TMTB EOD WRAP

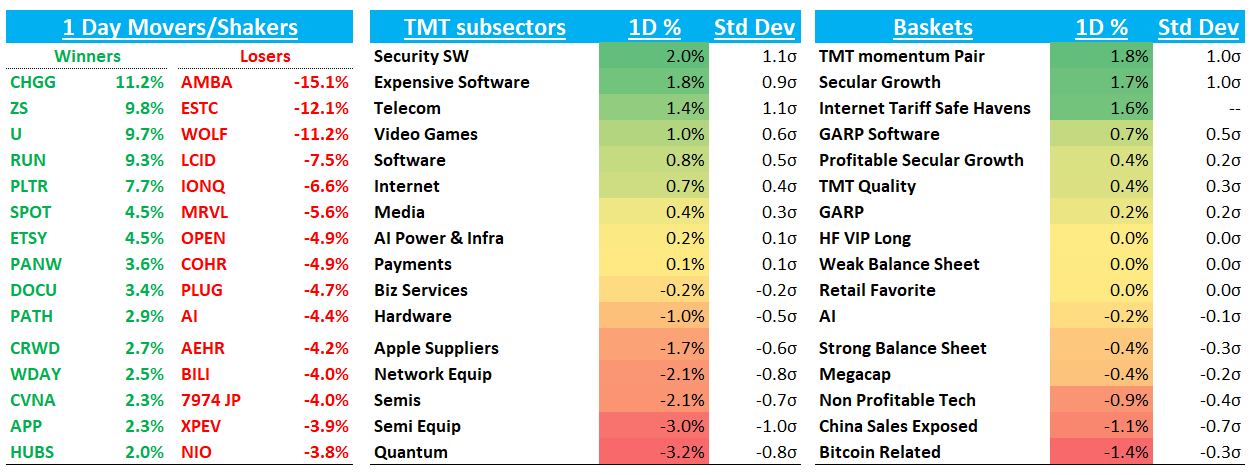

I love a good 4 day trading week…QQQs finished the day flattish shaking off some Trump hawkish tweets although SOX -2% underperformed:

Outside of that, stocks continue to act strong with the likes of SPOT, RBLX, NFLX all sitting near highs and PLTR getting its groove back today. Yields fell 2-5bps across the curve as fed expects moved in a dovish direction now pricing in 55bps worth of cuts this year. Econ data was better on average this morning with a cool PCE and lower Mich Inflation.

Ok, let’s get to the recap…

INTERNET

NFLX +2% as both Citi and ISI were out positive raising PTs to ~$1,400 - seems like both of them learned from last week’s JPM valuation downgrade that didn’t even ding the stock and instead decided to stay on the boat

SPOT +4.5% getting close to new highs again.

RDDT +3% continues its nice week after GS recapped followed ISI yesterday recapping meetings with mgmt. From our morning note:

DUOL +1.2% despite weaker Yipit data. Yup - like I mentioned this morning, this stock is like teflon (similar to SPOT/NFLX). We shorted small today, but have to take into account that this is a long-only favorite that is still underowned and we are sympathetic to the bull-case near-term (a potential narrative shift to AI loser from AI winner is a-ways down the road…)…similar stocks all sitting near highs….one where we’ll use the chart to guide us - likely won’t stay here long if breaks above 10d.

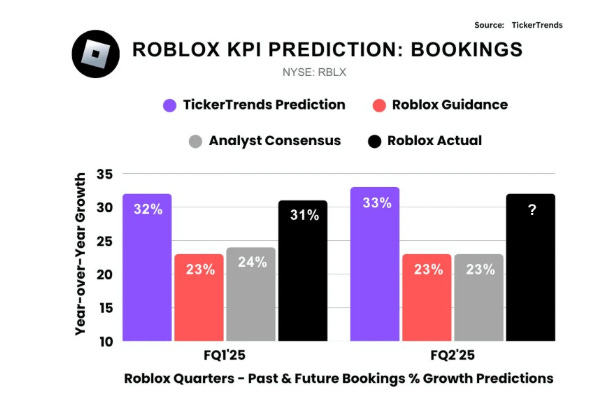

RBLX +2.6% can’t stop, won’t stop as stock continues to hit new highs. M-sci was out saying bookings strong through May (they are at 30% y/y vs street at 23%) calling out “Grow a Garden” driving engagement tailwind and called out a step function up in advertising in May. TickerTrends - who was pretty accurate on RBLX last q - was also out with their initial bookings estimate through the first 2 months yesterday, calling for 33% y/y growth. Everything pointing here to another big bookings beat…

I talked to TickerTrends today - they are just starting to build out their new KPI product and agreed to give TMTB subs a 1-month free trial to their Enterprise Product. E-mail vinit@tickertrends.io and tell him I sent you. For retail investors, they have a lower priced retail product here if you want 20% off that.

ETSY +4.5% continues to rally as 3p data showed an inflection up this week

AMZN -30bps: AWS CEO was on Bloomberg TV today - link here…3p data continues to track to a nice ~4ppts beat to NA retail

CART -20bps as Yipit said QTD GOV tracking in line at 9% y/y

CVNA +2.3%: amazed how strong stock is…never thought I’d see the day this became a long-only fav, but here we are…

SEMIS

MRVL -6%: One thing we love: clean, simple stocks/narratives and this isn’t one of them…The debate over Trn 3 / Trn 4 / Trn 97 goes on….

CRWV +5% doing CRWV things

NVDA -3% not helped by Trump hawkish China commentary. We expected better px action here post earnings…

AVGO +20bps shaking off AI semi weakness

MU -2.5% as Nikkei said SoftBank, Intel, new memory development company for AI, power consumption halved…Other AI names weak: ARM -3%; AMD -2%; TSM -2%

AI networking especially week, but didn’t see much: ALAB -4.5% / CRDO -6%

SOFTWARE

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.