TMTB EOD Wrap

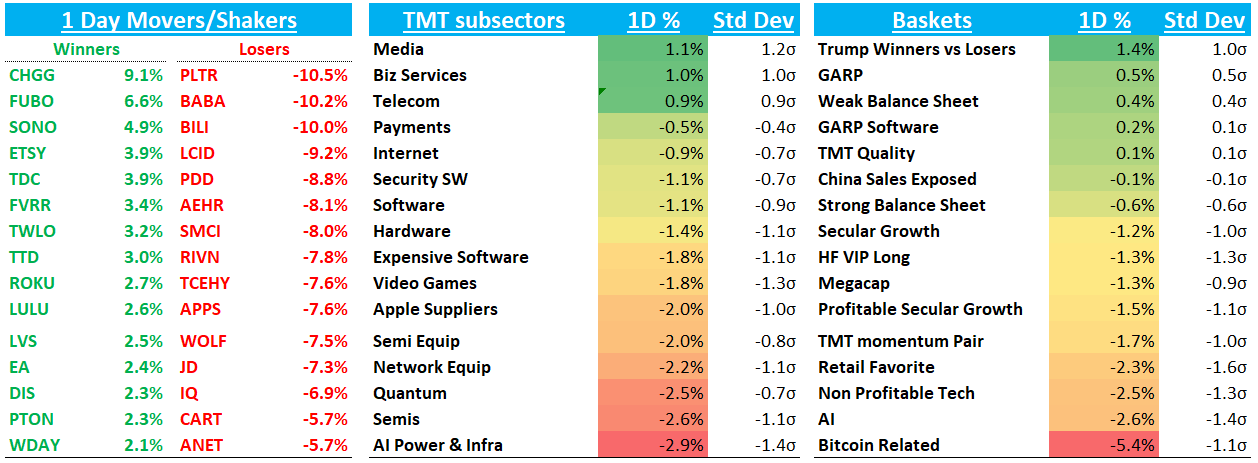

QQQs -1.2% led lower by SOX - 3% as AI Power and Infrastructure names led the way lower following MSFT controversy over the weekend. BTC - a decent measure of risk-on seems to breaking below its Anchored VWAP:

BofA noted today was the 2nd largest sell day by retail YTD and they weren’t buying the dip for only the 2nd time in 15 sessions in which the SP500 was red. Fed expectations continued to shift in a dovish direction with market now pricing in 50bps worth of cuts.

Chinese Tech names were particularly weak as Trump signed his America First policy over the weekend - Trump has always been the main risk in being long China and when you couple the news with stocks that have been vertical since January, not surprising to get some amount of pullback.

Lots of pnl pain the last few days. We like what our friend Rocha from Wells said yesterday: “This year feels like it’s been 8 months already.” We don’t disagree: Choppy macro + Trump + A secular cycle (AI) which is unlike any of us have ever seen before makes for a very dynamic market.

Despite the QQQs down 1%+, there was a decent amount of green on my screen and I noticed some positive tea leaves. Yesterday we mentioned we were watching a few stocks that were close to their earnings gap to see if they would drop below or bounce; in particular, TWLO, UPST, ROKU, CYBR, and CFLT. Out of those 5, 3 of those finished green — ROKU +2.6%, CFLT +26bps, and TWLO +3.2% - and UPST bounced off its gap and finished 3% off its lows. Only CYBR finished below its earnings gap. A couple other things. First, BKNG +1% was green following its stellar print late last week - a very small green day but positive follow through is positive follow through. Second, TTD and RDDT - two stocks which have been particular weak but had plenty of long only support heading into their misses saw strength near the end of the day with RDDT 5% off its lows and TTD finishing +3%. TTD also bounced off our initial $70 target at 25x ‘26 EBITDA which to us points to some 1) initial dip buying starting and 2) short covering; looking at it another way: there is some price sensitivity going on in. AMZN and META also getting closer to our risk/reward add prices at ~$200-$205 and $645-$650, respectively while CRM did hit our r/r add price of $305 (we think $25 down, $100+ up from here).

All of this doesn’t necessarily mean it’s all clear - on the contrary, we think this market likely continues to be choppy and we’re in pnl preservation mode - but it also confirms to us that we shouldn’t be getting too negative either and gives us some confidence in adding to longs/covering shorts when our r/r tells us to. Let’s see what tomorrow brings…

Let’s get to the recap…

Internet

Large cap weak: META -2.2% / AMZN - 1.8% / -NFLX 1.5% although SPOT -1% seems to always sneakily o/p. Another consensus long DASH -2% while more controversial/shorted GOOGL -20bps outperformed as it was rumored that Gemini might be coming to AAPL Intelligence + they announced a big cloud deal with CRM.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.