps while 10 year was up 8bp to 4.76% while fed expectations now sit at just 28bps worth of easing (down from 40bps). Oil +3.6%. BTC held in relatively well +3%. All eyes now shift to CPI on Wednesday of next week and then Megacap earnings following that, where focus has shifted to fx impact and comp’ing a leap year (see NFLX -4% as JPM cut #s).

Still not seeing great price action from stocks although would characterize today as “mediocre” rather than downright bad. Things like SNOW and TSM were up on good news and you have DKNG rallying once bad news priced in and out of the way, but PINS and TEAM both down on upgrades and UPST/ABNB down on what I thought were pretty solid 3p updates (although CHWY fared better).

Supreme court arguments didn’t seem to have gone too well for Tiktok, helping META +1%, SNAP +3.5%. Key points from hearing: TikTok lawyer emphasized First Amendment rights, but justices focused on ownership concerns rather than speech rights. Lawyer's questionable analogies and weak national security arguments were poorly received. Bloomberg reported Supreme Court likely to uphold ban. Timeline now is January 19 disposal deadline, with Trump taking office January 20. Ban would temporarily affect app updates assuming Trump extends disposal deadline to mid-April. While Oracle, and other private players have showed interest, resolution could also be through US IPO or shareholder carve-out. At this point, legal path to block bill appears increasingly difficult given judicial response.

Rogan / Zuck 3 hour episode now uploaded - link here and a summary here

Let’s get to the recap…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.