TMTB EOD Wrap

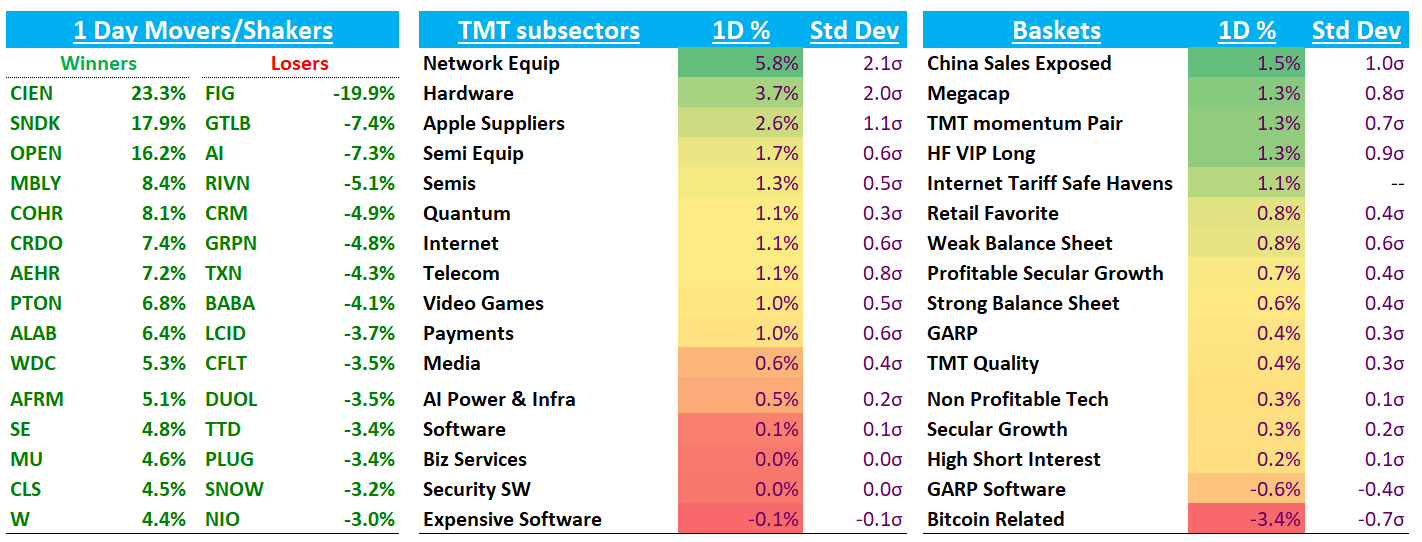

QQQs +90bps as the small dip last week/early this week seems all but forgotten for now. Semis led the way higher with SOX +1.35%. All eyes final three meetings of the year. Yields fell 3-6bps across the curve today. BTC -1.5%.

Let’s get straight to it….

POST-CLOSE EARNINGS

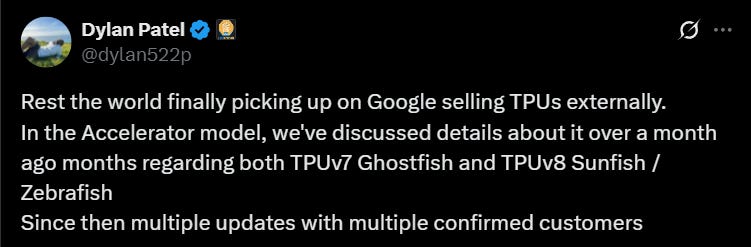

AVGO flat looks solid with LSD beat to top line, in line with buyside. Q4 guide also solid with AI revs $6.2B vs buyside at $6B. Nothing here to change LT bull case (along with burgeoning GOOGL possibly selling TPUs bull case), which is what one should be focused on with AVGO instead of quarterly prints. Upside surprise would be any update to 60-90B SAM # but we think Hock Tan might want to reserve that Ace for another time. We’ll see…

Revenue/Adj. EBITDA/EPS: $15.95B / $10.70B / $1.69 vs. Street $15.83B / $10.46B / $1.66

AI revenue: $5.2B vs. Street $5.11B; buyside expectations likely $5.2–5.3B

F4Q Guidance

Revenue/EBITDA margin: $17.4B / 67% vs. Street $17.01B / 66.0%

AI revenue: $6.2B vs. Street $5.82B; buyside likely $5.9–6.0B

DOCU +8% solid beat and raise. Q3 Revenue outlook of $804–808 million, exceeding the consensus of around $797 million Full-year FY2026: Raised revenue guidance to a range of $3.19–3.20 billion, slightly above the prior $3.16 billion estimate

INTERNET

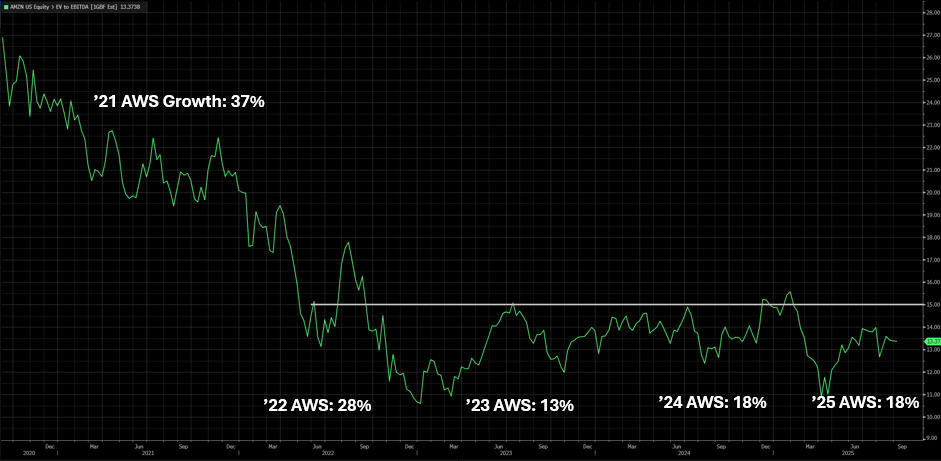

AMZN +4.3% as Semianalysis and Barclays both talked up a 20% AWS exit number. We wrote something similar in our weekly to Pro Tier subs this past Sunday:

If revenue per foot normalizes as supply bottlenecks ease, AWS growth could reach mid 20s AWS in ‘26.

The MS note last week jives with what SemiAnalysis has recently said, who thinks we could see AWS growth close to mid 20s by mid 26 spurred by the ramp of Anthropic DCs coming online. M-sci has also pointed to slightly easing capacity already in July/Aug and Yipit is pointing to early signs of acceleration with their AWS estimate around ~19%. We think that would likely be a very good result as investors will extrapolate Q4 to a 20% exit growth rate.

The reason why an AWS acceleration is important isn’t just that it will drive higher OI and add another leg to the retail operating margin bull case, but it’s that we think AWS has an overwhelmingly big impact on the multiple. And unlike other Internet large caps such as NFLX and META whose multiples have rebounded and sit closer to highs, AMZN’s multiple still sits in the middle of its ‘23 to ‘25 range, the beginning of which coincides with AWS’s deceleration into teens growth.

We think a return to 20%+ AWS growth is likely to bring AMZN’s multiple back to the 15-20x range, which implies significant upside to the stock.

RDDT +4% continues to be one of our favorites at the moment. Chart looking like a juicy cup and handle. Intra-q U.S. user data holding up while intra checks continue to be positive. Should get more positive checks as we head into the q in Oct…

RBLX -2.7% as seems like RBLX chat was shut down in some middle eastern countries. Also, this is the first w/w decline in user data in a while, but that has always been expected as Sept is always seasonally down given back to school. Importantly, we want to see the data hold next week. We trimmed a little of what we had added during the “Schlep” dip.

GOOGL +70bps more new highs as TPU story adds another leg to the multiple expansion bull case. Seems like this one set to continue to grind up…

DUOL -3.5% as DA Davison downgraded citing weak user data. Has become a crowded short for good reason as still trades at 50x P/E for declining top of funnel growth and structural/secular issues….

NFLX +2.5% nice strength - trying to get its groove back as investors begin to move to ‘27 #s

CVNA +2% as 3p data continues to long strong here tracking to 40%+ vs street in mid 30s.

W +4% continues to hit new highs as they sounded good at Citi yesteday

SEMIS

SNDK +18% on an MS note that cited strong upside orders for enterprise SSDs driven by hyperscaler AI investments and HDD shortages. The firm noted supply disruptions from new equipment restrictions and limited vendor capex could further support pricing durability. Sandisk’s position in eSSDs is improving, with the BICS 8 ramp expected to strengthen its competitive stance in 2026. MU +4.6% also benefits from NAND strength, but Morgan Stanley emphasizes the earnings impact is far less than DRAM. Overall, checks indicate NAND conditions have improved materially in recent weeks.

WDC +5% and STX +4% following suit as storage now viewed as a favorite place to be among AI longs.

ALAB +6.5% helped by CRDO bid as CEO was at Citi sounding good. Talked about ALAB broadening from PCIe retimers into Ethernet and rack‑level systems to become a connectivity platform for AI datacenters. With Scorpio contributing 10% of revenue and customers prioritizing performance, Astera is positioned to capture more value per rack.

MCHP +2% at Citi said August finished strong and the one - yes one! - day in September has started out very strong so far. TXN -4% didn’t sound as good saying recovery still taking time

ANET +3% sounded bullish at Citi saying Arista’s AI opportunity spans both back‑end and front‑end networking, with wins ramping and 800G in full swing. Update on the four major back‑end AI customers: two in production, one slated for production next year, and one transitioning from InfiniBand → Ethernet.

Other AI names strong: NVDA +61bps (reports that Chinese customers still want NVDA chips); TSM +1.6%; ARM +3%; CLS +4.5%

CRDO +7.5% on another big beat and raise that surpassed high buyside expects

SOFTWARE

U +2.7%: Didn’t get to hear first hand, but heard CEO sounded pretty positive at conference. CEO highlighted Unity’s optimism around content creation trends, with 3x more games being built this year versus last. Bromberg underscored the firm’s cultural shift toward execution and customer value, and management framed Unity as a data-driven platform. A major focus was the potential of runtime data, which could be an inflection point if used to analyze consumer behavior and optimize live services. CEO also flagged plans to extend Vector beyond its core ad network into app discovery and publishing, while eCommerce advertising is emerging as the next potential growth avenue.

MDB +3% as they confirmed they were giving out long-term guidance at their upcoming analyst day

SNOW -3% as some investors disappointed with Scarpelli leaving and new CFO coming from GTLB. Some pointed to comments from last year where new CFO Robins said GitLab’s guidance philosophy would be “less conservative” as the company matured as a public firm, so some taking that as large beats might not be as likely in the future.

PANW +40bps as Nikesh sounded good at Citi. Key quotes:

You can't replace a network security platform from Palo Alto in under three years if you are fully platformized across the board, or you can't replace a SIM platform in less than 12 to 18 months if you are fully platformized..

the question is, why don't you buy a startup and do it like you did the last 24 times? Why buy an incumbent? Because the value or the disruption in trying to replace a company's entire identity infrastructure is too high. CIOs will not replace their identity architecture infrastructure because they don't know what's going to break. If you break identity, you shut down the company. If you broke the identity system in a trading system, identity got dislodged, and your trading systems go down in your company, the CIOs don't have a job. It's worse than a breach. Nobody wants to touch the identity infrastructure. You have to go in as an identity player in the market who's doing the harder job of identity, not the easier job. So, long story for short, we bought CyberArk because we think -- by the way, unequivocally, every customer we've talked to at CyberArk is delighted we bought them.

APP +2.5% as Jefferies was out positive after meeting with mgmt, raising revs and ebtida estimates and saying meeting reinforced confidence in a Q4 e-commerce ad acceleration, supported by seasonal strength, international audience expansion, and referral-driven onboarding

NET +2%: Good interview with CEO on Stratchery Some interesting quotes:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.