TMTB EOD Wrap

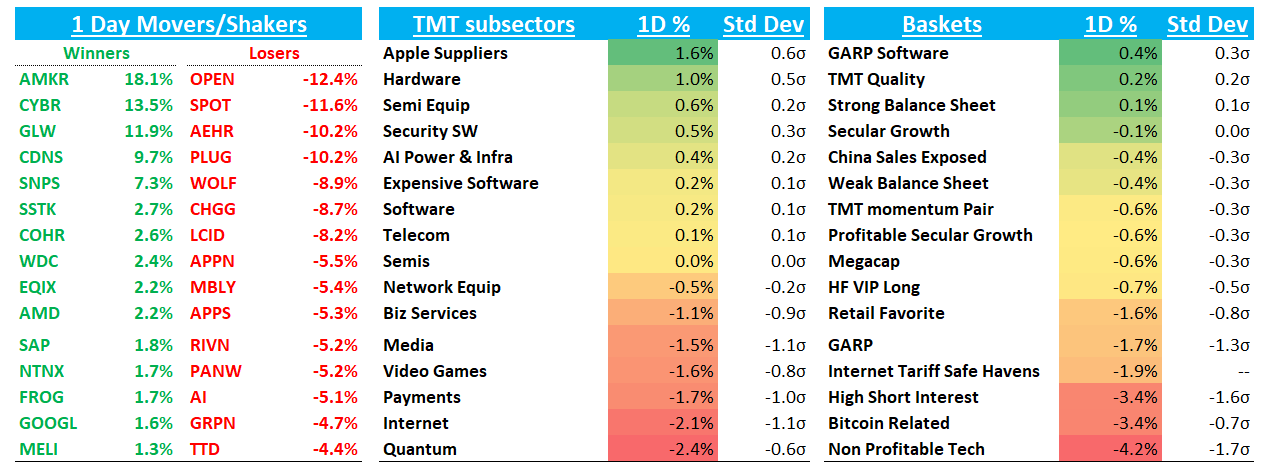

Earnings reactions outside of AI-related names continue to skew to the downside: SPOT’s -12% was the biggest move down in a couple years despite the quarter having been previewed as being somewhat messy. As has been the case over the first couple of weeks of earnings, misses are getting sold harder than expected while the reaction function to beats is anemic and positioning is playing a significant role in T+1 moves.

The exception to the rule: companies with specific and substantial AI tailwinds. Names like CLS +16.5%, CDNS +10% and AMKR +18% all performed admirably after beating and raising, despite high expectations going in: CLS & CDNS were at or near 52wk highs.

This price action spooked internet investors today with companies reporting this week underperforming: META -2.5%; AMZN -75bps; ETSY -4%; RBLX -2%; RDDT - 4.5%.

From a factor perspective, even though Megacap and HF longs underperformed the QQQs, highly shorted stocks + non profitable tech fell even more, down 3-4%. The unwindy action of shorts outperforming longs the past month is taking a break so far this week.

Meme-y names are also taking a break as well: OPEN -12%. Charts in Quantum - a barometer of froth - look to be breaking down. QBTS and IONQ were both down on bullish initiations from Rosenblatt, which slapped targets 50%+ higher on both. Remember: down on good news is not the price action you want to see if you’re a bull.

Here’s QBTS:

And IONQ, breaking down below ST MAs:

We all know the markets have been very frothy the past couple months and now we are seeing stocks going down on good news (outside of AI semis) in the face of the seasonally weakest period for stocks. Adjusting net/gross/sizing somewhat doesn’t sound like a bad idea. That also means focusing on higher quality ideas this earnings season — wish I would have listened to my own advice before getting involved in PYPL.

Post-close:

TER +3% on a strong beat but weaker guide. F2Q revenue came in at $652M vs. guidance of $645M and the Street at $650.6M. EPS was $0.57, ahead of both the $0.525 guide and Street consensus of $0.54. For F3Q, the company guided revenue to $740M, below the Street at $759.1M, and EPS to $0.78, also well under Street expectations of $0.89. Outperformance led by Semiconductor Test, which helped counter softness in Robotics and Product Test. Growth was driven largely by strength in System-on-a-Chip (SoC), particularly in AI-related applications. Management highlighted improving visibility for the second half of the year, citing rising demand across compute, networking, and memory: “We believe that AI will be a key driver of strong second-half results for Teradyne.”

BKNG unch on a q2 beat across the board. Q2 results in line to slightly ahead of expectations. Room nights rose 8% Y/Y to 309M (vs. +4–6% guide), gross bookings of $46.7B (+9% Y/Y ex-FX) beat by ~1%, revenue of $6.8B (+12% Y/Y ex-FX, 14.6% take rate) topped by ~4%, and adjusted EBITDA of $2.4B (35.6% margin) came in ~10% above consensus. Q3 guidance was largely in line, with room nights growth of 3.5–5.5% Y/Y (vs. Street at 5.8%), gross bookings up 8–10% Y/Y (vs. 8.9%) including 4pts of FX tailwind, and revenue up 7–9% Y/Y (vs. 8.6%), also with 4pts of FX tailwind. Adjusted EBITDA is expected at $3.9–$4.0B (vs. $3.99B consensus). Guidance reflects macro and geopolitical risks, though underlying demand trends continue to improve.

QRVO +10% on a nice beat and raise: F1Q26 revenue was $818.8M, beating Street expectations of $776.4M, with EPS of $0.92 vs. $0.63 consensus. Margins improved by 200bps, with management noting this expansion should persist into fiscal 2027. For F2Q26, the company guided revenue to $1.025B (vs. $955.5M Street) and EPS to $2.00 (vs. $1.61 consensus).

Let’s get to the recap…

INTERNET

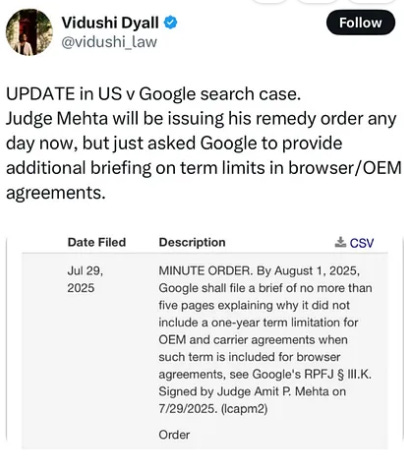

GOOGL +1.65%: on this ask from judge Mehta to google:

Specifically, it asks the company to explain why its proposed remedies include a one-year term limitation for browser agreements (e.g., deals with Apple for Safari or Mozilla for Firefox, where Google pays to be the default search engine) but not for original equipment manufacturer (OEM) or carrier agreements (e.g., pre-installation deals with Android device makers like Samsung or carriers like Verizon).

There are two interpretations to this:

The Glass Half full one is that Mehta is Leaning Toward Behavioral Remedies Over Structural Ones. Mehta appears to be scrutinizing and potentially building on Google’s own proposed remedies, which include terminating certain exclusive provisions in browser agreements and limiting them to one-year terms. By questioning the inconsistency in not applying similar short-term limits to OEM/carrier deals, the judge may be signaling an intent to impose uniform one-year caps across all relevant agreements. This would force annual renegotiations, making it easier for competitors (e.g., Microsoft Bing or DuckDuckGo) to bid for default status and reducing Google’s entrenched dominance without mandating a full breakup. It’s a middle-ground approach—more stringent than Google’s baseline proposal but far less disruptive than the DOJ’s demands, which include banning default search payments entirely, divesting Chrome, and potentially forcing a sale of Android.

The Glass Half empty argument is that Mehta is requesting this supplemental brief primarily to better understand Google's position before rebutting it. However, my legal analyst Grok 4 tells me that is more unlikely:

In antitrust remedies phases like this, judges often seek targeted clarifications to refine their rulings, especially when weighing proposals from both sides. Here, the order's narrow focus—questioning the inconsistency in Google's own suggested remedies (one-year term limits for browser deals but not OEM/carrier ones)—suggests Mehta is probing for logical weaknesses rather than outright dismissing the concept of short-term contracts. If he were purely gearing up for a full rebuttal, he might have requested broader briefing or signaled more skepticism during prior hearings (e.g., his May 2025 comments on AI's potential to disrupt search naturally).

That said, the timing and phrasing do lean toward rebuttal of Google's specific distinction. By forcing Google to explain the asymmetry in a concise five-page brief by August 1, he's essentially asking them to defend why OEM/carrier agreements (key to Android's ecosystem) deserve longer terms, which could expose flaws if their rationale boils down to business convenience rather than competitive necessity. If Google's response is unconvincing (e.g., citing operational complexities without strong antitrust justification), it provides Mehta cover to rebut and impose uniform one-year caps, aligning with his earlier trial hints at "contingent" or balanced fixes.

Again, lots of focus on the decision as it will have significant implications for GOOGL’s business (and stock price). From a stock perspective, the stock has failed to rally post-quarter partly because long-onlys are waiting for more clarity on this key decision — if remedies are moderate, it likely provides the rally many bulls were hoping for post-earnings. These type of things are always hard to handicap so take with a big grain of salt (at least I do!)

SPOT -11.5%: A big tug of war between bulls and bears here with bears being more vocal near-term although in the long-term bulls are still in control. Bulls framed the FX‑related revenue shortfall as transitory and still see pricing action, audiobooks, and a lean cost structure driving another leg of margin expansion. Bears took the glass half empty view and said the same miss is evidence that consensus overestimates Spotify’s ARPU trajectory and underestimates execution risk in advertising and opex control.

UBER -4% as Waymo announced they were partnering with CAR and not UBER on their Dallas rollout. Wedbush was out with a negative take on the news saying while Uber still holds exclusive Waymo access in Atlanta and Austin, that edge may fade as third-party AV distribution scales and 40% of mobility bookings are exposed to AV disruption. Sentiment continues to flip/flop on this one as the AV/FSD situation remains fluid — we tend to think UBER will have a strong role to play in any future AV ecosystem, but its a v nascent field so have to read the tea leaves as they come out.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.