TMTB EOD Wrap

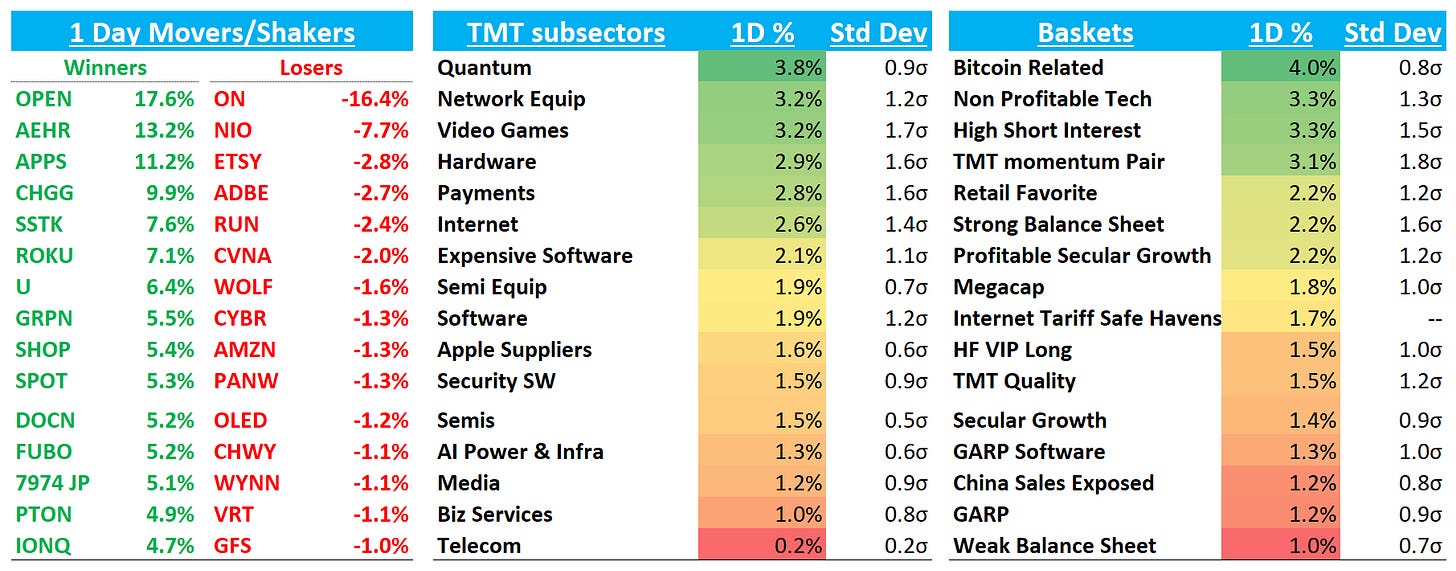

The 2nd trading day of August finishing a lot better than the first with QQQs +1.7% gaining back most of what it lost on Friday. AI-related names leading the way again as NVDA close to another all-time closing high (that dip was quick!). This is the semi analog we’ve been watching that seems to be holding for now:

Let’s get straight to the recap…

INTERNET

W +11% as bulls loved the beat and margin flow through, confirming to them that estimate revision likely just getting started and are playing for $1B in EBITDA in 2027. Bears were focused on the company's evasive pricing commentary, arguing not taking price increases will eventually challenge the business, and they worry about gross margin sacrifice to drive growth and eventual moderation of operating expense leverage (wayfair has tended to spend upside away in the past.)

Regarding the guide, mgmt was asked on the call back why despite mid-single digit top line growth in the second quarter and similar performance so far in the third quarter, the company guided to low-to-mid single digit growth for the full quarter. Wayfair cited two reasons: First, they were only one month into the three-month quarter and wanted to be conservative. Second, they were coming off a strong Black Friday promotional event in July and didn't want to get ahead of themselves early in the quarter.

Stock got an upgrade at Gordon Haskett calling out Leverage Upside from Loyalty, Stores, and Logistics as Industry Stabilizes, noting Brick-and-mortar expansion (e.g., new stores in Atlanta, Denver, and Yonkers) and CastleGate’s growing logistics network (volumes +40% y/y) add structural support and cost advantages.

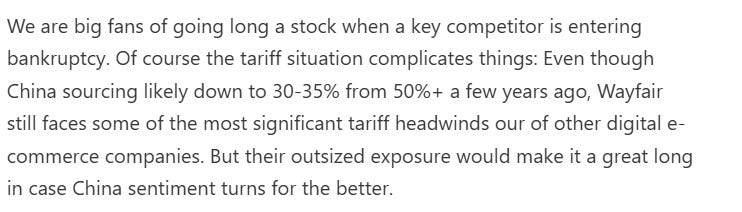

This is one of our biggest whiffs of the year as we wrote back in April that the name was the of the first ones we wanted to buy in case China/tariff news flow got better:

Just never pulled the trigger as it ran away from us. Hope some of you caught it!

RDDT +7% with nice follow through after a beat and raise. We had bullish thoughts on the print on Friday - mainly that it alleviated bear fears of big deceleration in 2H and DAU commentary allows narrative to shift back to large and nascent ad opportunity as RDDT becomes a more strategic asset for LLMs.

AMZN -1% as the debate over AWS (share loss? not enough GPU allocation?) and lack of acceleration at this moment in time continues…our thoughts from Friday morning:

Near-term, we think stock needs some digestion as the narrative of a bad mgmt team is hooking on and against a set of stronger large cap prints from META, MSFT, and GOOGL, AMZN will likely become a funding short among pods.

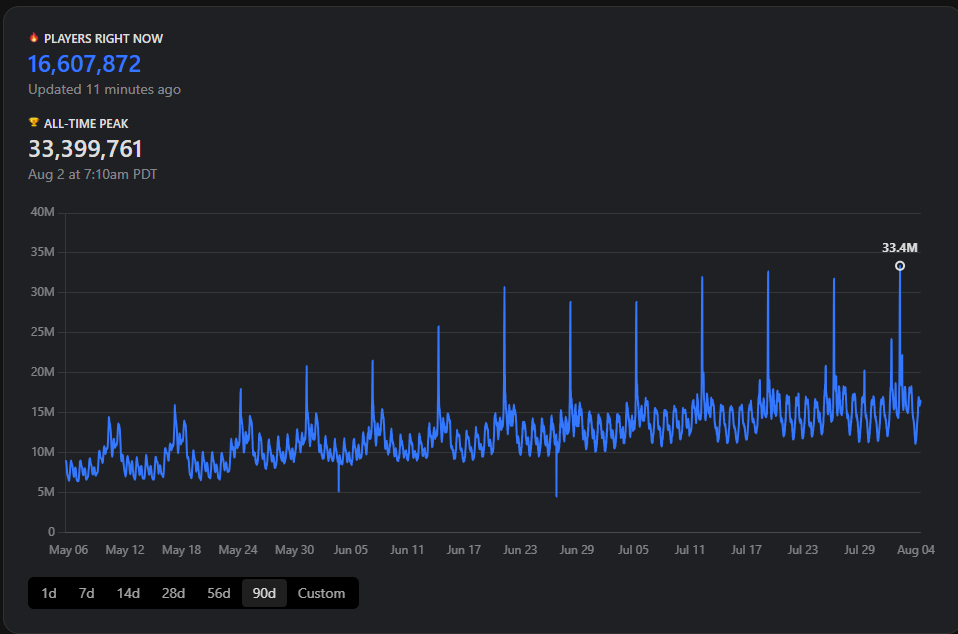

RBLX +4%: New CCU record this past weekend. I’m hearing from investors Q3 tracking to 60%+ so far, although comps get harder over the next couple months. Mgmt said on the call back they are baking a pretty significant decay linearity i their Q3 guide so hard to see RBLX not come above unless trends massively reverse from here.

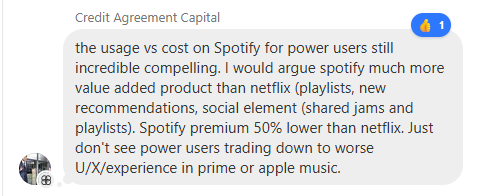

SPOT +5% after raising prices internationally by ~10%.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.